Credit Suisse Investment Banking Pitch Book

Executive summary

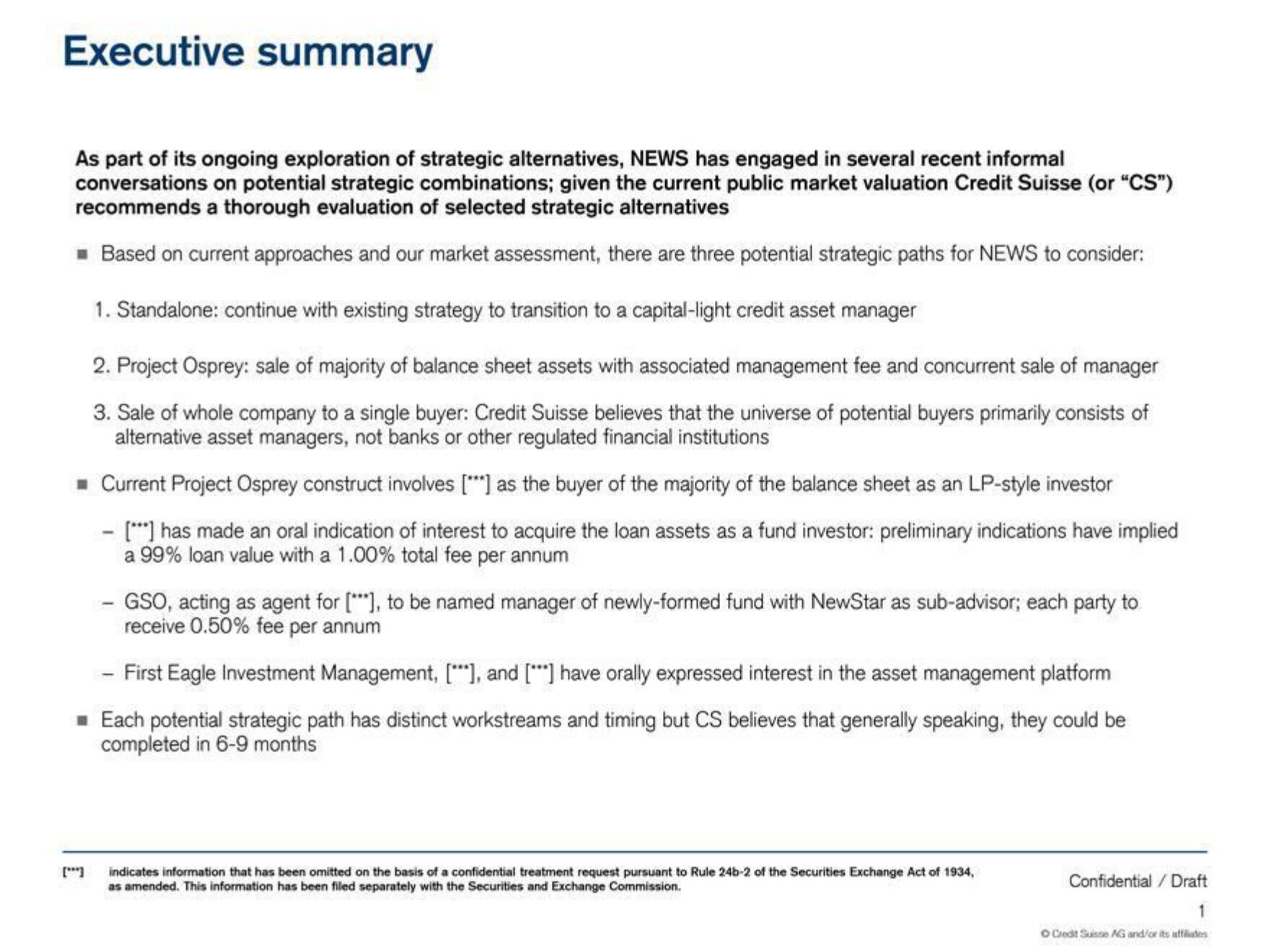

As part of its ongoing exploration of strategic alternatives, NEWS has engaged in several recent informal

conversations on potential strategic combinations; given the current public market valuation Credit Suisse (or "CS")

recommends a thorough evaluation of selected strategic alternatives

Based on current approaches and our market assessment, there are three potential strategic paths for NEWS to consider:

1. Standalone: continue with existing strategy to transition to a capital-light credit asset manager

2. Project Osprey: sale of majority of balance sheet assets with associated management fee and concurrent sale of manager

3. Sale of whole company to a single buyer: Credit Suisse believes that the universe of potential buyers primarily consists of

alternative asset managers, not banks or other regulated financial institutions

Current Project Osprey construct involves [***] as the buyer of the majority of the balance sheet as an LP-style investor

- [***] has made an oral indication of interest to acquire the loan assets as a fund investor: preliminary indications have implied

a 99% loan value with a 1.00% total fee per annum

(

- GSO, acting as agent for [***], to be named manager of newly-formed fund with NewStar as sub-advisor; each party to

receive 0.50% fee per annum

- First Eagle Investment Management, [***], and [***] have orally expressed interest in the asset management platform

Each potential strategic path has distinct workstreams and timing but CS believes that generally speaking, they could be

completed in 6-9 months

indicates information that has been omitted on the basis of a confidential treatment request pursuant to Rule 24b-2 of the Securities Exchange Act of 1934,

as amended. This information has been filed separately with the Securities and Exchange Commission.

Confidential / Draft

Ⓒ Credit Suisse AG and/or its affiliatesView entire presentation