AT&T Results Presentation Deck

3Q23 Consumer and Business Wireline Results

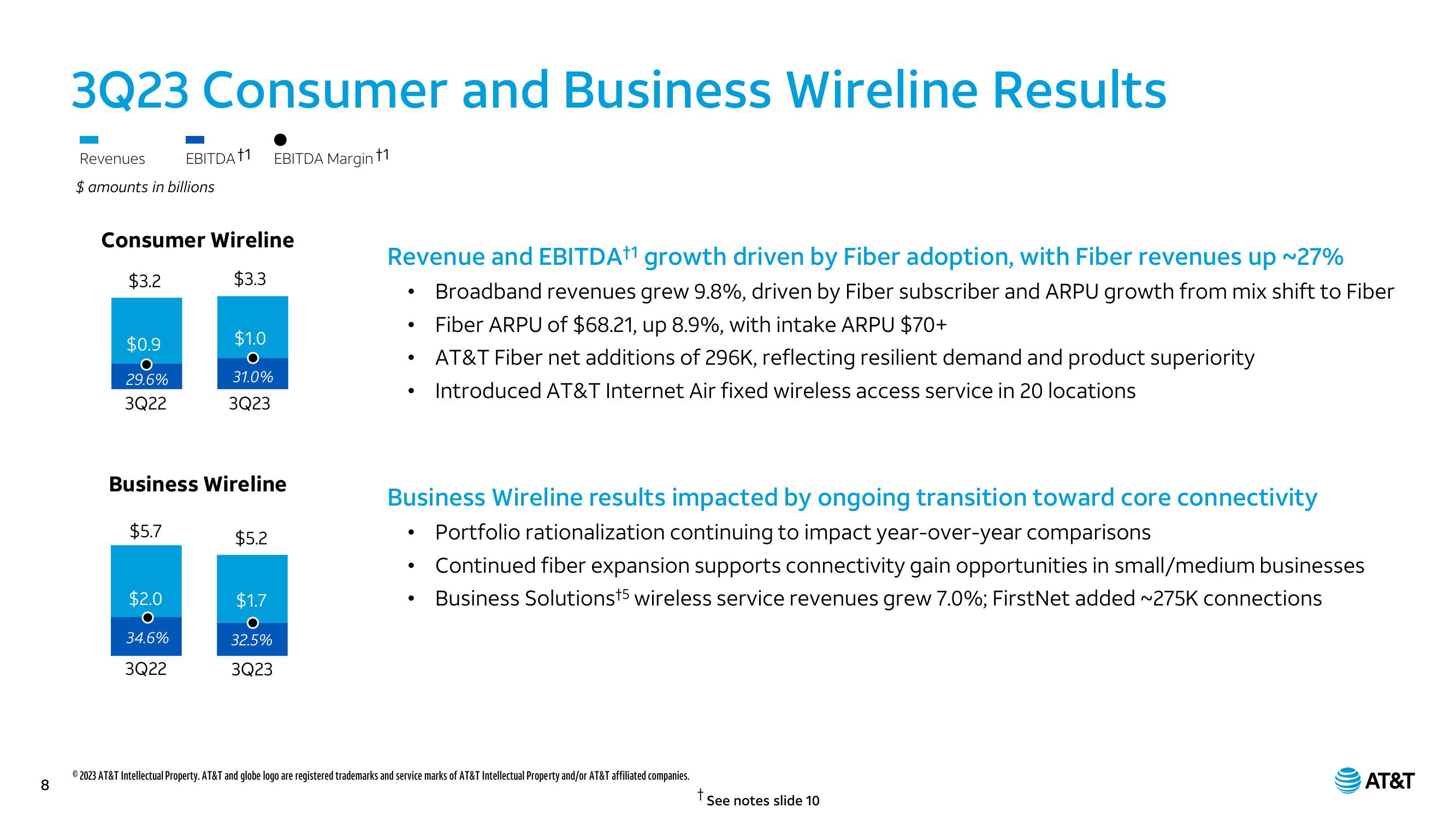

Revenues EBITDA †1 EBITDA Margin †1

$ amounts in billions

Consumer Wireline

$3.2

$3.3

$0.9

O

29.6%

3Q22

$5.7

Business Wireline

$2.0

$1.0

34.6%

3Q22

31.0%

3Q23

$5.2

$1.7

32.5%

3Q23

Revenue and EBITDA+¹ growth driven by Fiber adoption, with Fiber revenues up ~27%

Broadband revenues grew 9.8%, driven by Fiber subscriber and ARPU growth from mix shift to Fiber

Fiber ARPU of $68.21, up 8.9%, with intake ARPU $70+

AT&T Fiber net additions of 296K, reflecting resilient demand and product superiority

Introduced AT&T Internet Air fixed wireless access service in 20 locations

●

●

Business Wireline results impacted by ongoing transition toward core connectivity

Portfolio rationalization continuing to impact year-over-year comparisons

●

• Continued fiber expansion supports connectivity gain opportunities in small/medium businesses

●

Business Solutions t5 wireless service revenues grew 7.0%; FirstNet added ~275K connections

●

© 2023 AT&T Intellectual Property. AT&T and globe logo are registered trademarks and service marks of AT&T Intellectual Property and/or AT&T affiliated companies.

8

t

See notes slide 10

AT&TView entire presentation