Allwyn Investor Conference Presentation Deck

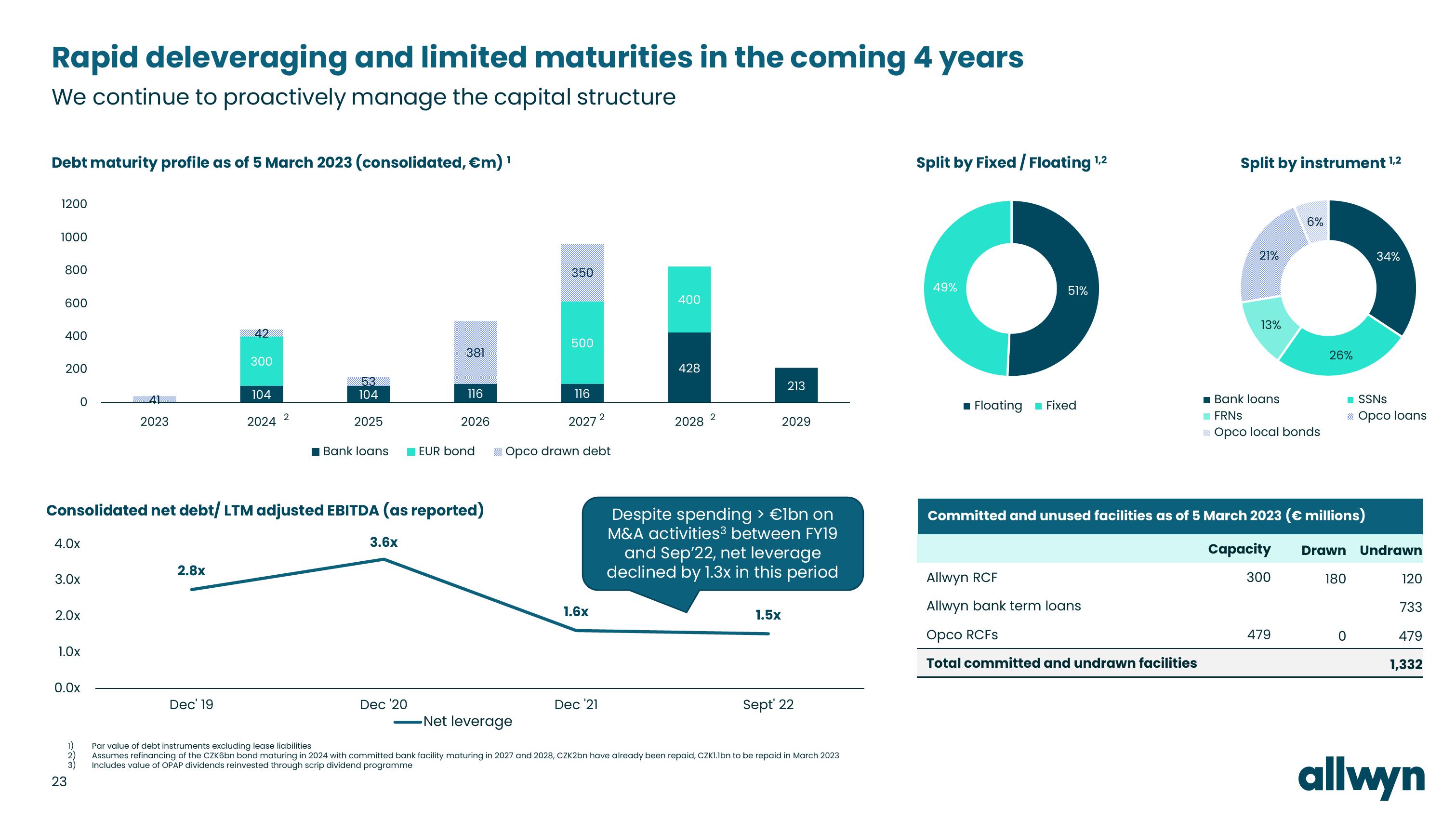

Rapid deleveraging and limited maturities in the coming 4 years

We continue to proactively manage the capital structure

1

Debt maturity profile as of 5 March 2023 (consolidated, €m) ¹

1200

1000

800

600

400

200

0

4.0x

3.0x

2.0x

1.0x

0.0x

1)

2)

3)

23

2023

2.8x

42

Dec' 19

300

104

2024

Consolidated net debt/ LTM adjusted EBITDA (as reported)

2

53

104

2025

Bank loans

3.6x

381

Dec '20

116

2026

EUR bond

350

500

116

2027

Opco drawn debt

1.6x

2

Dec '21

400

428

2028

2

213

2029

Despite spending > €1bn on

M&A activities3 between FY19

and Sep'22, net leverage

declined by 1.3x in this period

1.5x

Sept' 22

-Net leverage

Par value of debt instruments excluding lease liabilities

Assumes refinancing of the CZK6bn bond maturing in 2024 with committed bank facility maturing in 2027 and 2028, CZK2bn have already been repaid, CZK1.1bn to be repaid in March 2023

Includes value of OPAP dividends reinvested through scrip dividend programme

Split by Fixed / Floating 1,2

49%

51%

■ Floating Fixed

Split by instrument ¹,2

Allwyn RCF

Allwyn bank term loans

Opco RCFS

Total committed and undrawn facilities

21%

13%

■Bank loans

FRNS

>> Opco local bonds

6%

XXXXXX

Committed and unused facilities as of 5 March 2023 (€ millions)

300

26%

479

■SSNs

> Opco loans

Capacity Drawn Undrawn

34%

180

0

120

733

479

1,332

allwynView entire presentation