Bridge Investment Group Results Presentation Deck

DIFFERENTIATED DATA-DRIVEN INVESTMENT STRATEGY ENABLED BY

SPECIALIZED UNDERWRITING CAPABILITIES

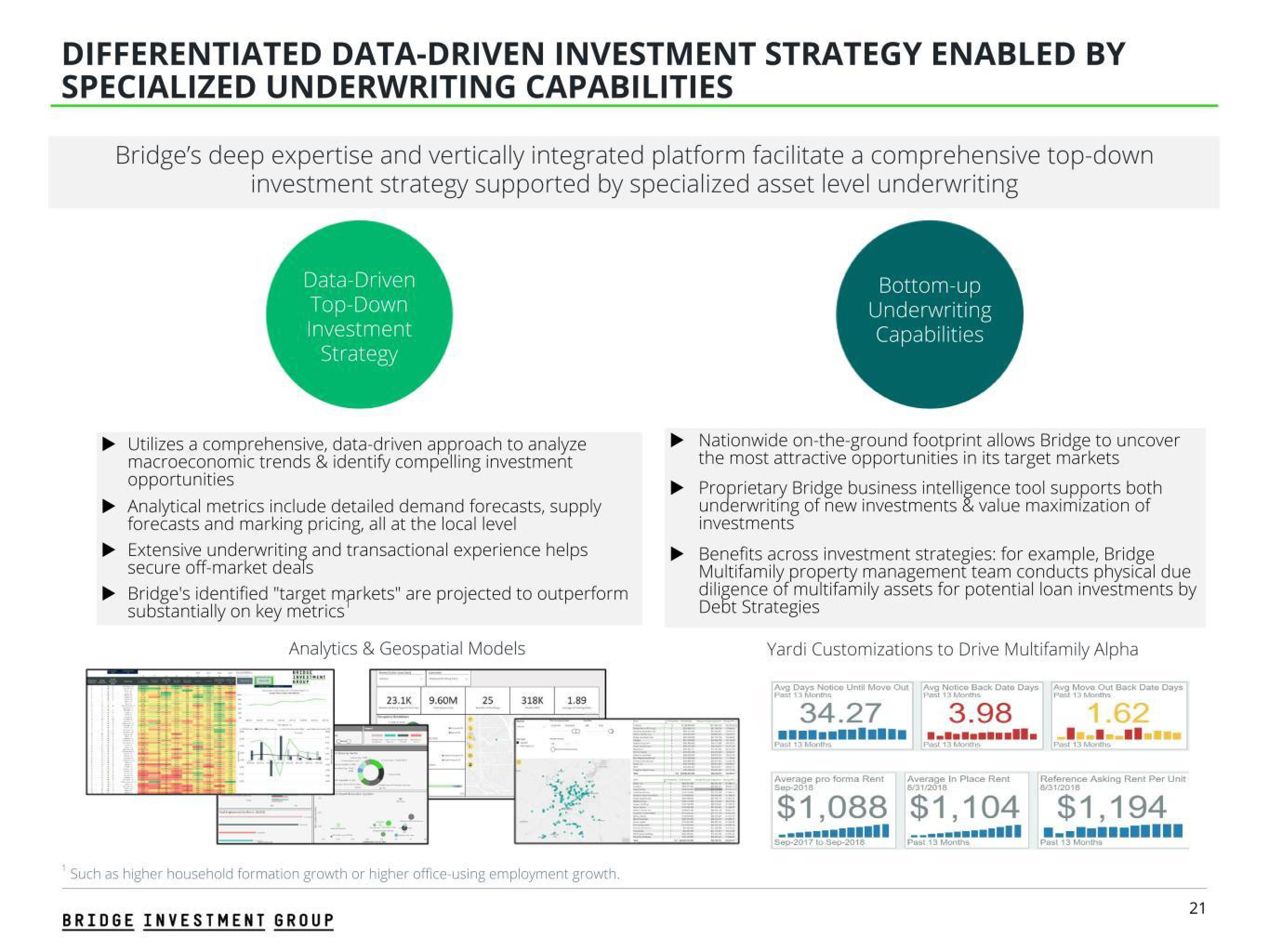

Bridge's deep expertise and vertically integrated platform facilitate a comprehensive top-down

investment strategy supported by specialized asset level underwriting

Data-Driven

Top-Down

Investment

Strategy

Utilizes a comprehensive, data-driven approach to analyze

macroeconomic trends & identify compelling investment

opportunities

Analytical metrics include detailed demand forecasts, supply

forecasts and marking pricing, all at the local level

Extensive underwriting and transactional experience helps

secure off-market deals

Bridge's identified "target markets" are projected to outperform

substantially on key metrics

Analytics & Geospatial Models

GRIESE

INVESTMENT

23.1K 9.60M 25

BRIDGE INVESTMENT GROUP

318K 1.89

B

1

Such as higher household formation growth or higher office-using employment growth.

Nationwide on-the-ground footprint allows Bridge to uncover

the most attractive opportunities in its target markets

Bottom-up

Underwriting

Capabilities

Proprietary Bridge business intelligence tool supports both

underwriting of new investments & value maximization of

investments

Benefits across investment strategies: for example, Bridge

Multifamily property management team conducts physical due

diligence of multifamily assets for potential loan investments by

Debt Strategies

Yardi Customizations to Drive Multifamily Alpha

Avg Days Notice Until Move Out

Past 13 Months

Avg Notice Back Date Days

Past 13 Months

34.27

3.98

Past 13 Months

Average pro forma Rent

Sep-2018

Average In Place Rent

8/31/2018

$1,088 $1,104

Sep-2017 to Sep-2018

Past 13 Months

Past 13 Months

Avg Move Out Back Dato Days

Past 13 Months

1.62

Past 13 Months

Reference Asking Rent Per Unit

8/31/2018

$1,194

Past 13 Months

21View entire presentation