Evercore Investment Banking Pitch Book

Preliminary Valuation of SIRE Common Units

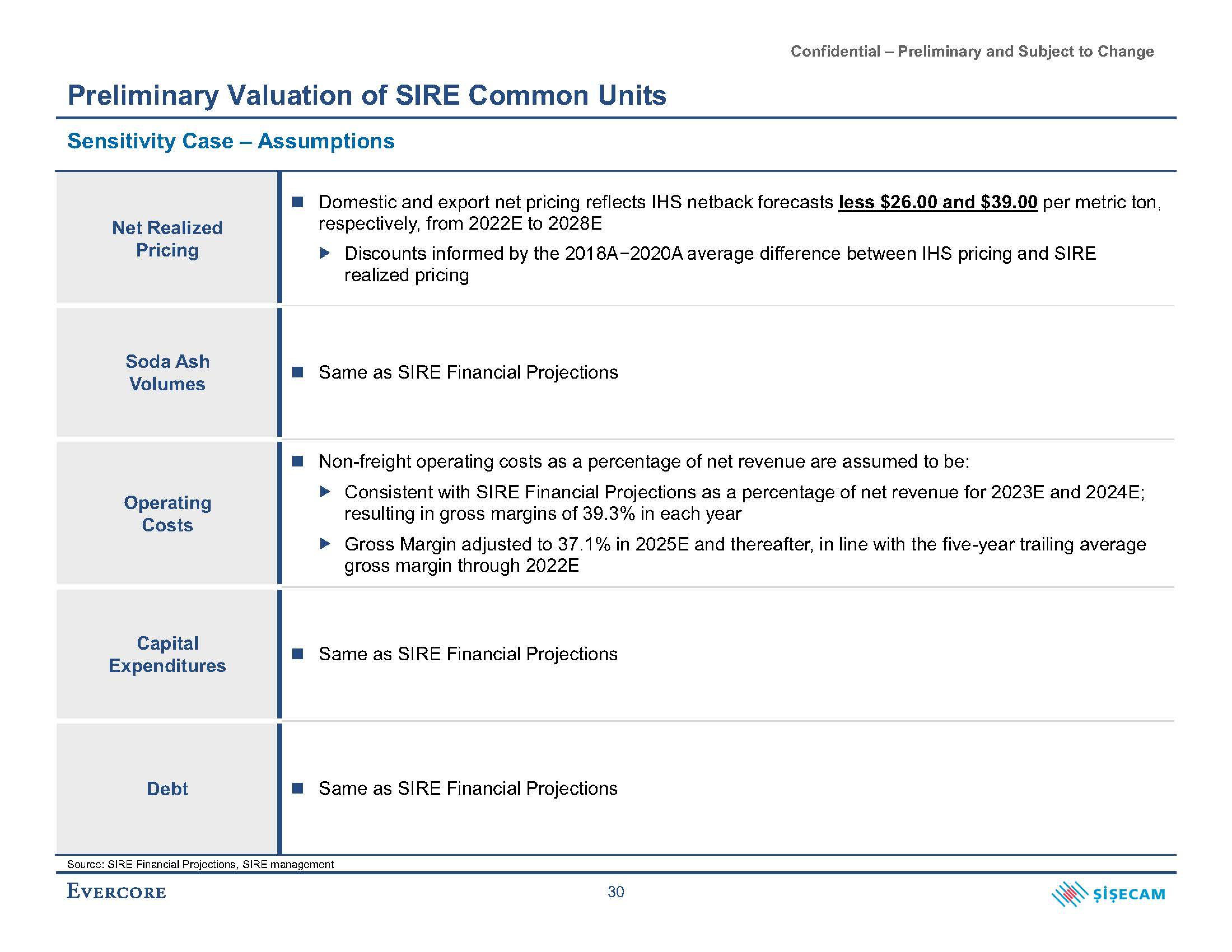

Sensitivity Case - Assumptions

Net Realized

Pricing

Soda Ash

Volumes

Operating

Costs

Capital

Expenditures

Debt

Domestic and export net pricing reflects IHS netback forecasts less $26.00 and $39.00 per metric ton,

respectively, from 2022E to 2028E

► Discounts informed by the 2018A-2020A average difference between IHS pricing and SIRE

realized pricing

Same as SIRE Financial Projections

Non-freight operating costs as a percentage of net revenue are assumed to be:

Consistent with SIRE Financial Projections as a percentage of net revenue for 2023E and 2024E;

resulting in gross margins of 39.3% in each year

Confidential - Preliminary and Subject to Change

▸ Gross Margin adjusted to 37.1% in 2025E and thereafter, in line with the five-year trailing average

gross margin through 2022E

Same as SIRE Financial Projections

Same as SIRE Financial Projections

Source: SIRE Financial Projections, SIRE management

EVERCORE

30

ŞİŞECAMView entire presentation