J.P.Morgan 2Q23 Investor Results

JPMORGAN CHASE & CO.

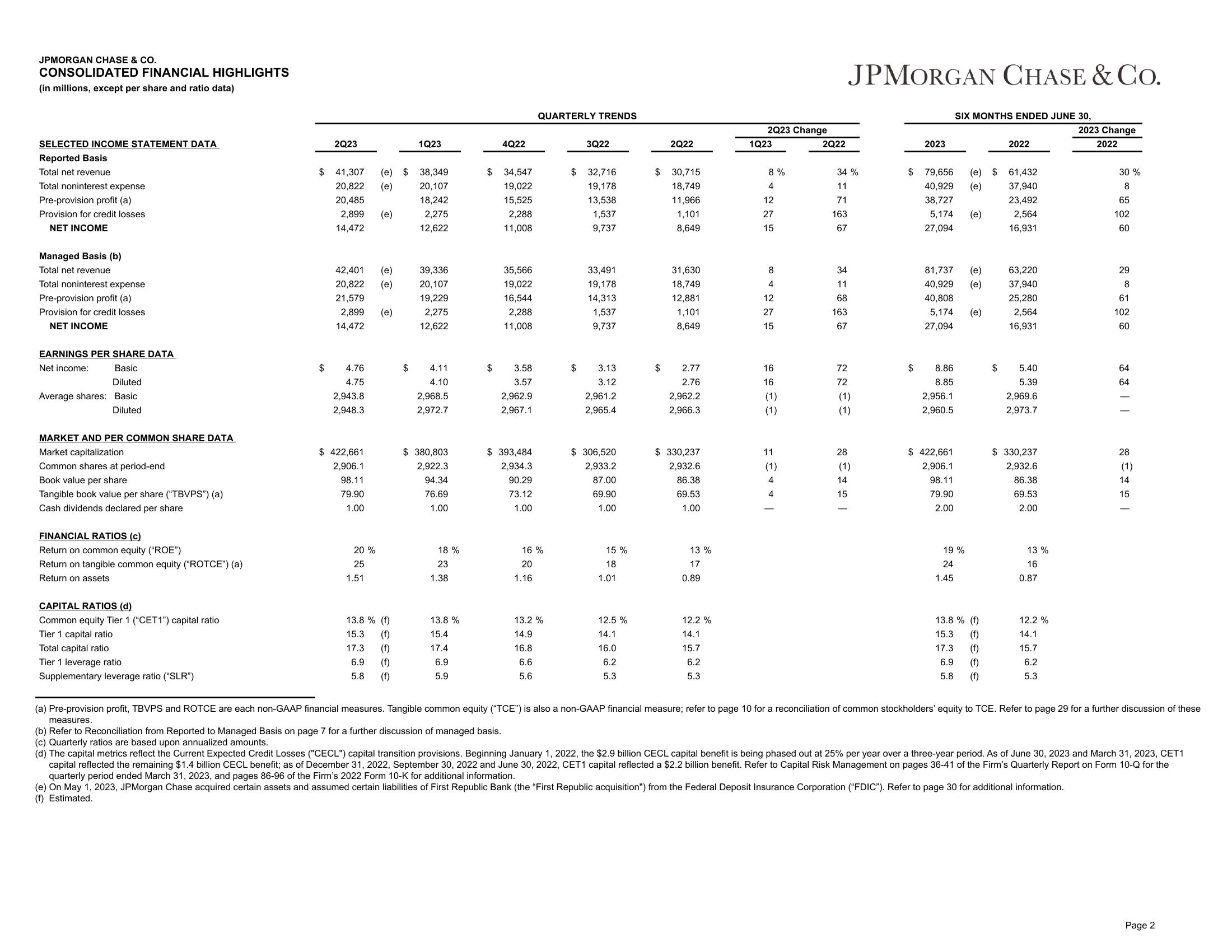

CONSOLIDATED FINANCIAL HIGHLIGHTS

(in millions, except per share and ratio data)

SELECTED INCOME STATEMENT DATA

Reported Basis

Total net revenue

Total noninterest expense

Pre-provision profit (a)

Provision for credit losses

NET INCOME

Managed Basis (b)

Total net revenue

Total noninterest expense

Pre-provision profit (a)

Provision for credit losses

NET INCOME

EARNINGS PER SHARE DATA

Net income:

Basic

Diluted

Average shares: Basic

Diluted

MARKET AND PER COMMON SHARE DATA

Market capitalization

Common shares at period-end

Book value per share

Tangible book value per share ("TBVPS") (a)

Cash dividends declared per share

FINANCIAL RATIOS (c)

