Baird Investment Banking Pitch Book

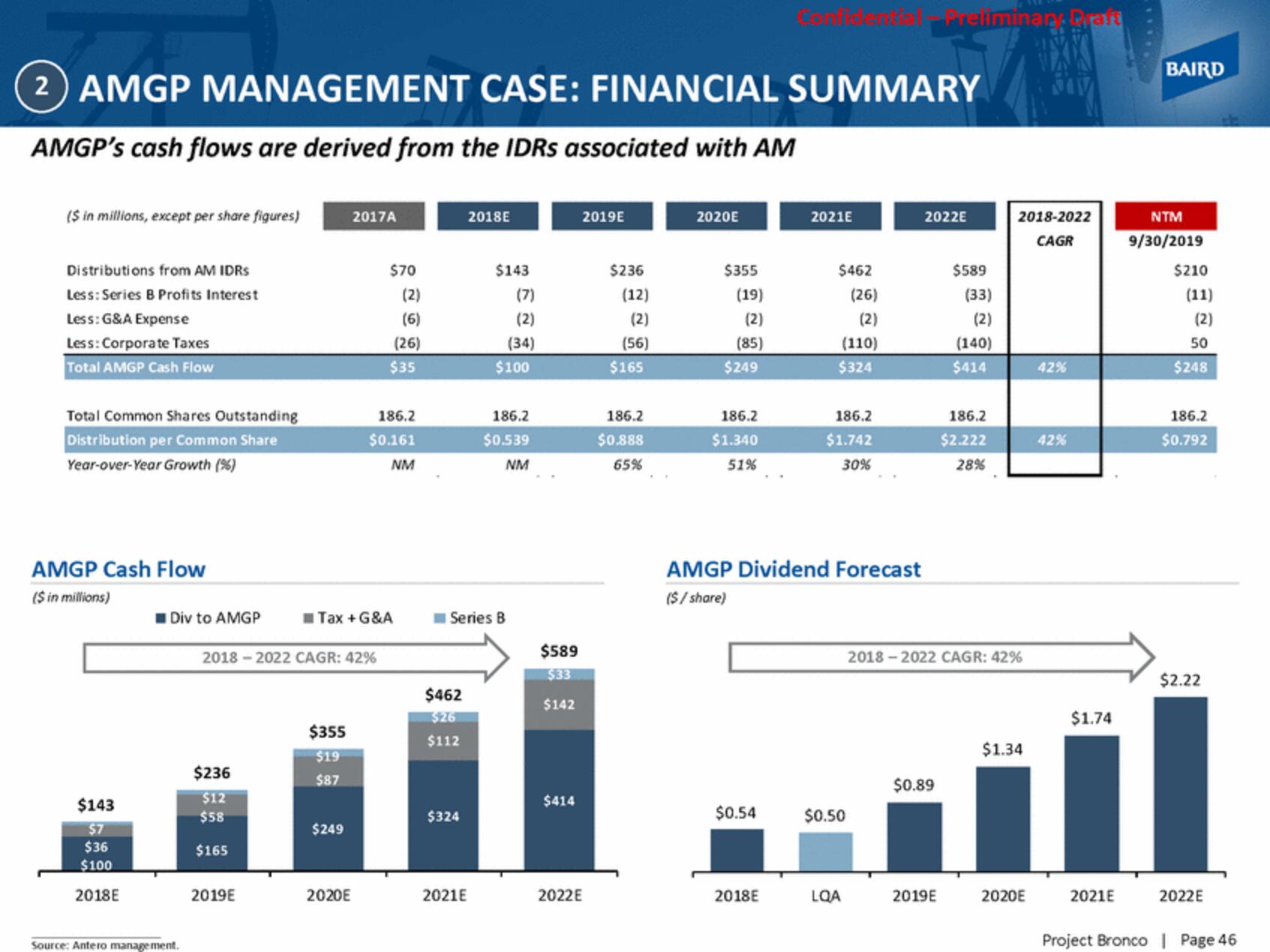

(2) AMGP MANAGEMENT CASE: FINANCIAL SUMMARY

AMGP's cash flows are derived from the IDRS associated with AM

($ in millions, except per share figures)

Distributions from AM IDRS

Less: Series B Profits Interest

Less: G&A Expense

Less: Corporate Taxes

Total AMGP Cash Flow

Total Common Shares Outstanding

Distribution per Common Share

Year-over-Year Growth (%)

AMGP Cash Flow

($ in millions)

$143

$7

$36

$100

2018E

Div to AMGP

Source: Antero management.

$236

$12

$58

$165

2019E

2018-2022 CAGR: 42%

2017A

$355

$19

$87

$249

$70

Tax + G&A

2020E

(2)

(6)

(26)

$35

186.2

$0.161

NM

$462

$26

$112

2018E

$324

$143

(7)

(2)

(34)

Series B

2021E

$100

186.2

$0.539

NM

$589

$33

$142

$414

2019E

2022E

$236

(12)

(2)

(56)

$165

186.2

$0.888

65%

2020E

$355

(19)

(2)

(85)

$249

186.2

$1.340

51%

$0.54

2021E

2018E

$462

(26)

(2)

(110)

$324

AMGP Dividend Forecast

($/share)

186.2

$1.742

30%

$0.50

LQA

reliminary Prafi

2022E

$0.89

2019E

$589

(33)

(2)

(140)

$414

186.2

$2.222

28%

2018-2022 CAGR: 42%

2018-2022

CAGR

$1.34

2020E

42%

42%

$1.74

2021E

BAIRD

NTM

9/30/2019

$210

(11)

(2)

50

$248

186.2

$0.792

$2.22

2022E

Project Bronco | Page 46View entire presentation