Altus Power SPAC Presentation Deck

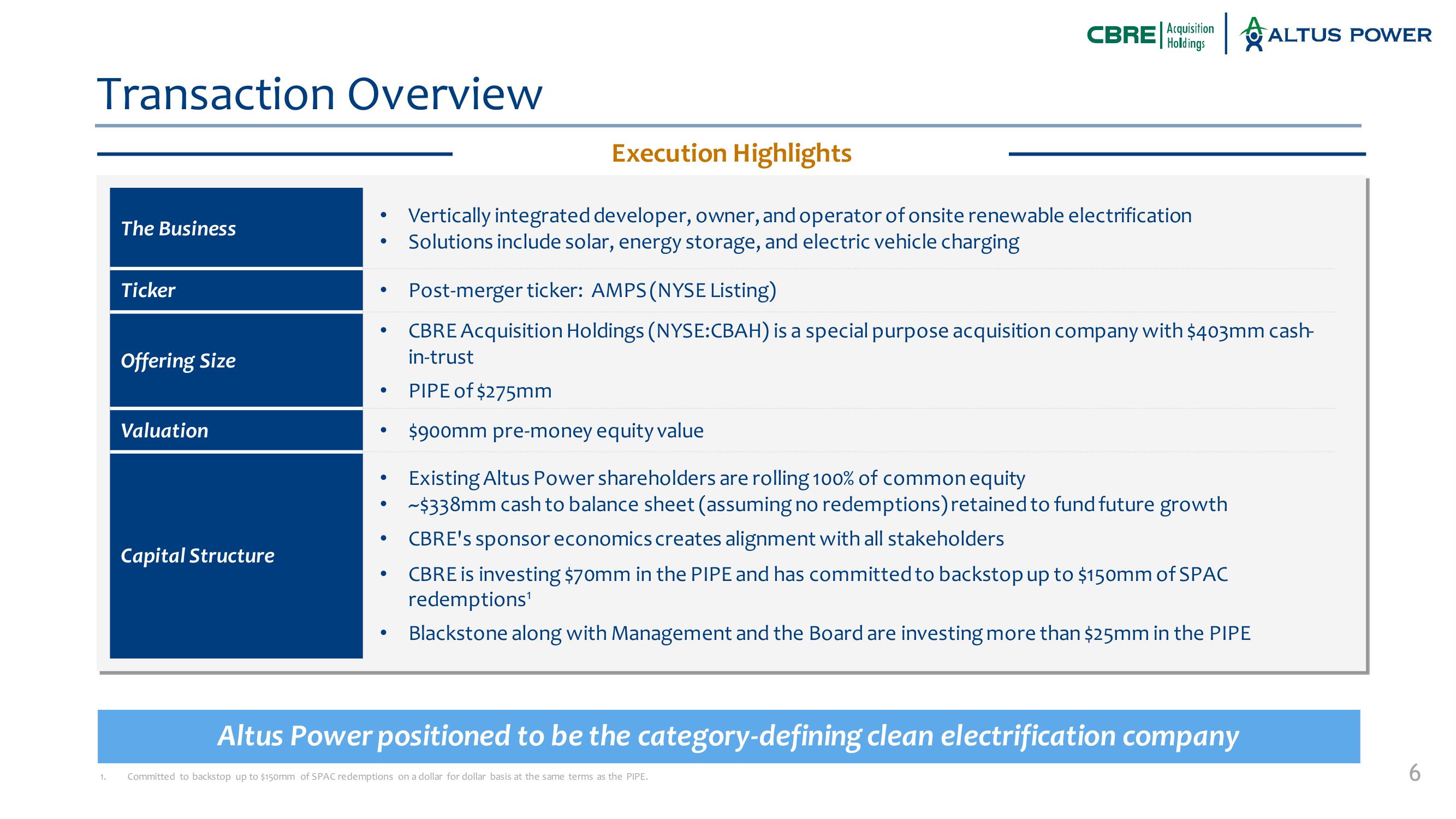

Transaction Overview

The Business

Ticker

Offering Size

Valuation

Capital Structure

●

●

●

●

●

●

●

●

CBRE Acquisition ALTUS POWER

Holdings

Execution Highlights

Vertically integrated developer, owner, and operator of onsite renewable electrification

Solutions include solar, energy storage, and electric vehicle charging

Post-merger ticker: AMPS (NYSE Listing)

CBRE Acquisition Holdings (NYSE:CBAH) is a special purpose acquisition company with $403mm cash-

in-trust

PIPE of $275mm

$900mm pre-money equity value

Existing Altus Power shareholders are rolling 100% of common equity

~$338mm cash to balance sheet (assuming no redemptions) retained to fund future growth

CBRE's sponsor economics creates alignment with all stakeholders

CBRE is investing $70mm in the PIPE and has committed to backstop up to $150mm of SPAC

redemptions¹

Blackstone along with Management and the Board are investing more than $25mm in the PIPE

Altus Power positioned to be the category-defining clean electrification company

1. Committed to backstop up to $150mm of SPAC redemptions on a dollar for dollar basis at the same terms as the PIPE.

6View entire presentation