Bausch Health Companies Investor Conference Presentation Deck

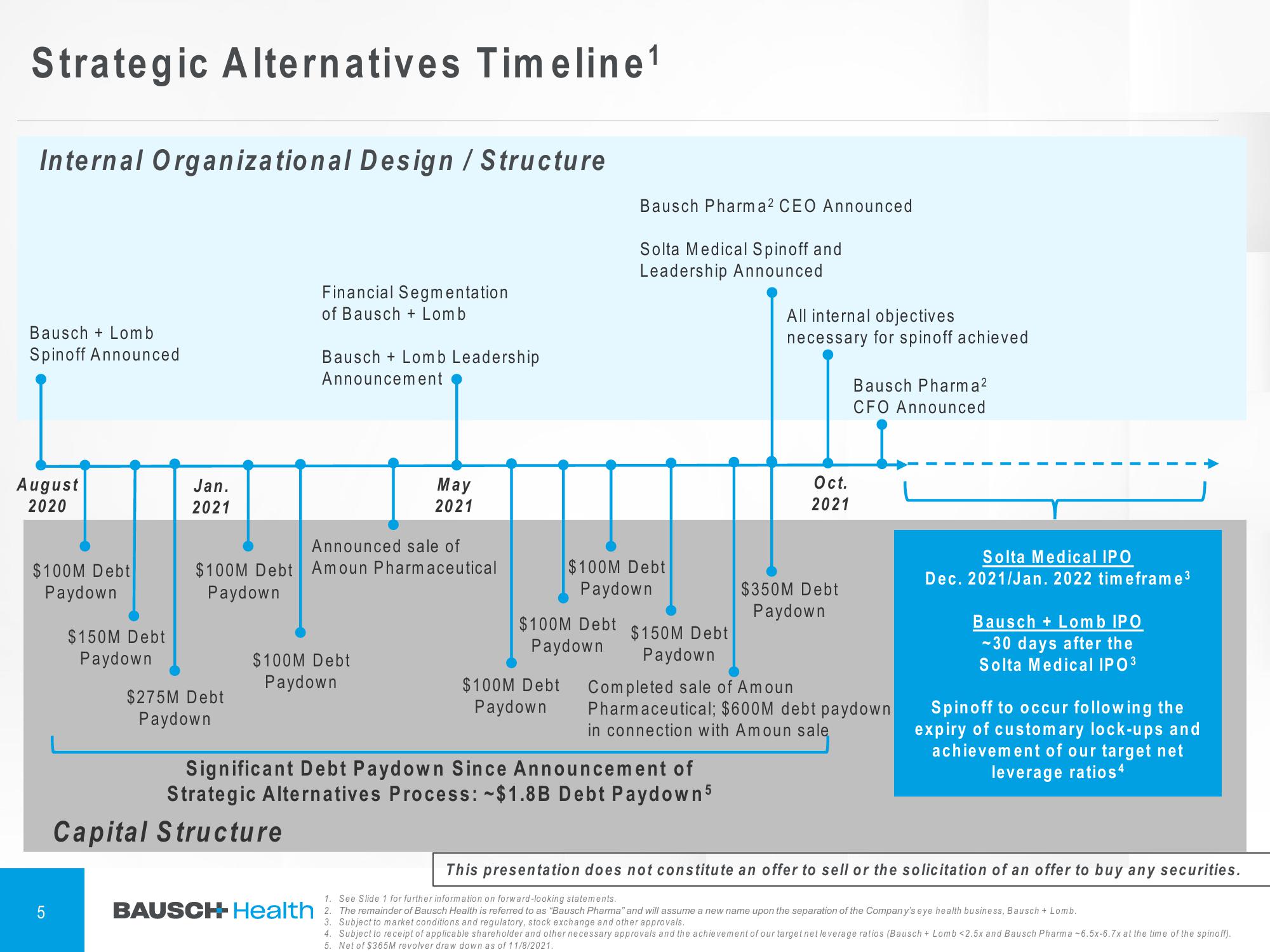

Strategic Alternatives Timeline ¹

Internal Organizational Design / Structure

Bausch+Lomb

Spinoff Announced

August

2020

$100M Debt

Paydown

5

$150M Debt

Paydown

Jan.

2021

$275M Debt

Paydown

Financial Segmentation

of Bausch + Lomb

Bausch+Lomb Leadership

Announcement

Announced sale of

$100M Debt Amoun Pharmaceutical

Paydown

$100M Debt

Paydown

Capital Structure

May

2021

$100M Debt

Paydown

$100M Debt

Paydown

Bausch Pharma² CEO Announced

Solta Medical Spinoff and

Leadership Announced

$100M Debt

Paydown

Significant Debt Paydown Since Announcement of

Strategic Alternatives Process: ~$1.8B Debt Paydown5

All internal objectives

necessary for spinoff achieved

Oct.

2021

$350M Debt

Paydown

Bausch Pharma²

CFO Announced

$150M Debt

Paydown

Completed sale of Amoun

Pharmaceutical; $600M debt paydown

in connection with Amoun sale

Solta Medical IPO

Dec. 2021/Jan. 2022 timeframe³

Bausch + Lomb IPO

-30 days after the

Solta Medical IPO³

Spinoff to occur following the

expiry of customary lock-ups and

achievement of our target net

leverage ratios4

This presentation does not constitute an offer to sell or the solicitation of an offer to buy any securities.

1. See Slide 1 for further information on forward-looking statements.

BAUSCH- Health 2 The remainder of Bausch Health is referred to as "Bausch Pharma" and will assume a new name upon the separation of the Company's eye health business, Bausch + Lomb.

3. Subject to market conditions and regulatory, stock exchange and other approvals.

4. Subject to receipt of applicable shareholder and other necessary approvals and the achievement of our target net leverage ratios (Bausch+Lomb <2.5x and Bausch Pharma -6.5x-6.7x at the time of the spinoff).

5. Net of $365M revolver draw down as of 11/8/2021.View entire presentation