Lazard Investor Presentation Deck

Endnotes related to Non-GAAP Adjustments

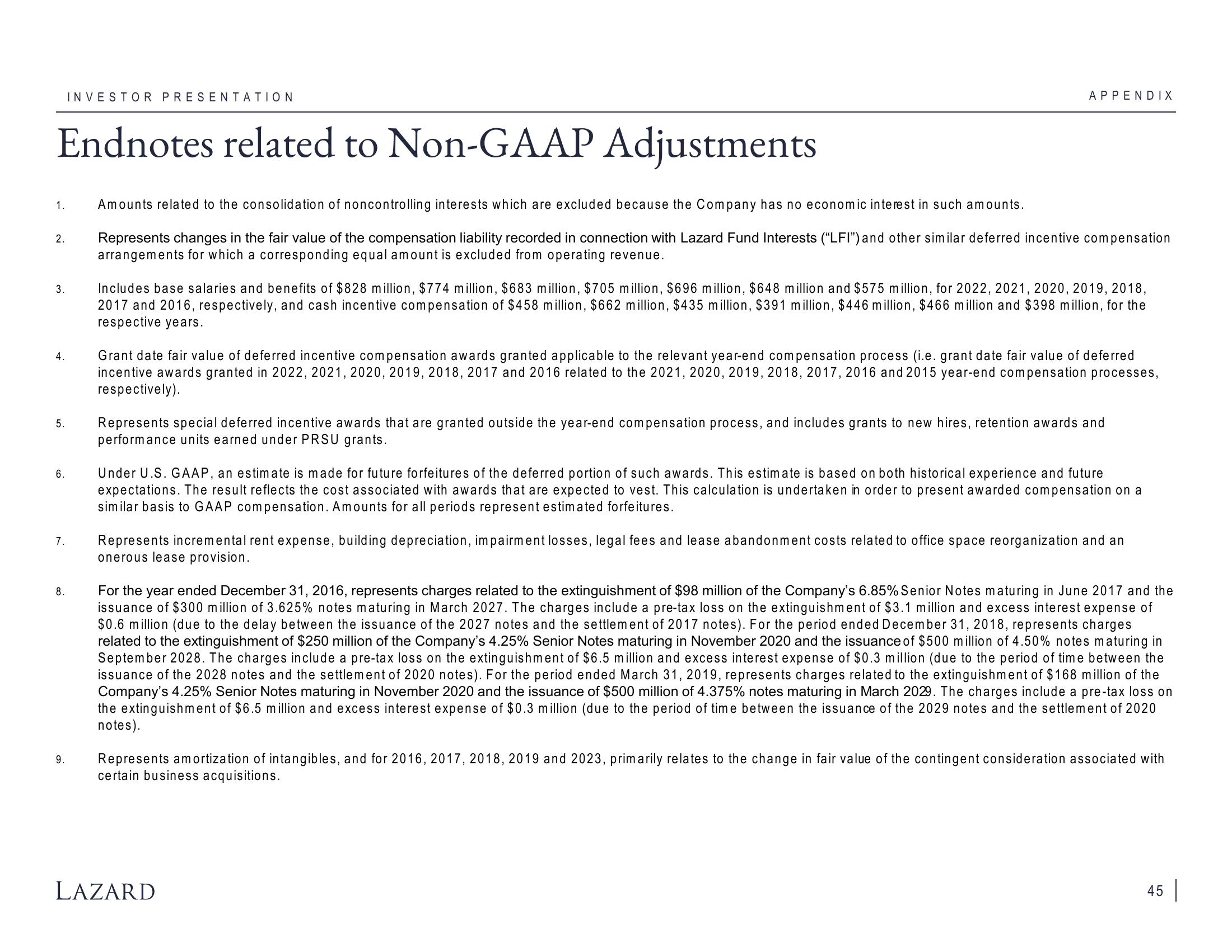

1.

2.

3.

4.

5.

6.

7.

8.

INVESTOR PRESENTATION

9.

APPENDIX

Amounts related to the consolidation of noncontrolling interests which are excluded because the Company has no economic interest in such amounts.

Represents changes in the fair value of the compensation liability recorded in connection with Lazard Fund Interests ("LFI") and other similar deferred incentive compensation

arrangements for which a corresponding equal amount is excluded from operating revenue.

Includes base salaries and benefits of $828 million, $774 million, $683 million, $705 million, $696 million, $648 million and $575 million, for 2022, 2021, 2020, 2019, 2018,

2017 and 2016, respectively, and cash incentive compensation of $458 million, $662 million, $435 million, $391 million, $446 million, $466 million and $398 million, for the

respective years.

Grant date fair value of deferred incentive compensation awards granted applicable to the relevant year-end compensation process (i.e. grant date fair value of deferred

incentive awards granted in 2022, 2021, 2020, 2019, 2018, 2017 and 2016 related to the 2021, 2020, 2019, 2018, 2017, 2016 and 2015 year-end compensation processes,

respectively).

Represents special deferred incentive awards that are granted outside the year-end compensation process, and includes grants to new hires, retention awards and

performance units earned under PRSU grants.

Under U.S. GAAP, an estimate is made for future forfeitures of the deferred portion of such awards. This estimate is based on both historical experience and future

expectations. The result reflects the cost associated with wards that are expected to vest. This calculation is undertaken in order to present awarded compensation on a

similar basis to GAAP compensation. Amounts for all periods represent estimated forfeitures.

Represents incremental rent expense, building depreciation, impairment losses, legal fees and lease abandonment costs related to office space reorganization and an

onerous lease provision.

For the year ended December 31, 2016, represents charges related to the extinguishment of $98 million of the Company's 6.85% Senior Notes maturing in June 2017 and the

issuance of $300 million of 3.625% notes maturing in March 2027. The charges include a pre-tax loss on the extinguishment of $3.1 million and excess interest expense of

$0.6 million (due to the delay between the issuance of the 2027 notes and the settlement of 2017 notes). For the period ended December 31, 2018, represents charges

related to the extinguishment of $250 million of the Company's 4.25% Senior Notes maturing in November 2020 and the issuance of $500 million of 4.50% notes maturing in

September 2028. The charges include a pre-tax loss on the extinguishment of $6.5 million and excess interest expense of $0.3 million (due to the period of time between the

issuance of the 2028 notes and the settlement of 2020 notes). For the period ended March 31, 2019, represents charges related to the extinguishment of $168 million of the

Company's 4.25% Senior Notes maturing in November 2020 and the issuance of $500 million of 4.375% notes maturing in March 2029. The charges include a pre-tax loss on

the extinguishment of $6.5 million and excess interest expense of $0.3 million (due to the period of time between the issuance of the 2029 notes and the settlement of 2020

notes).

Represents amortization of intangibles, and for 2016, 2017, 2018, 2019 and 2023, primarily relates to the change in fair value of the contingent consideration associated with

certain business acquisitions.

LAZARD

45View entire presentation