Bank of America Investment Banking Pitch Book

Project PIONEER

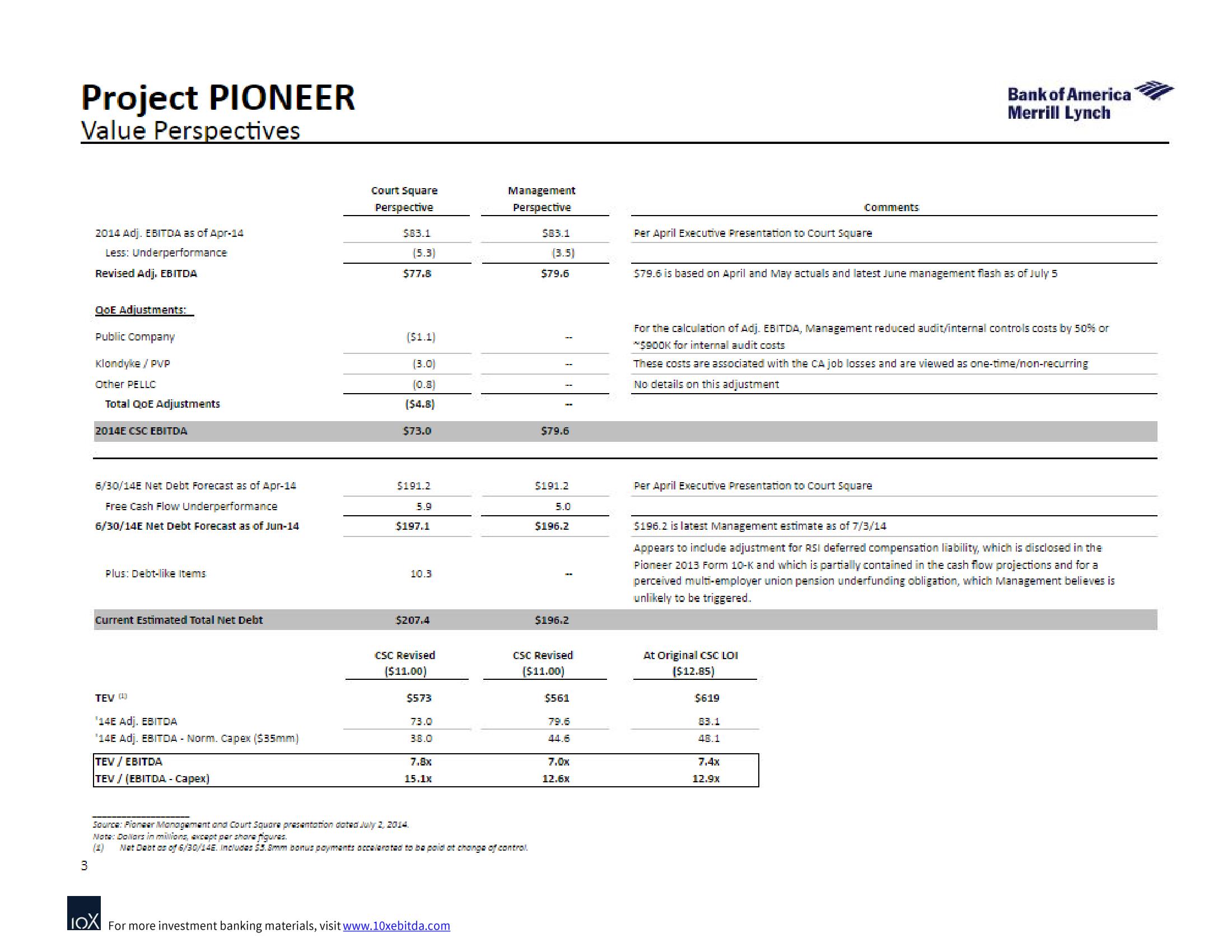

Value Perspectives

3

2014 Adj. EBITDA as of Apr-14

Less: Underperformance

Revised Adj. EBITDA

QoE Adjustments:

Public Company

Klondyke / PVP

Other PELLC

Total QoE Adjustments

2014E CSC EBITDA

6/30/14E Net Debt Forecast as of Apr-14

Free Cash Flow Underperformance

6/30/14E Net Debt Forecast as of Jun-14

Plus: Debt-like Items

Current Estimated Total Net Debt

TEV (¹)

'14E Adj. EBITDA

¹14E Adj. EBITDA - Norm. Capex ($35mm)

TEV / EBITDA

TEV/ (EBITDA. - Capex)

Court Square

Perspective

583.1

(5.3)

$77.8

($1.1)

(3.0)

(0.8)

($4.8)

$73.0

$191.2

5.9

$197.1

10.3

$207.4

CSC Revised

($11.00)

$573

73.0

3.8.0

7.8x

15.1x

Management

Perspective

LOX For more investment banking materials, visit www.10xebitda.com

Source: Pioneer Management and Court Square presentation dated July 2, 2014.

Note: Dollars in milions, except par share figures.

Nat Debt as of 6/30/14E. Includes $3.8mm bonus payments accelerated to be paid at change of control.

503.1

(3.5)

$79.6

$79.6

$191.2

5.0

$196.2

$196.2

CSC Revised

($11.00)

$561

79.6

7.0x

12.6x

Per April Executive Presentation to Court Square

$79.6 is based on April and May actuals and latest June management flash as of July 5

Comments

For the calculation of Adj. EBITDA, Management reduced audit/internal controls costs by 50% or

*$900K for internal audit costs

These costs are associated with the CA job losses and are viewed as one-time/non-recurring

No details on this adjustment

Per April Executive Presentation to Court Square

At Original CSC LOI

($12.85)

$196.2 is latest Management estimate as of 7/3/14

Appears to include adjustment for RSI deferred compensation liability, which is disclosed in the

Pioneer 2013 Form 10-K and which is partially contained in the cash flow projections and for a

perceived multi-employer union pension underfunding obligation, which Management believes is

unlikely to be triggered.

$619

Bank of America

Merrill Lynch

83.1

48.1

7.4x

12.9xView entire presentation