Bunzl Results Presentation Deck

NORTH AMERICA / CONTINENTAL

EUROPE

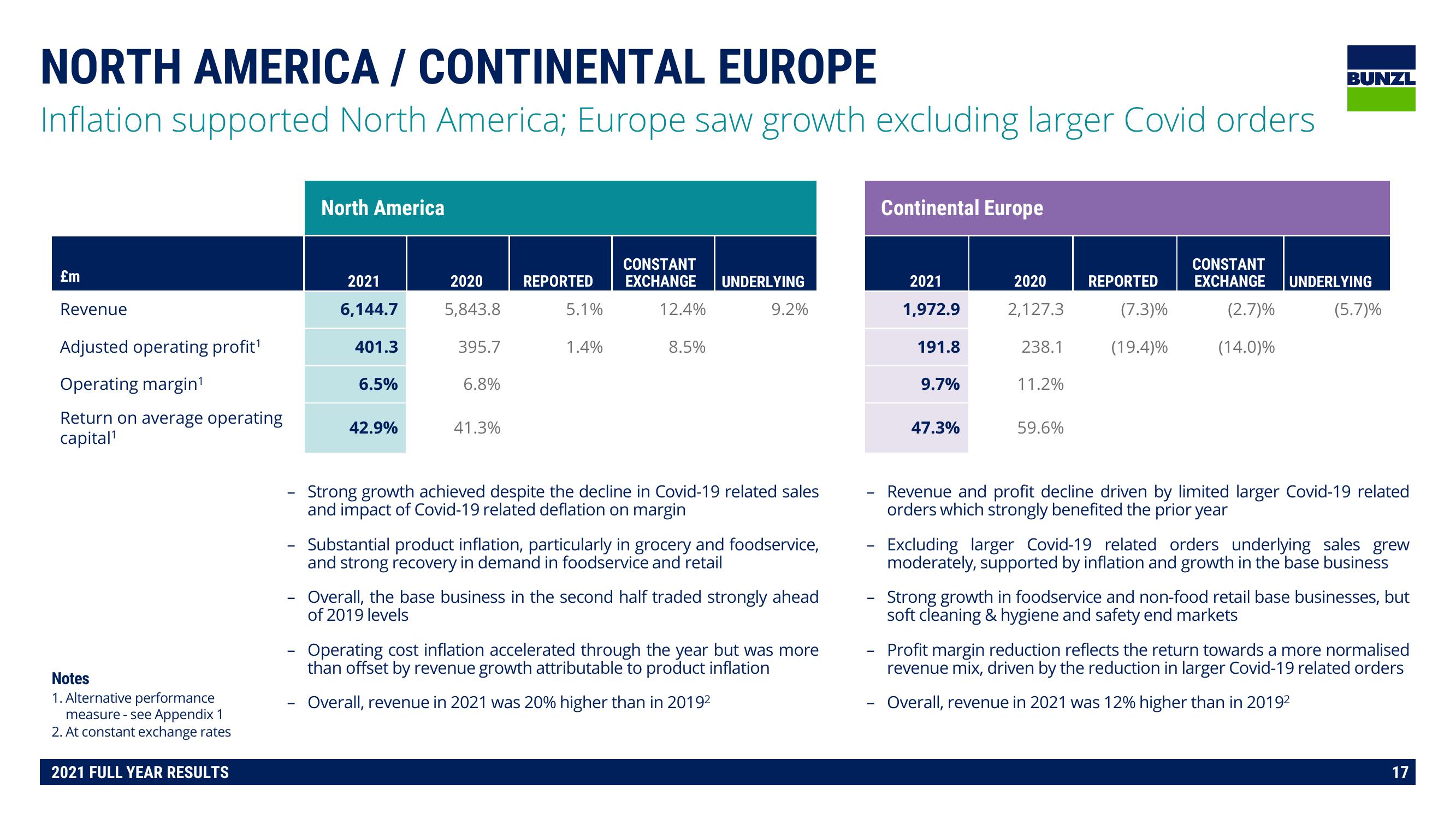

Inflation supported North America; Europe saw growth excluding larger Covid orders

£m

Revenue

Adjusted operating profit¹

Operating margin¹

Return on average operating

capital¹

Notes

1. Alternative performance

measure - see Appendix 1

2. At constant exchange rates

2021 FULL YEAR RESULTS

North America

-

2021

6,144.7

401.3

6.5%

42.9%

2020

5,843.8

395.7

6.8%

41.3%

REPORTED

5.1%

1.4%

CONSTANT

EXCHANGE UNDERLYING

12.4%

8.5%

9.2%

Strong growth achieved despite the decline in Covid-19 related sales

and impact of Covid-19 related deflation on margin

Substantial product inflation, particularly in grocery and foodservice,

and strong recovery in demand in foodservice and retail

- Overall, the base business in the second half traded strongly ahead

of 2019 levels

Operating cost inflation accelerated through the year but was more

than offset by revenue growth attributable to product inflation

Overall, revenue in 2021 was 20% higher than in 2019²

-

Continental Europe

2021

1,972.9

191.8

9.7%

47.3%

2020

2,127.3

238.1

11.2%

59.6%

REPORTED

(7.3)%

(19.4)%

BUNZL

CONSTANT

EXCHANGE UNDERLYING

(2.7)%

(14.0)%

(5.7)%

Revenue and profit decline driven by limited larger Covid-19 related

orders which strongly benefited the prior year

Excluding larger Covid-19 related orders underlying sales grew

moderately, supported by inflation and growth in the base business

Strong growth in foodservice and non-food retail base businesses, but

soft cleaning & hygiene and safety end markets

Profit margin reduction reflects the return towards a more normalised

revenue mix, driven by the reduction in larger Covid-19 related orders

Overall, revenue in 2021 was 12% higher than in 2019²

17View entire presentation