First Busey Results Presentation Deck

4Q23 Earnings Investor Presentation

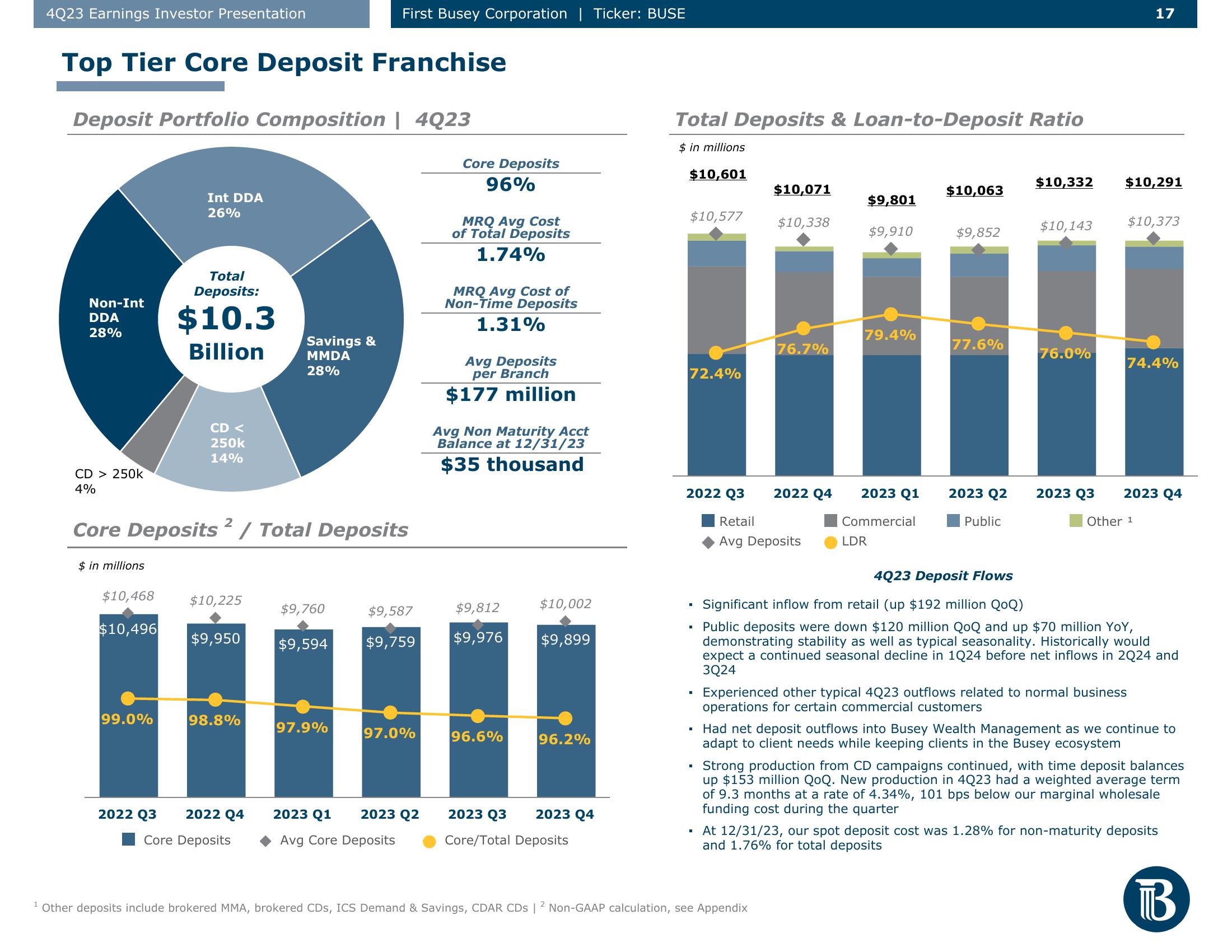

Top Tier Core Deposit Franchise

Deposit Portfolio Composition | 4Q23

Non-Int

DDA

28%

CD > 250k

4%

$ in millions

$10,468

$10,496

Int DDA

26%

99.0%

Total

Deposits:

$10.3

Billion

CD <

250k

14%

2

Core Deposits ² / Total Deposits

$10,225

$9,950

98.8%

Savings &

MMDA

28%

2022 Q3 2022 Q4

Core Deposits

$9,760

First Busey Corporation | Ticker: BUSE

$9,594

97.9%

$9,587

$9,759

97.0%

2023 Q1

2023 Q2

Avg Core Deposits

Core Deposits

96%

MRQ Avg Cost

of Total Deposits

1.74%

MRQ Avg Cost of

Non-Time Deposits

1.31%

Avg Deposits

per Branch

$177 million

Avg Non Maturity Acct

Balance at 12/31/23

$35 thousand

$9,812

$9,976

96.6%

$10,002

$9,899

96.2%

2023 Q3

2023 Q4

Core/Total Deposits

Total Deposits & Loan-to-Deposit Ratio

$ in millions

$10,601

$10,577

72.4%

2022 Q3

.

▪

I

▪

$10,071

$10,338

76.7%

2022 Q4

Retail

Avg Deposits

¹ Other deposits include brokered MMA, brokered CDs, ICS Demand & Savings, CDAR CDs | 2 Non-GAAP calculation, see Appendix

$9,801

$9,910

79.4%

LDR

2023 Q1

Commercial

$10,063

$9,852

77.6%

2023 Q2

Public

$10,332

$10,143

76.0%

2023 Q3

$10,291

17

$10,373

Experienced other typical 4Q23 outflows related to normal business

operations for certain commercial customers

74.4%

2023 Q4

Other 1

4Q23 Deposit Flows

Significant inflow from retail (up $192 million QoQ)

Public deposits were down $120 million QoQ and up $70 million YoY,

demonstrating stability as well as typical seasonality. Historically would

expect a continued seasonal decline in 1024 before net inflows in 2Q24 and

3Q24

Had net deposit outflows into Busey Wealth Management as we continue to

adapt to client needs while keeping clients in the Busey ecosystem

Strong production from CD campaigns continued, with time deposit balances

up $153 million QoQ. New production in 4Q23 had a weighted average term

of 9.3 months at a rate of 4.34%, 101 bps below our marginal wholesale

funding cost during the quarter

▪ At 12/31/23, our spot deposit cost was 1.28% for non-maturity deposits

and 1.76% for total deposits

BView entire presentation