J.P.Morgan Investment Banking Pitch Book

KEY TRANSACTION CONSIDERATIONS

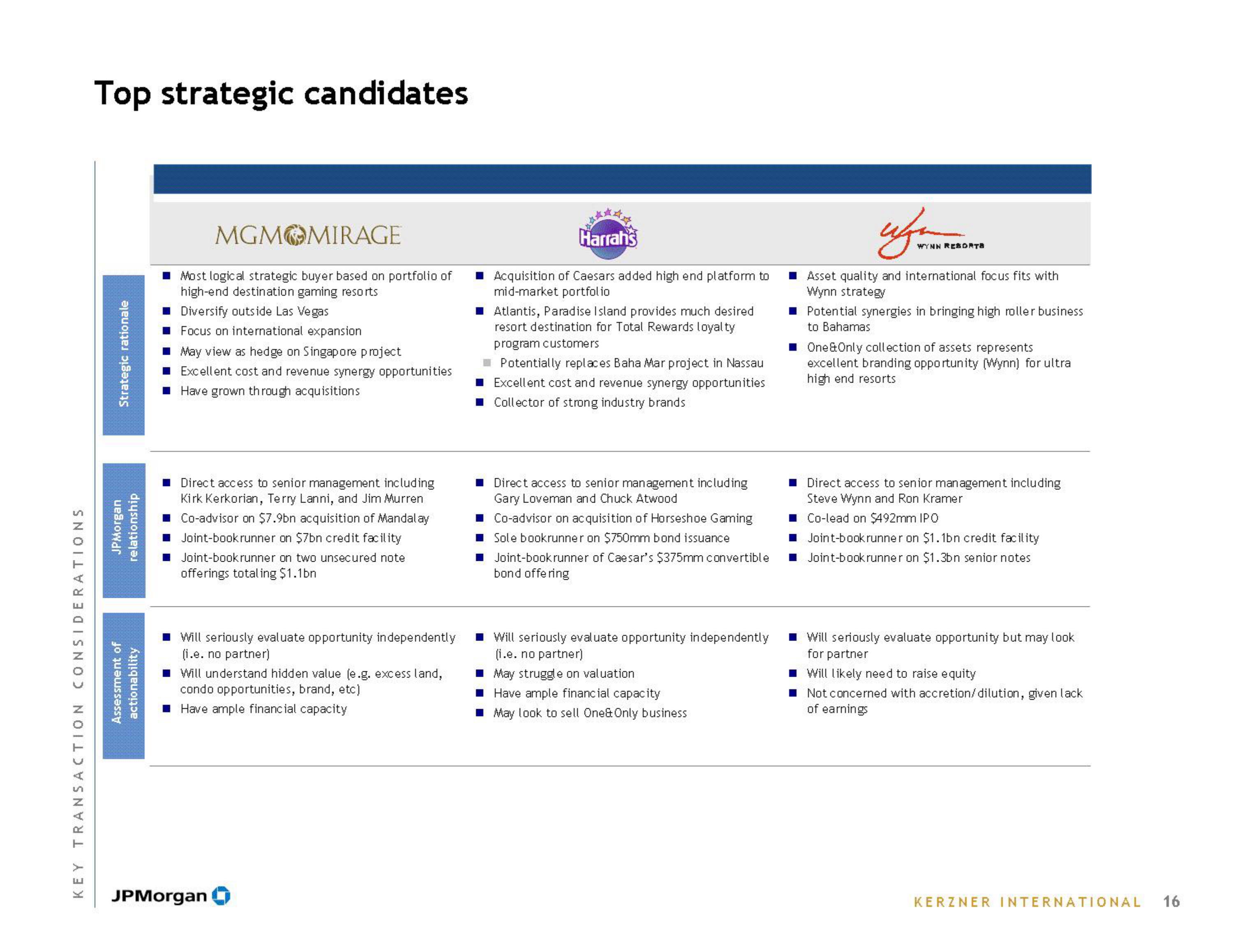

Top strategic candidates

Strategic rationale

JPMorgan

relationship

Assessment of

actionability

■ Most logical strategic buyer based on portfolio of

high-end destination gaming resorts

■

Diversify outside Las Vegas

■ Focus on international expansion

MGM MIRAGE

■ May view as hedge on Singapore project

Excellent cost and revenue synergy opportunities

Have grown through acquisitions

III

Direct access to senior management including

Kirk Kerkorian, Terry Lanni, and Jim Murren

Co-advisor on $7.9bn acquisition of Mandalay

Joint-book runner on $7bn credit facility

Joint-book runner on two unsecured note

offerings totaling $1.1bn

■Will seriously evaluate opportunity independently

(i.e. no partner)

■Will understand hidden value (e.g. excess land,

condo opportunities, brand, etc)

Have ample financial capacity

JPMorgan

Harrah's

Acquisition of Caesars added high end platform to

mid-market portfolio

Atlantis, Paradise Island provides much desired

resort destination for Total Rewards loyalty

program customers

Potentially replaces Baha Mar project in Nassau

Excellent cost and revenue synergy opportunities

■ Collector of strong industry brands

Direct access to senior management including

Gary Loveman and Chuck Atwood

Co-advisor on acquisition of Horseshoe Gaming

Sole bookrunner on $750mm bond issuance

Joint-book runner of Caesar's $375mm convertible

bond offering

■Will seriously evaluate opportunity independently

(i.e. no partner)

■ May struggle on valuation

■Have ample financial capacity

■ May look to sell One&Only business

WYNN RESORTA

■Asset quality and international focus fits with

Wynn strategy

■ Potential synergies in bringing high roller business

to Bahamas

■One&Only collection of assets represents

excellent branding opportunity (Wynn) for ultra

high end resorts

Direct access to senior management including

Steve Wynn and Ron Kramer

Co-lead on $492mm IPO

Joint-book runner on $1.1bn credit facility

Joint-book runner on $1.3bn senior notes

■ Will seriously evaluate opportunity but may look

for partner

■Will likely need to raise equity

■ Not concerned with accretion/dilution, given lack

of earnings

KERZNER INTERNATIONAL 16View entire presentation