MP Materials Results Presentation Deck

13

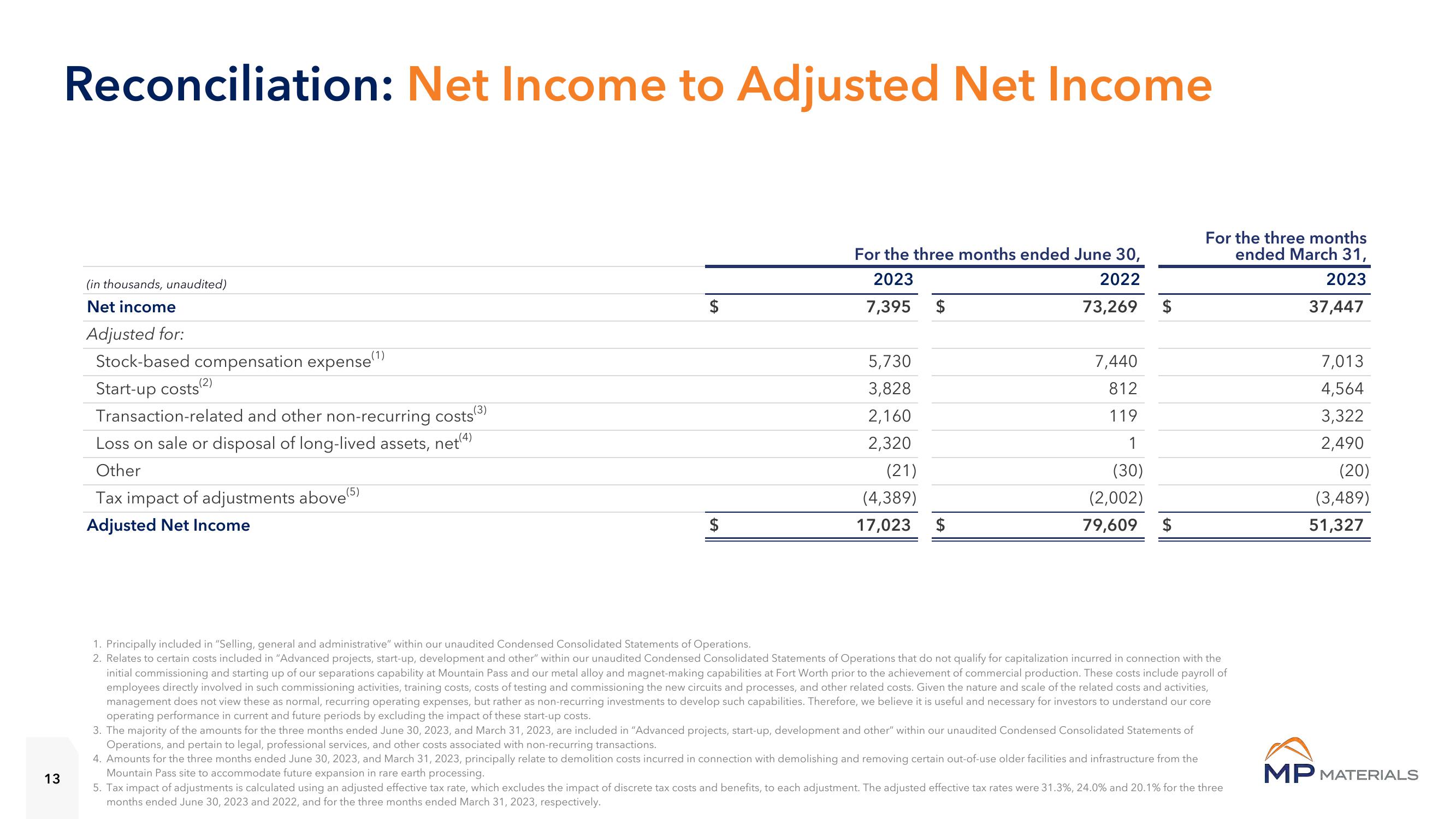

Reconciliation: Net Income to Adjusted Net Income

(in thousands, unaudited)

Net income

Adjusted for:

Stock-based compensation expense(¹)

Start-up costs

(2)

(3)

Transaction-related and other non-recurring costs

Loss on sale or disposal of long-lived assets, net(4)

Other

Tax impact of adjustments above (5)

Adjusted Net Income

$

$

For the three months ended June 30,

2022

2023

7,395

73,269 $

5,730

3,828

2,160

2,320

(21)

(4,389)

17,023

$

$

7,440

812

119

1

(30)

(2,002)

79,609

$

For the three months

ended March 31,

2023

37,447

1. Principally included in "Selling, general and administrative" within our unaudited Condensed Consolidated Statements of Operations.

2. Relates to certain costs included in "Advanced projects, start-up, development and other" within our unaudited Condensed Consolidated Statements of Operations that do not qualify for capitalization incurred in connection with the

initial commissioning and starting up of our separations capability at Mountain Pass and our metal alloy and magnet-making capabilities at Fort Worth prior to the achievement of commercial production. These costs include payroll of

employees directly involved in such commissioning activities, training costs, costs of testing and commissioning the new circuits and processes, and other related costs. Given the nature and scale of the related costs and activities,

management does not view these as normal, recurring operating expenses, but rather as non-recurring investments to develop such capabilities. Therefore, we believe it is useful and necessary for investors to understand our core

operating performance in current and future periods by excluding the impact of these start-up costs.

3. The majority of the amounts for the three months ended June 30, 2023, and March 31, 2023, are included in "Advanced projects, start-up, development and other" within our unaudited Condensed Consolidated Statements of

Operations, and pertain to legal, professional services, and other costs associated with non-recurring transactions.

4. Amounts for the three months ended June 30, 2023, and March 31, 2023, principally relate to demolition costs incurred in connection with demolishing and removing certain out-of-use older facilities and infrastructure from the

Mountain Pass site to accommodate future expansion in rare earth processing.

5. Tax impact of adjustments is calculated using an adjusted effective tax rate, which excludes the impact of discrete tax costs and benefits, to each adjustment. The adjusted effective tax rates were 31.3%, 24.0% and 20.1% for the three

months ended June 30, 2023 and 2022, and for the three months ended March 31, 2023, respectively.

7,013

4,564

3,322

2,490

(20)

(3,489)

51,327

MP MATERIALSView entire presentation