Barclays Global Financial Services Conference

Merger Update, Medium Term Targets

and Cost Saves

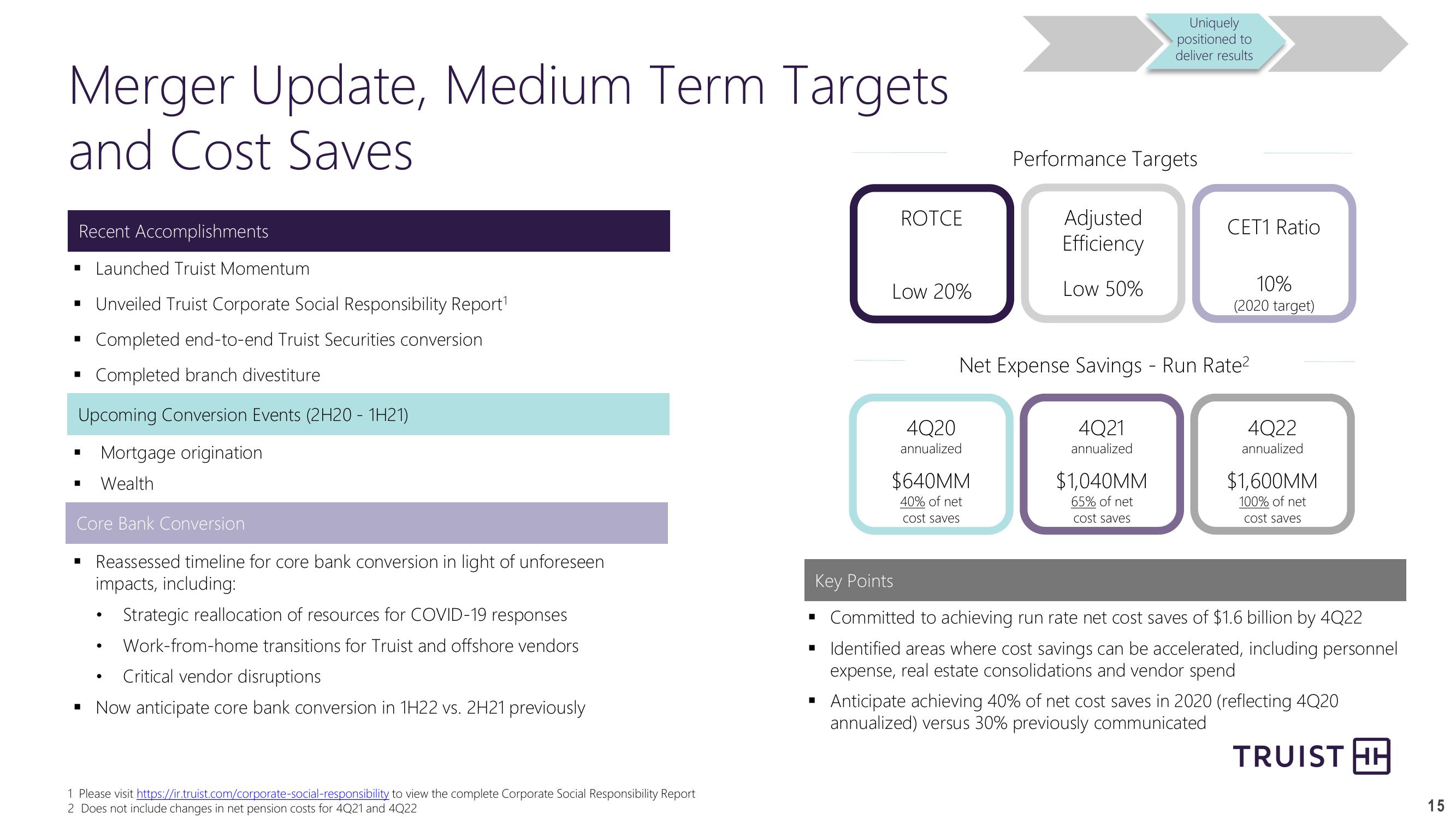

Recent Accomplishments

■ Launched Truist Momentum

■

Unveiled Truist Corporate Social Responsibility Report¹

■

Completed end-to-end Truist Securities conversion

◉

Completed branch divestiture

Upcoming Conversion Events (2H20 - 1H21)

■

Mortgage origination

◉

Wealth

Uniquely

positioned to

deliver results

Performance Targets

ROTCE

Adjusted

Efficiency

CET1 Ratio

Low 20%

Low 50%

10%

(2020 target)

4Q20

annualized

Net Expense Savings - Run Rate²

$640MM

40% of net

cost saves

4Q21

annualized

$1,040MM

65% of net

cost saves

4Q22

annualized

$1,600MM

100% of net

cost saves

Core Bank Conversion

Reassessed timeline for core bank conversion in light of unforeseen

impacts, including:

•

.

Strategic reallocation of resources for COVID-19 responses

Work-from-home transitions for Truist and offshore vendors

•

Critical vendor disruptions

Now anticipate core bank conversion in 1H22 vs. 2H21 previously

Key Points

■ Committed to achieving run rate net cost saves of $1.6 billion by 4Q22

Identified areas where cost savings can be accelerated, including personnel

expense, real estate consolidations and vendor spend

☐

Anticipate achieving 40% of net cost saves in 2020 (reflecting 4Q20

annualized) versus 30% previously communicated

1 Please visit https://ir.truist.com/corporate-social-responsibility to view the complete Corporate Social Responsibility Report

2 Does not include changes in net pension costs for 4Q21 and 4Q22

TRUIST HH

15View entire presentation