Avantor Results Presentation Deck

6

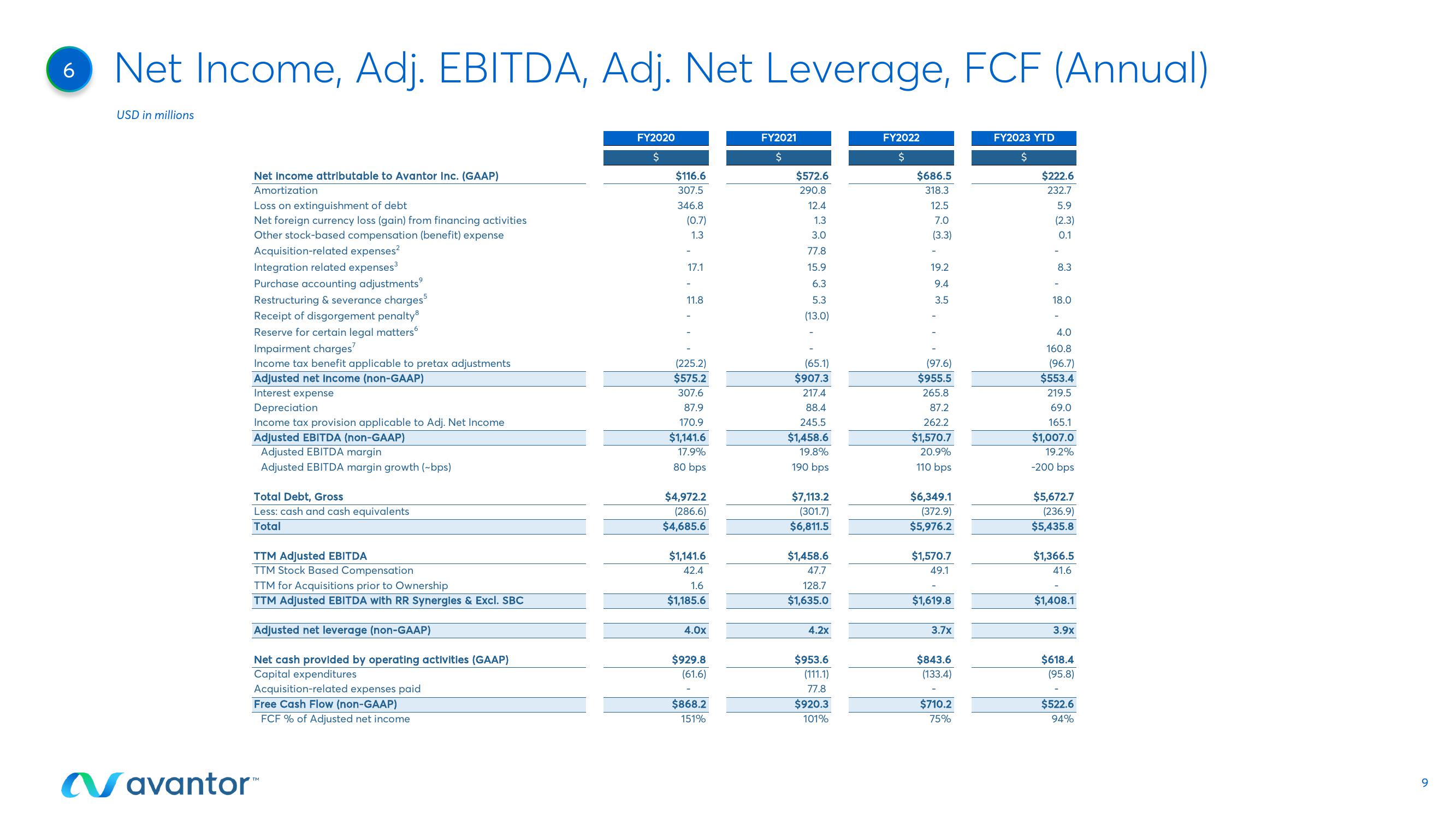

Net Income, Adj. EBITDA, Adj. Net Leverage, FCF (Annual)

USD in millions

Net income attributable to Avantor Inc. (GAAP)

Amortization

Loss on extinguishment of debt

Net foreign currency loss (gain) from financing activities

Other stock-based compensation (benefit) expense

Acquisition-related expenses²

Integration related expenses³

Purchase accounting adjustments

Restructuring & severance charges5

Receipt of disgorgement penalty

Reserve for certain legal matters

Impairment charges?

Income tax benefit applicable to pretax adjustments

Adjusted net income (non-GAAP)

Interest expense

Depreciation

Income tax provision applicable to Adj. Net Income

Adjusted EBITDA (non-GAAP)

Adjusted EBITDA margin

Adjusted EBITDA margin growth (~bps)

Total Debt, Gross

Less: cash and cash equivalents

Total

9

TTM Adjusted EBITDA

TTM Stock Based Compensation

TTM for Acquisitions prior to Ownership

TTM Adjusted EBITDA with RR Synergies & Excl. SBC

Adjusted net leverage (non-GAAP)

Net cash provided by operating activities (GAAP)

Capital expenditures

Acquisition-related expenses paid

Free Cash Flow (non-GAAP)

FCF % of Adjusted net income

avantor™

FY2020

$

$116.6

307.5

346.8

(0.7)

1.3

-

17.1

-

11.8

(225.2)

$575.2

307.6

87.9

170.9

$1,141.6

17.9%

80 bps

$4,972.2

(286.6)

$4,685.6

$1,141.6

42.4

1.6

$1,185.6

4.0x

$929.8

(61.6)

$868.2

151%

FY2021

$

$572.6

290.8

12.4

1.3

3.0

77.8

15.9

6.3

5.3

(13.0)

(65.1)

$907.3

217.4

88.4

245.5

$1,458.6

19.8%

190 bps

$7,113.2

(301.7)

$6,811.5

$1,458.6

47.7

128.7

$1,635.0

4.2x

$953.6

(111.1)

77.8

$920.3

101%

FY2022

$

$686.5

318.3

12.5

7.0

(3.3)

-

19.2

9.4

3.5

(97.6)

$955.5

265.8

87.2

262.2

$1,570.7

20.9%

110 bps

$6,349.1

(372.9)

$5,976.2

$1,570.7

49.1

$1,619.8

3.7x

$843.6

(133.4)

$710.2

75%

FY2023 YTD

$

$222.6

232.7

5.9

(2.3)

0.1

8.3

-

18.0

4.0

160.8

(96.7)

$553.4

219.5

69.0

165.1

$1,007.0

19.2%

-200 bps

$5,672.7

(236.9)

$5,435.8

$1,366.5

41.6

$1,408.1

3.9x

$618.4

(95.8)

$522.6

94%

9View entire presentation