Coppersmith Presentation to Alere Inc Stockholders

PAGE 35 |

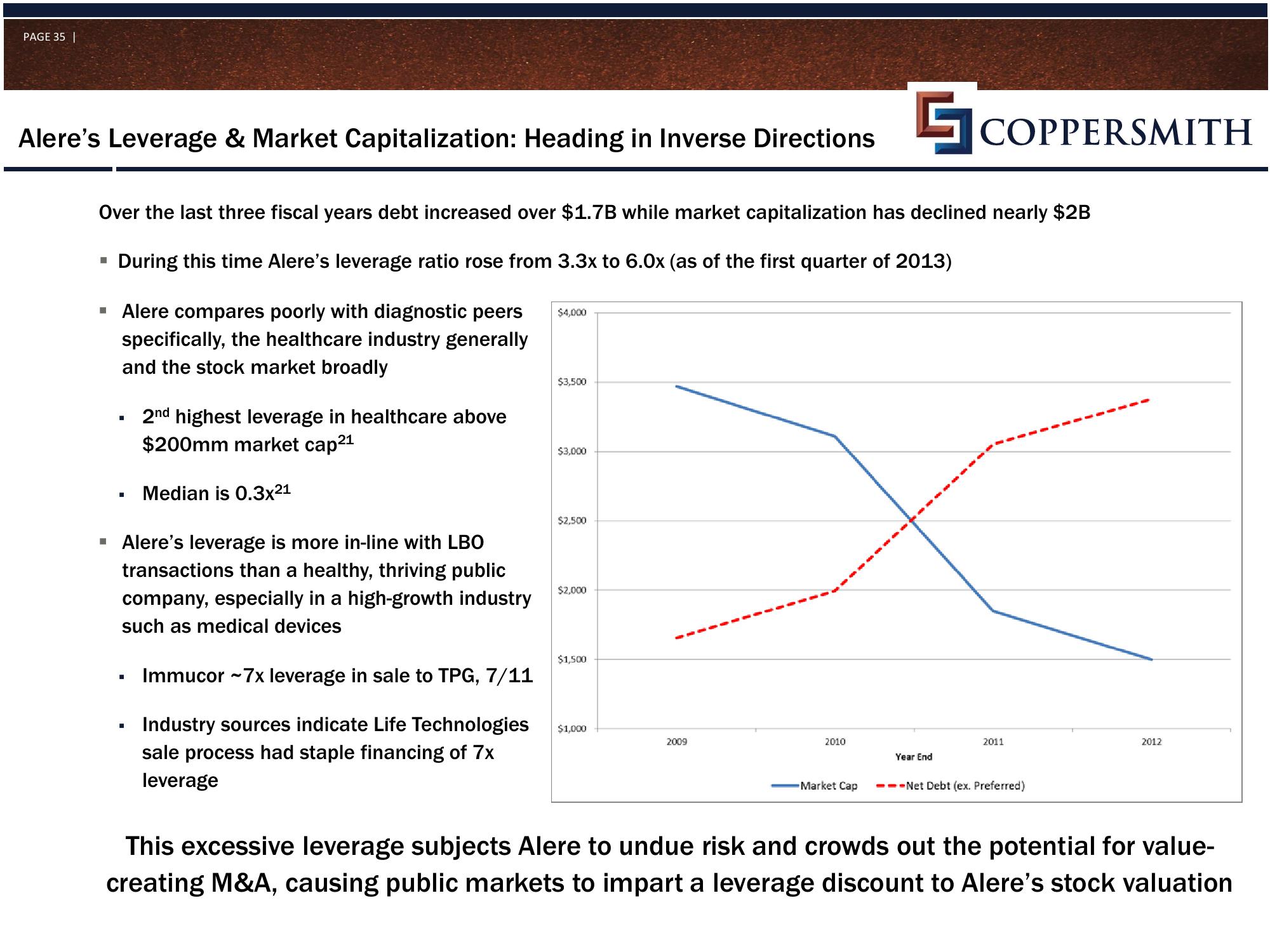

Alere's Leverage & Market Capitalization: Heading in Inverse Directions

Over the last three fiscal years debt increased over $1.7B while market capitalization has declined nearly $2B

During this time Alere's leverage ratio rose from 3.3x to 6.0x (as of the first quarter of 2013)

▪ Alere compares poorly with diagnostic peers $4,000

specifically, the healthcare industry generally

and the stock market broadly

■

■

-

▪ Alere's leverage is more in-line with LBO

transactions than a healthy, thriving public

company, especially in a high-growth industry

such as medical devices

Immucor ~7x leverage in sale to TPG, 7/11

Industry sources indicate Life Technologies

sale process had staple financing of 7x

leverage

■

2nd highest leverage in healthcare above

$200mm market cap²1

Median is 0.3x21

■

$3,500

$3,000

$2,500

$2,000

$1,500

$1,000

2009

2010

Market Cap

COPPERSMITH

Year End

2011

---Net Debt (ex. Preferred)

2012

This excessive leverage subjects Alere to undue risk and crowds out the potential for value-

creating M&A, causing public markets to impart a leverage discount to Alere's stock valuationView entire presentation