Mondi Mergers and Acquisitions Presentation Deck

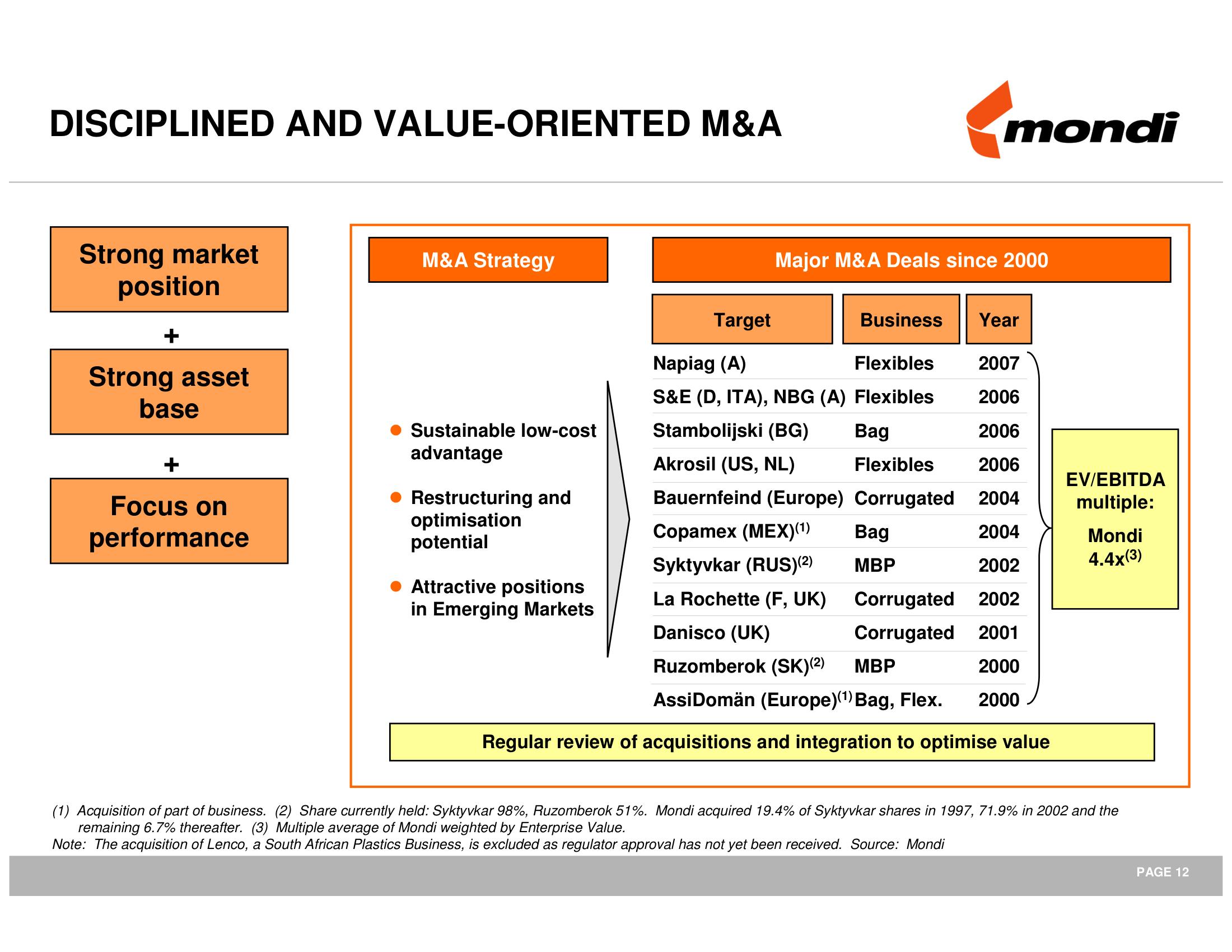

DISCIPLINED AND VALUE-ORIENTED M&A

Strong market

position

+

Strong asset

base

+

Focus on

performance

M&A Strategy

Sustainable low-cost

advantage

Restructuring and

optimisation

potential

Target

Attractive positions

in Emerging Markets

Napiag (A)

Flexibles

2007

S&E (D, ITA), NBG (A) Flexibles

2006

Stambolijski (BG)

Bag

2006

Akrosil (US, NL)

Flexibles

2006

Bauernfeind (Europe) Corrugated 2004

Copamex (MEX)(¹)

2004

2002

Syktyvkar (RUS)(2)

La Rochette (F, UK)

Danisco (UK)

Ruzomberok (SK)(²)

Corrugated 2002

Corrugated 2001

2000

MBP

AssiDomän (Europe) (¹) Bag, Flex.

2000

Regular review of acquisitions and integration to optimise value

mondi

Major M&A Deals since 2000

Business Year

Bag

MBP

EV/EBITDA

multiple:

Mondi

4.4x(3)

(1) Acquisition of part of business. (2) Share currently held: Syktyvkar 98%, Ruzomberok 51%. Mondi acquired 19.4% of Syktyvkar shares in 1997, 71.9% in 2002 and the

remaining 6.7% thereafter. (3) Multiple average of Mondi weighted by Enterprise Value.

Note: The acquisition of Lenco, a South African Plastics Business, is excluded as regulator approval has not yet been received. Source: Mondi

PAGE 12View entire presentation