HyperloopTT Investor Presentation Deck

H

Confidential and Proprietary

30

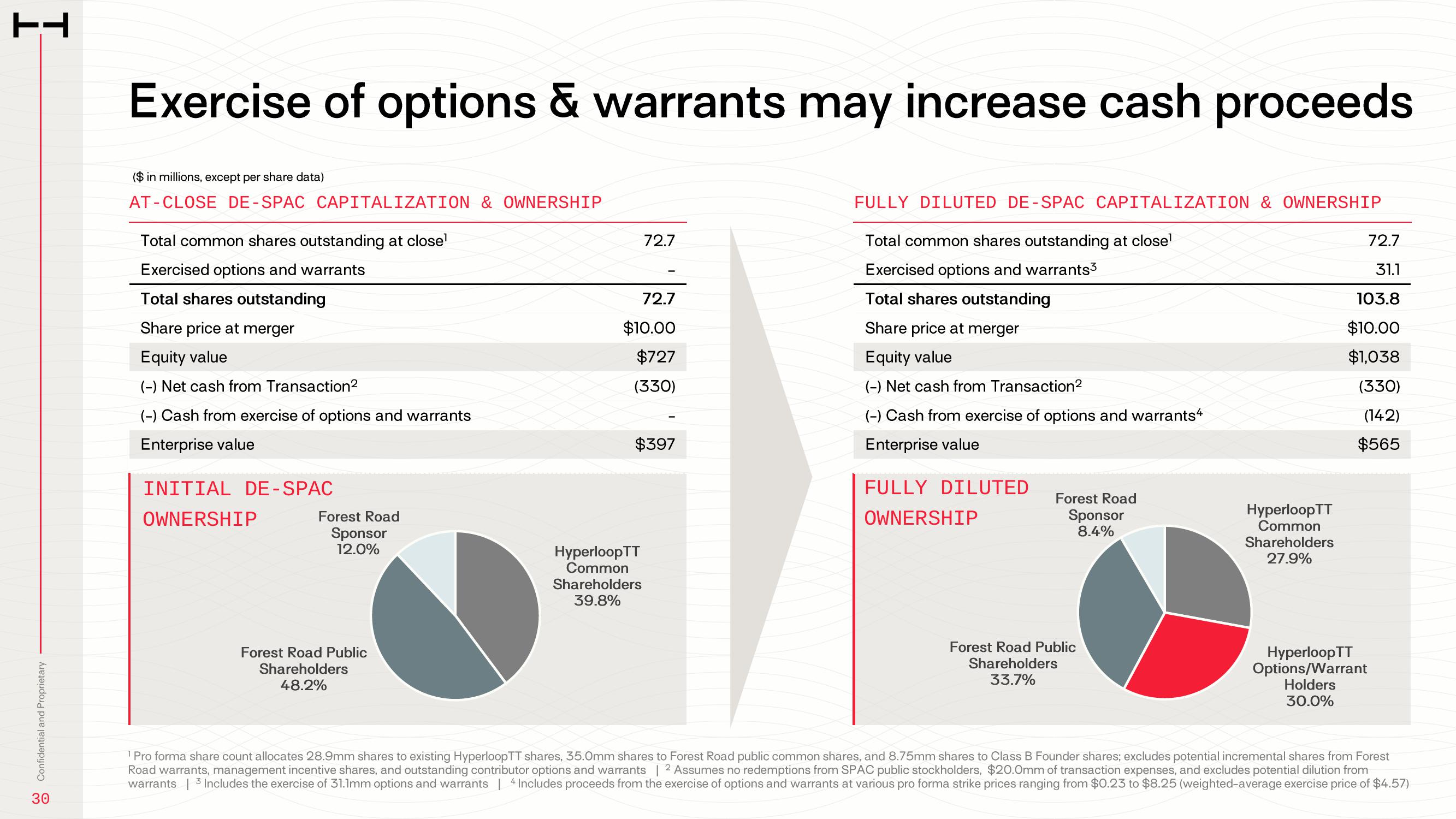

Exercise of options & warrants may increase cash proceeds

($ in millions, except per share data)

AT-CLOSE DE-SPAC CAPITALIZATION & OWNERSHIP

Total common shares outstanding at close¹

Exercised options and warrants

Total shares outstanding

Share price at merger

Equity value

(-) Net cash from Transaction²

(-) Cash from exercise of options and warrants

Enterprise value

INITIAL DE-SPAC

OWNERSHIP

Forest Road

Sponsor

12.0%

Forest Road Public

Shareholders

48.2%

72.7

72.7

$10.00

$727

(330)

$397

HyperloopTT

Common

Shareholders

39.8%

FULLY DILUTED DE-SPAC CAPITALIZATION & OWNERSHIP

Total common shares outstanding at close¹

Exercised options and warrants³

Total shares outstanding

Share price at merger

Equity value

(-) Net cash from Transaction²

(-) Cash from exercise of options and warrants4

Enterprise value

FULLY DILUTED

OWNERSHIP

Forest Road

Sponsor

8.4%

Forest Road Public

Shareholders

33.7%

HyperloopTT

Common

Shareholders

27.9%

72.7

31.1

103.8

$10.00

$1,038

(330)

(142)

$565

HyperloopTT

Options/Warrant

Holders

30.0%

1 Pro forma share count allocates 28.9mm shares to existing HyperloopTT shares, 35.0mm shares to Forest Road public common shares, and 8.75mm shares to Class B Founder shares; excludes potential incremental shares from Forest

Road warrants, management incentive shares, and outstanding contributor options and warrants | 2 Assumes no redemptions from SPAC public stockholders, $20.0mm of transaction expenses, and excludes potential dilution from

warrants | 3 Includes the exercise of 31.1mm options and warrants | 4 Includes proceeds from the exercise of options and warrants at various pro forma strike prices ranging from $0.23 to $8.25 (weighted-average exercise price of $4.57)View entire presentation