Strategically Positioning Truist Insurance Holdings for Long-Term Success

Strong capital generation

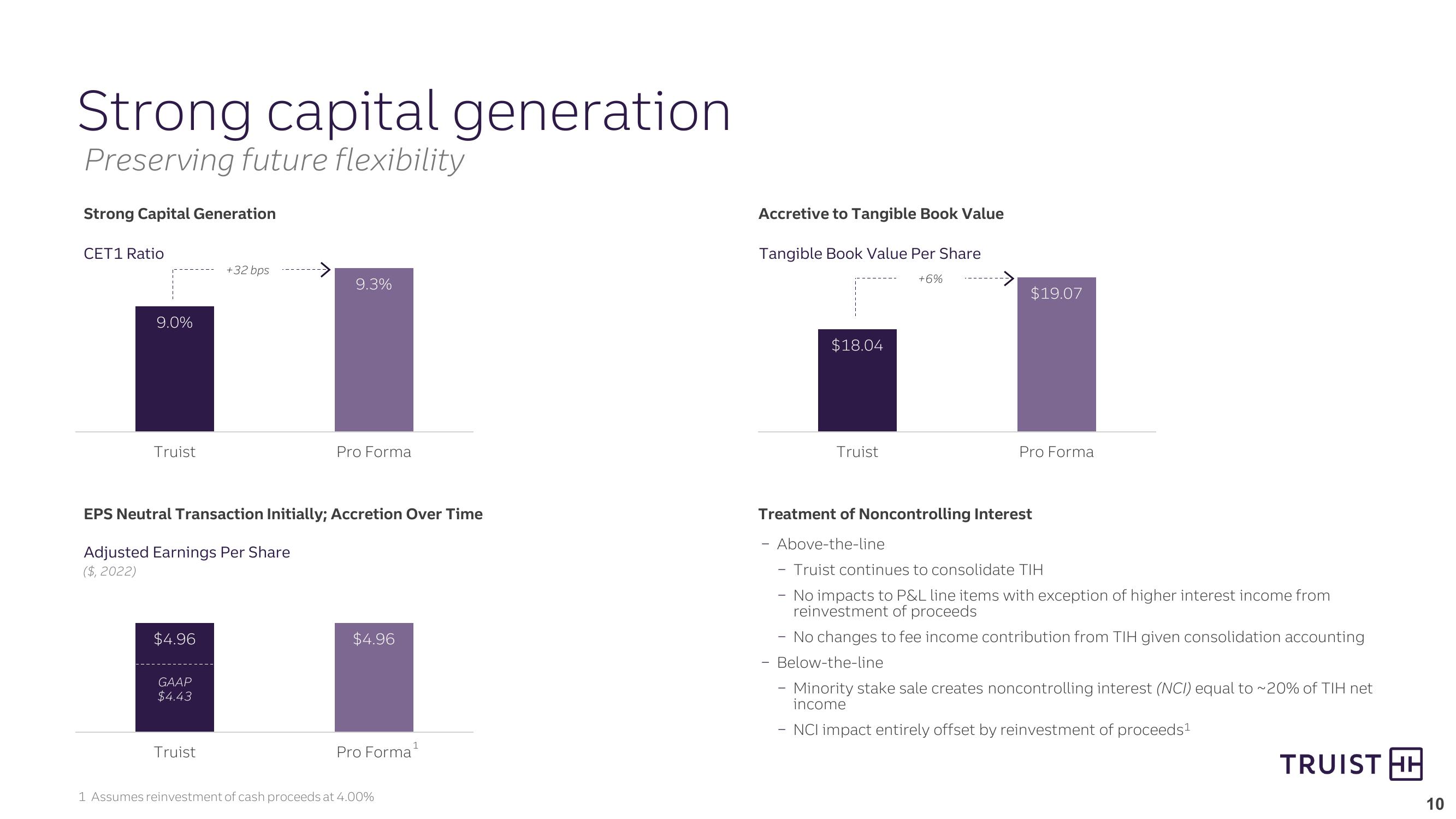

Preserving future flexibility

Strong Capital Generation

CET1 Ratio

+32 bps

9.3%

9.0%

Truist

Pro Forma

Accretive to Tangible Book Value

Tangible Book Value Per Share

$18.04

Truist

+6%

$19.07

Pro Forma

EPS Neutral Transaction Initially; Accretion Over Time

Adjusted Earnings Per Share

($, 2022)

$4.96

GAAP

$4.43

$4.96

Treatment of Noncontrolling Interest

- Above-the-line

- Truist continues to consolidate TIH

- No impacts to P&L line items with exception of higher interest income from

reinvestment of proceeds

- No changes to fee income contribution from TIH given consolidation accounting

· Below-the-line

- Minority stake sale creates noncontrolling interest (NCI) equal to ~20% of TIH net

income

NCI impact entirely offset by reinvestment of proceeds¹

Truist

Pro Forma¹

1 Assumes reinvestment of cash proceeds at 4.00%

TRUIST HH

10View entire presentation