Bausch+Lomb Results Presentation Deck

2Q22 Financial Highlights & Segment Drivers - Revenue

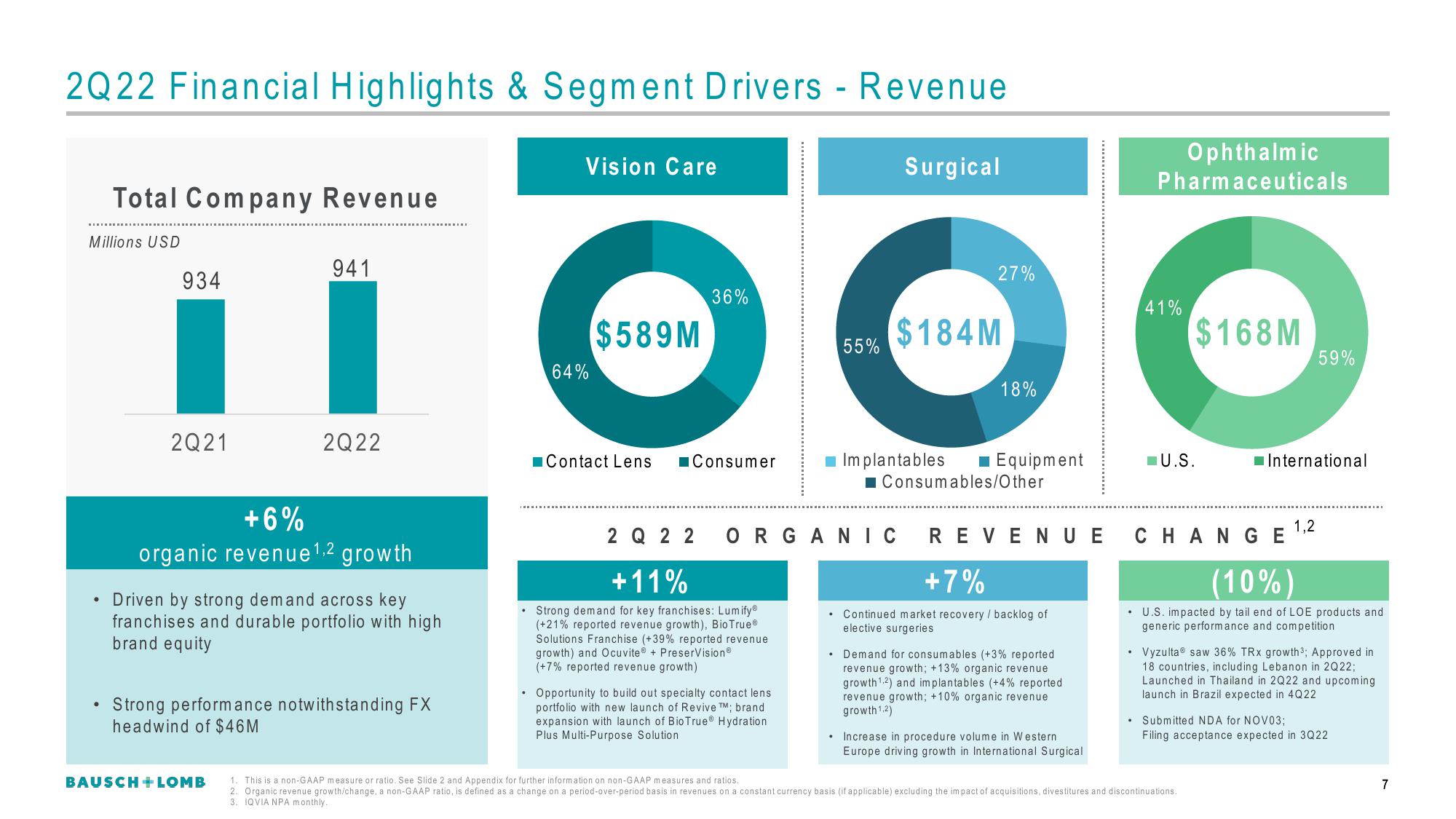

Total Company Revenue

Millions USD

934

2Q21

941

2Q22

+6%

organic revenue ¹,2 growth

• Driven by strong demand across key

franchises and durable portfolio with high

brand equity

BAUSCH + LOMB

Strong performance notwithstanding FX

headwind of $46M

Vision Care

64%

$589M

36%

Contact Lens ■Consumer

2 Q 22

+11%

• Strong demand for key franchises: Lumify®

(+21% reported revenue growth), Bio True®

Solutions Franchise (+39% reported revenue

growth) and Ocuvite® + PreserVision®

(+7% reported revenue growth)

Opportunity to build out specialty contact lens.

portfolio with new launch of Revive TM; brand

expansion with launch of Bio True® Hydration

Plus Multi-Purpose Solution

ORGANIC

55%

..

.

Surgical

27%

$184M

■ Implantables ■ Equipment

■ Consumables/Other

18%

REVENUE

+7%

Continued market recovery / backlog of

elective surgeries

Demand for consumables (+3% reported

revenue growth; +13% organic revenue

growth ¹.2) and implantables (+4% reported

revenue growth; +10% organic revenue

growth 1.2)

Increase in procedure volume in Western

Europe driving growth in International Surgical

Ophthalmic

Pharmaceuticals

41%

$168M

U.S.

CHANGE

International

59%

1,2

1. This is a non-GAAP measure or ratio. See Slide 2 and Appendix for further information on non-GAAP measures and ratios.

2. Organic revenue growth/change, a non-GAAP ratio, is defined as a change on a period-over-period basis in revenues on a constant currency basis (if applicable) excluding the impact of acquisitions, divestitures and discontinuations.

3. IQVIA NPA monthly..

(10%)

• U.S. impacted by tail end of LOE products and

generic performance and competition

Vyzulta® saw 36% TRx growth³; Approved in

18 countries, including Lebanon in 2Q22;

Launched in Thailand in 2Q22 and upcoming

launch in Brazil expected in 4Q22

. Submitted NDA for NOV03;

Filing acceptance expected in 3Q22

7View entire presentation