Baird Investment Banking Pitch Book

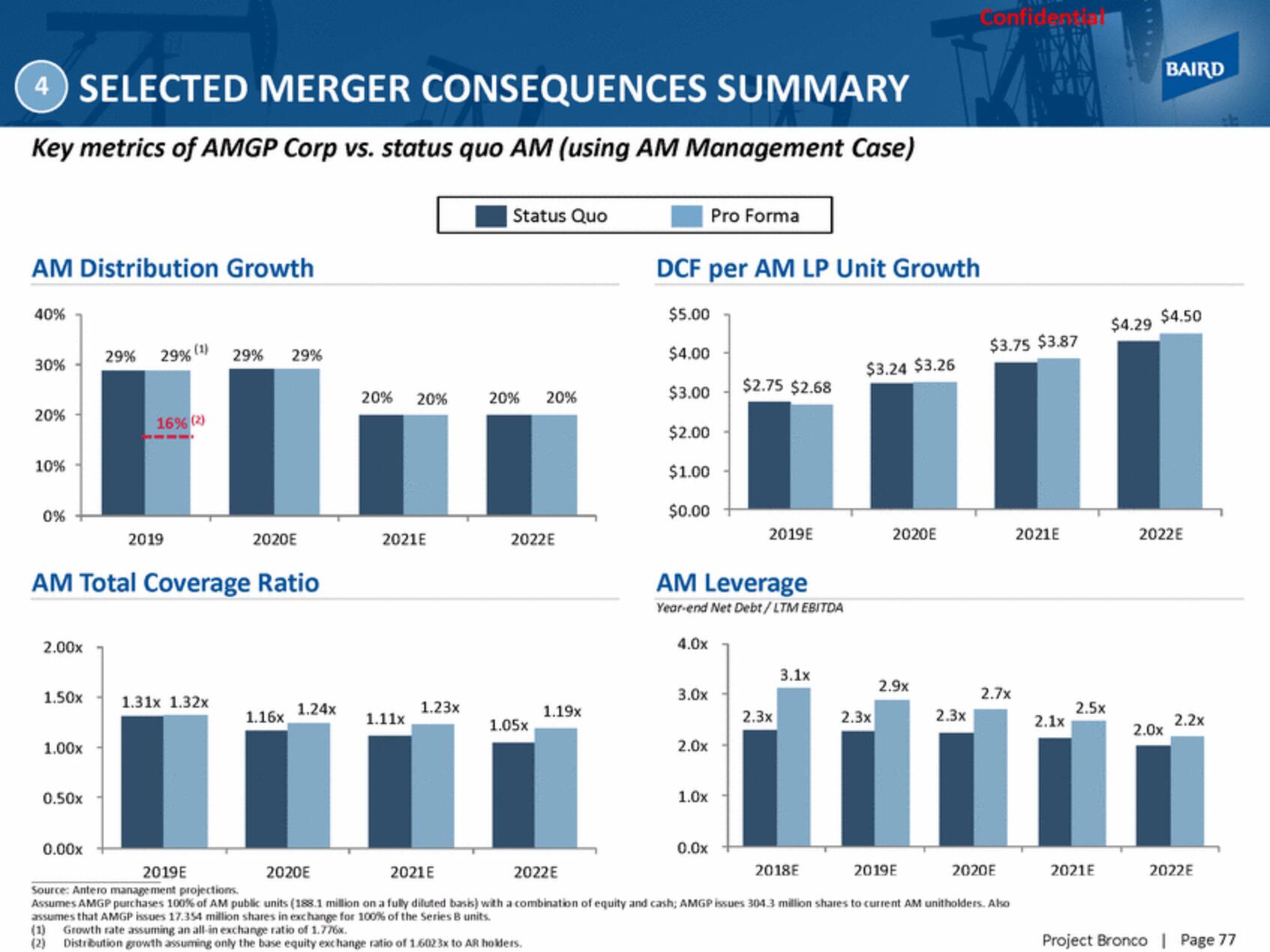

4 SELECTED MERGER CONSEQUENCES SUMMARY

Key metrics of AMGP Corp vs. status quo AM (using AM Management Case)

AM Distribution Growth

40%

30%

20%

10%

0%

2.00x

1.50x

1.00x

0.50x

29%

0.00x

29% (1)

AM Total Coverage Ratio

16% (2)

2019

29% 29%

1.31x 1.32x

2020E

1.16x

1.24x

20% 20%

2021E

1.11x

1.23x

Status Quo

20% 20%

2022E

1.05x

1.19x

Pro Forma

DCF per AM LP Unit Growth

$5.00

$4.00

$3.00

$2.00

$1.00

$0.00

4.0x

AM Leverage

Year-end Net Debt/LTM EBITDA

3.0x

2.0x

1.0x

$2.75 $2.68

0.0x

2019E

2.3x

3.1x

$3.24 $3.26

2018E

2.3x

2020E

2.9x

2.3x

Confidential

$3.75 $3.87

2.7x

2019E

2020E

2021E

2022E

2019E

Source: Antero management projections.

Assumes AMGP purchases 100% of AM public units (188.1 million on a fully diluted basis) with a combination of equity and cash; AMGP issues 304.3 million shares to current AM unitholders. Also

assumes that AMGP issues 17.354 million shares in exchange for 100% of the Series B units.

(1) Growth rate assuming an all-in exchange ratio of 1.776x.

(2)

Distribution growth assuming only the base equity exchange ratio of 1.6023x to AR holders.

2020E

2021E

2.1x

2.5x

2021E

$4.29

BAIRD

$4.50

2022E

2.0x

2.2x

2022E

Project Bronco | Page 77View entire presentation