SoftBank Results Presentation Deck

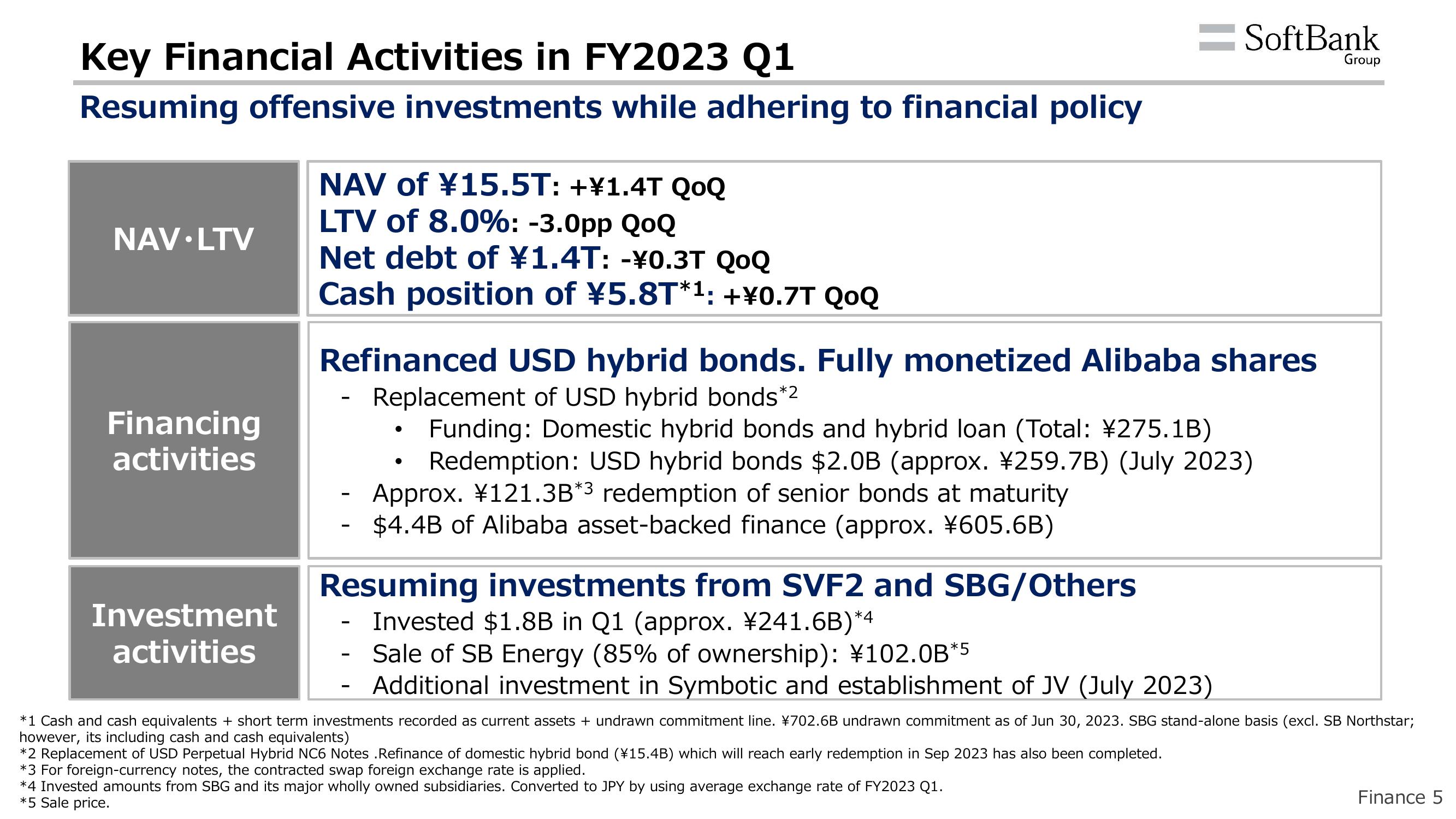

Key Financial Activities in FY2023 Q1

Resuming offensive investments while adhering to financial policy

NAV.LTV

Financing

activities

Investment

activities

NAV of ¥15.5T: +¥1.4T QOQ

LTV of 8.0%: -3.0pp QoQ

Net debt of ¥1.4T: -¥0.3T QOQ

Cash position of ¥5.8T*¹: +¥0.7T QOQ

Refinanced USD hybrid bonds. Fully monetized Alibaba shares

Replacement of USD hybrid bonds*2

-

-

-

-

●

Funding: Domestic hybrid bonds and hybrid loan (Total: ¥275.1B)

Redemption: USD hybrid bonds $2.0B (approx. ¥259.7B) (July 2023)

Approx. ¥121.3B*³ redemption of senior bonds at maturity

$4.4B of Alibaba asset-backed finance (approx. ¥605.6B)

Resuming investments from SVF2 and SBG/Others

Invested $1.8B in Q1 (approx. ¥241.6B)*4

Sale of SB Energy (85% of ownership): ¥102.0B*5

Additional investment in Symbotic and establishment of JV (July 2023)

●

SoftBank

*3 For foreign-currency notes, the contracted swap foreign exchange rate is applied.

*4 Invested amounts from SBG and its major wholly owned subsidiaries. Converted to JPY by using average exchange rate of FY2023 Q1.

*5 Sale price.

Group

*1 Cash and cash equivalents + short term investments recorded as current assets + undrawn commitment line. ¥702.6B undrawn commitment as of Jun 30, 2023. SBG stand-alone basis (excl. SB Northstar;

however, its including cash and cash equivalents)

*2 Replacement of USD Perpetual Hybrid NC6 Notes .Refinance of domestic hybrid bond (¥15.4B) which will reach early redemption in Sep 2023 has also been completed.

Finance 5View entire presentation