Q4 & FY 2018 Financial Results

Debt and Liquidity Summary

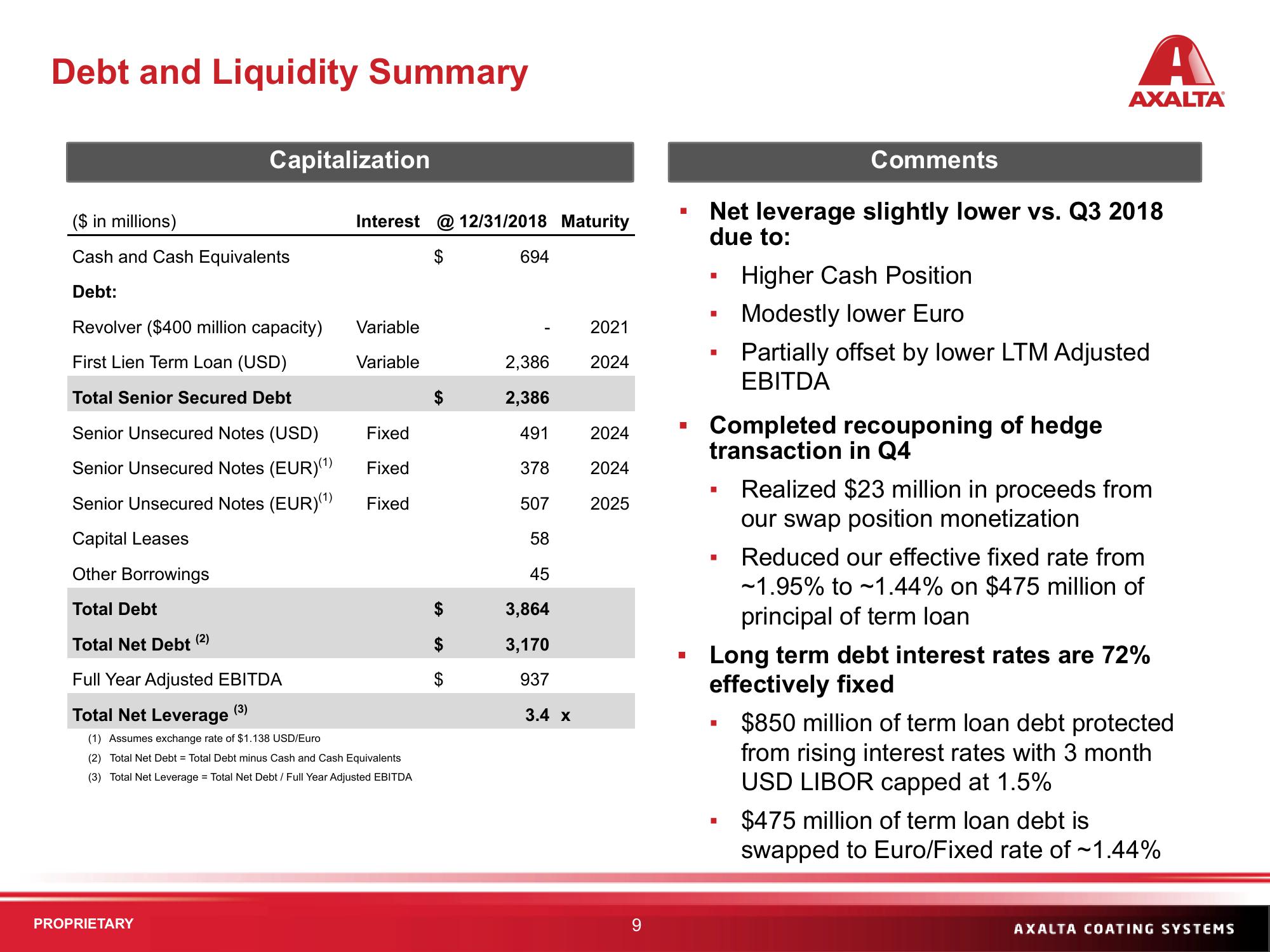

($ in millions)

Cash and Cash Equivalents

Debt:

Revolver ($400 million capacity)

First Lien Term Loan (USD)

Total Senior Secured Debt

Senior Unsecured Notes (USD)

Senior Unsecured Notes (EUR)(1)

Senior Unsecured Notes (EUR) (¹)

Capital Leases

Other Borrowings

Total Debt

Total Net Debt

Capitalization

(2)

Full Year Adjusted EBITDA

(3)

PROPRIETARY

Interest @ 12/31/2018 Maturity

$

Variable

Variable

Fixed

Fixed

Fixed

Total Net Leverage

(1) Assumes exchange rate of $1.138 USD/Euro

(2) Total Net Debt = Total Debt minus Cash and Cash Equivalents

(3) Total Net Leverage = Total Net Debt / Full Year Adjusted EBITDA

694

2,386

2,386

491

378

507

58

45

3,864

3,170

937

3.4 x

2021

2024

2024

2024

2025

9

■

1

■

Net leverage slightly lower vs. Q3 2018

due to:

■

■

■

Completed recouponing of hedge

transaction in Q4

■

Comments

■

A

AXALTA

■

Higher Cash Position

Modestly lower Euro

Partially offset by lower LTM Adjusted

EBITDA

Realized $23 million in proceeds from

our swap position monetization

Long term debt interest rates are 72%

effectively fixed

Reduced our effective fixed rate from

-1.95% to 1.44% on $475 million of

principal of term loan

$850 million of term loan debt protected

from rising interest rates with 3 month

USD LIBOR capped at 1.5%

$475 million of term loan debt is

swapped to Euro/Fixed rate of ~1.44%

AXALTA COATING SYSTEMSView entire presentation