Doma SPAC Presentation Deck

Accelerating Growth of Our Business

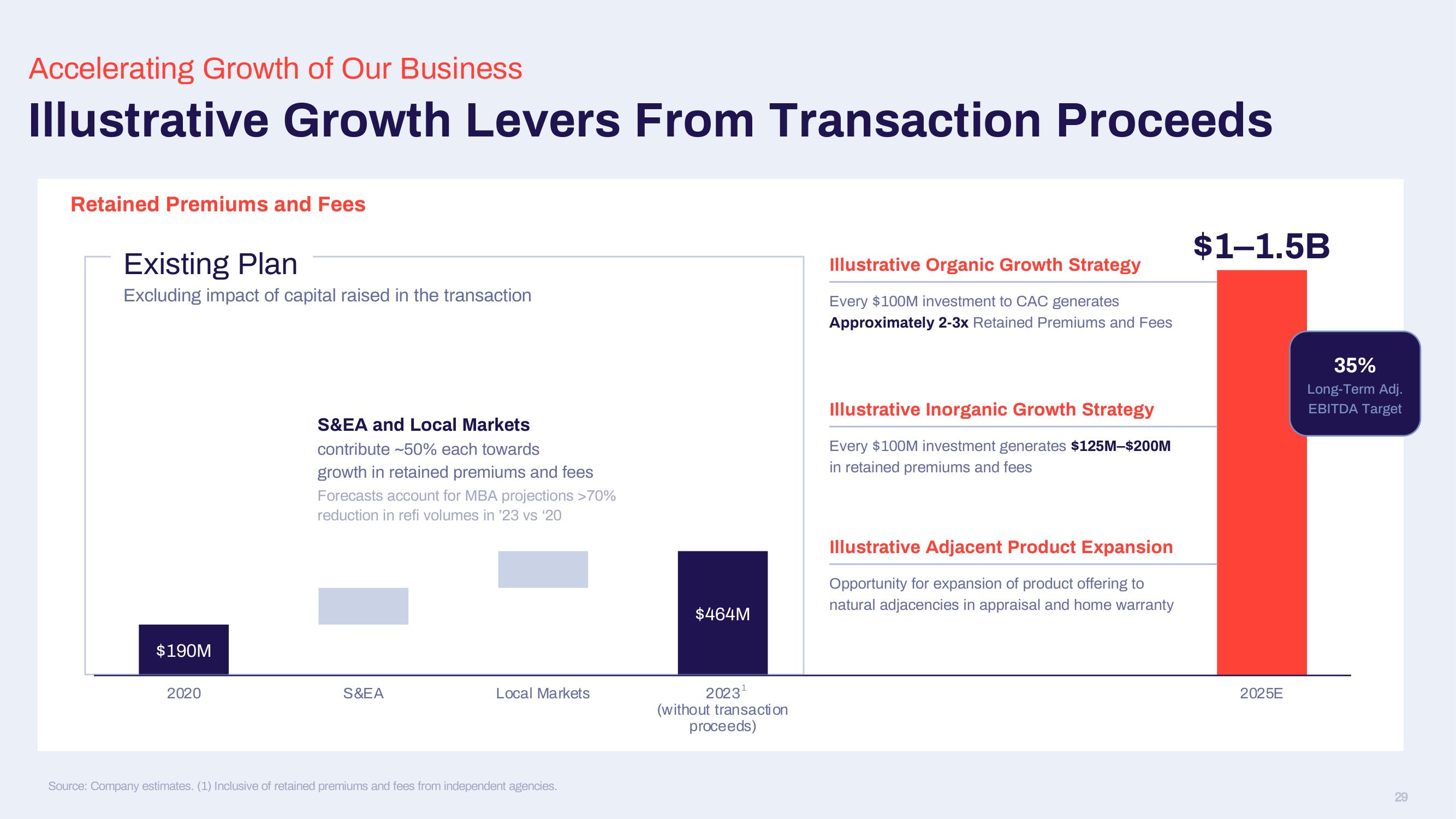

Illustrative Growth Levers From Transaction Proceeds

Retained Premiums and Fees

Existing Plan

Excluding impact of capital raised in the transaction

$190M

2020

S&EA and Local Markets

contribute -50% each towards

growth in retained premiums and fees

Forecasts account for MBA projections >70%

reduction in refi volumes in '23 vs ¹'20

S&EA

Local Markets

Source: Company estimates. (1) Inclusive of retained premiums and fees from independent agencies.

$464M

2023¹

(without transaction

proceeds)

Illustrative Organic Growth Strategy

Every $100M investment to CAC generates

Approximately 2-3x Retained Premiums and Fees

Illustrative Inorganic Growth Strategy

Every $100M investment generates $125M-$200M

in retained premiums and fees

Illustrative Adjacent Product Expansion

Opportunity for expansion of product offering to

natural adjacencies in appraisal and home warranty

$1-1.5B

2025E

35%

Long-Term Adj.

EBITDA Target

29View entire presentation