Return on common equity ("ROE")

Return on tangible common equity ("ROTCE") (a)

Return on assets

CAPITAL RATIOS (d)

Common equity Tier 1 ("CET1") capital ratio

Tier 1 capital ratio

Total capital ratio

Tier 1 leverage ratio

Supplementary leverage ratio ("SLR")

$

$

2Q23

41,307

20,822

20,485

2,899 (e)

14,472

42,401 (e)

(e)

20,822

21,579

2,899 (e)

14,472

4.76

4.75

2,943.8

2,948.3

$ 422,661

2,906.1

98.11

79.90

1.00

20%

25

(e)

(e) $ 38,349

20,107

18,242

2,275

12,622

1.51

13.8% (f)

15.3

(f)

17.3

(f)

6.9

(f)

5.8 (f)

1Q23

$

39,336

20,107

19,229

2,275

12,622

4.11

4.10

2,968.5

2,972.7

$380,803

2,922.3

94.34

76.69

1.00

18 %

23

1.38

13.8%

15.4

17.4

6.9

5.9

$

$

4Q22

34,547

19,022

15,525

2,288

11,008

35,566

19,022

16,544

2,288

11,008

3.58

3.57

2,962.9

2,967.1

$393,484

2,934.3

90.29

73.12

1.00

QUARTERLY TRENDS

16 %

20

1.16

13.2 %

14.9

16.8

6.6

5.6

3Q22

$32,716

19,178

13,538

1,537

9,737

$

33,491

19,178

14,313

1,537

9,737

3.13

3.12

2,961.2

2,965.4

$ 306,520

2,933.2

87.00

69.90

1.00

15 %

18

1.01

12.5 %

14.1

16.0

6.2

5.3

2Q22

$ 30,715

18,749

11,966

1,101

8,649

$

31,630

18,749

12,881

1,101

8,649

2.77

2.76

2,962.2

2,966.3

$ 330,237

2,932.6

86.38

69.53

1.00

13 %

17

0.89

12.2 %

14.1

15.7

6.2

5.3

2Q23 Change

1Q23

8%

4

12

27

15

8

4

12

27

15

16

16

(1)

(1)

11

(1)

+ + 1

2Q22

34%

11

71

163

67

34

11

68

163

67

72

72

JPMORGAN CHASE & Co.

(1)

(1)

28

(1)

14

15

2023

$ 79,656

40,929

38,727

5,174

27,094

$

8.86

8.85

2,956.1

2,960.5

$ 422,661

2,906.1

SIX MONTHS ENDED JUNE 30,

81,737 (e)

40,929 (e)

40,808

5,174

27,094

98.11

79.90

2.00

19 %

24

1.45

(e) $ 61,432

(e)

37,940

23,492

(e)

(e)

13.8% (f)

15.3

(f)

17.3

(f)

6.9

(f)

5.8 (f)

2022

$

2,564

16,931

63,220

37,940

25,280

2,564

16,931

5.40

5.39

2,969.6

2,973.7

$ 330,237

2,932.6

86.38

69.53

2.00

13 %

16

0.87

12.2 %

14.1

15.7

6.2

5.3

2023 Change

2022

30 %

8

65

102

60

29

8

61

102

60

64

64

28

(1)

14

15

(a) Pre-provision profit, TBVPS and ROTCE are each non-GAAP financial measures. Tangible common equity ("TCE") is also a non-GAAP financial measure; refer to page 10 for a reconciliation of common stockholders' equity to TCE. Refer to page 29 for a further discussion of these

(b) Refer to Reconciliation from Reported to Managed Basis on page 7 for a further discussion of managed basis.

measures.

(c) Quarterly ratios are based upon annualized amounts.

(d) The capital metrics reflect the Current Expected Credit Losses ("CECL") capital transition provisions. Beginning January 1, 2022, the $2.9 billion CECL capital benefit is being phased out at 25% per year over a three-year period. As of June 30, 2023 and March 31, 2023, CET1

capital reflected the remaining $1.4 billion CECL benefit; as of December 31, 2022, September 30, 2022 and June 30, 2022, CET1 capital reflected a $2.2 billion benefit. Refer to Capital Risk Management on pages 36-41 of the Firm's Quarterly Report on Form 10-Q for the

quarterly period ended March 31, 2023, and pages 86-96 of the Firm's 2022 Form 10-K for additional information.

(e) On May 1, 2023, JPMorgan Chase acquired certain assets and assumed certain liabilities of First Republic Bank (the "First Republic acquisition") from the Federal Deposit Insurance Corporation ("FDIC"). Refer to page 30 for additional information.

(f) Estimated.

Page 2View entire presentation