WeWork Investor Presentation Deck

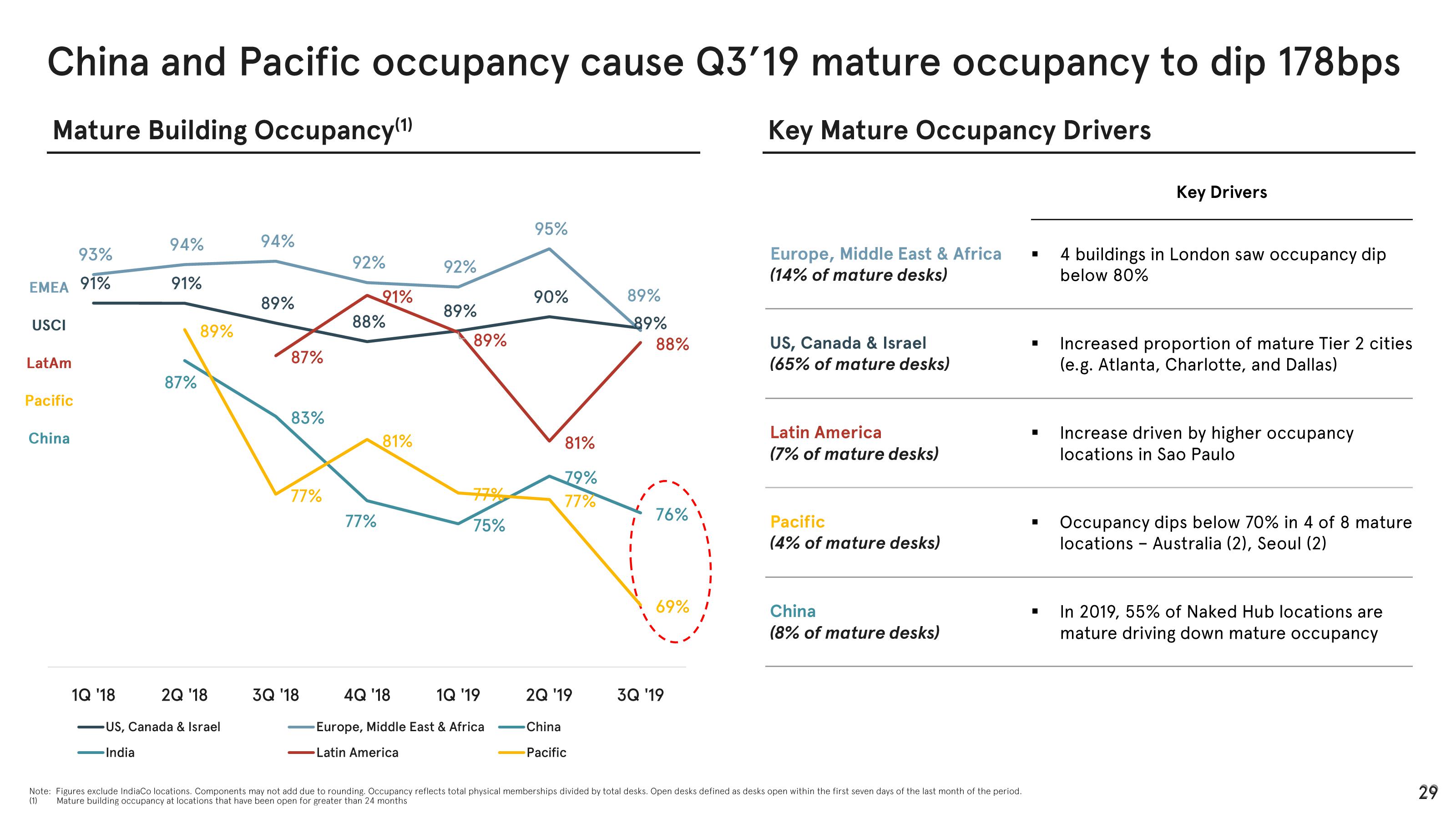

China and Pacific occupancy cause Q3'19 mature occupancy to dip 178bps

Mature Building Occupancy(¹)

Key Mature Occupancy Drivers

93%

EMEA 91%

USCI

LatAm

Pacific

China

1Q '18

94%

91%

87%

89%

2Q '18

US, Canada & Israel

India

94%

89%

87%

83%

77%

3Q '18

92%

91%

88%

77%

81%

92%

89%

89%

75%

4Q '18 1Q '19

Europe, Middle East & Africa

Latin America

95%

90%

81%

79%

77%

2Q '19

-China

Pacific

89%

89%

88%

76%

69%

3Q '19

Europe, Middle East & Africa

(14% of mature desks)

US, Canada & Israel

(65% of mature desks)

Latin America

(7% of mature desks)

Pacific

(4% of mature desks)

China

(8% of mature desks)

Note: Figures exclude IndiaCo locations. Components may not add due to rounding. Occupancy reflects total physical memberships divided by total desks. Open desks defined as desks open within the first seven days of the last month of the period.

(1) Mature building occupancy at locations that have been open for greater than 24 months

■

■

■

■

Key Drivers

4 buildings in London saw occupancy dip

below 80%

Increased proportion of mature Tier 2 cities

(e.g. Atlanta, Charlotte, and Dallas)

Increase driven by higher occupancy

locations in Sao Paulo

Occupancy dips below 70% in 4 of 8 mature

locations - Australia (2), Seoul (2)

In 2019, 55% of Naked Hub locations are

mature driving down mature occupancy

29View entire presentation