Nano Dimension Mergers and Acquisitions Presentation Deck

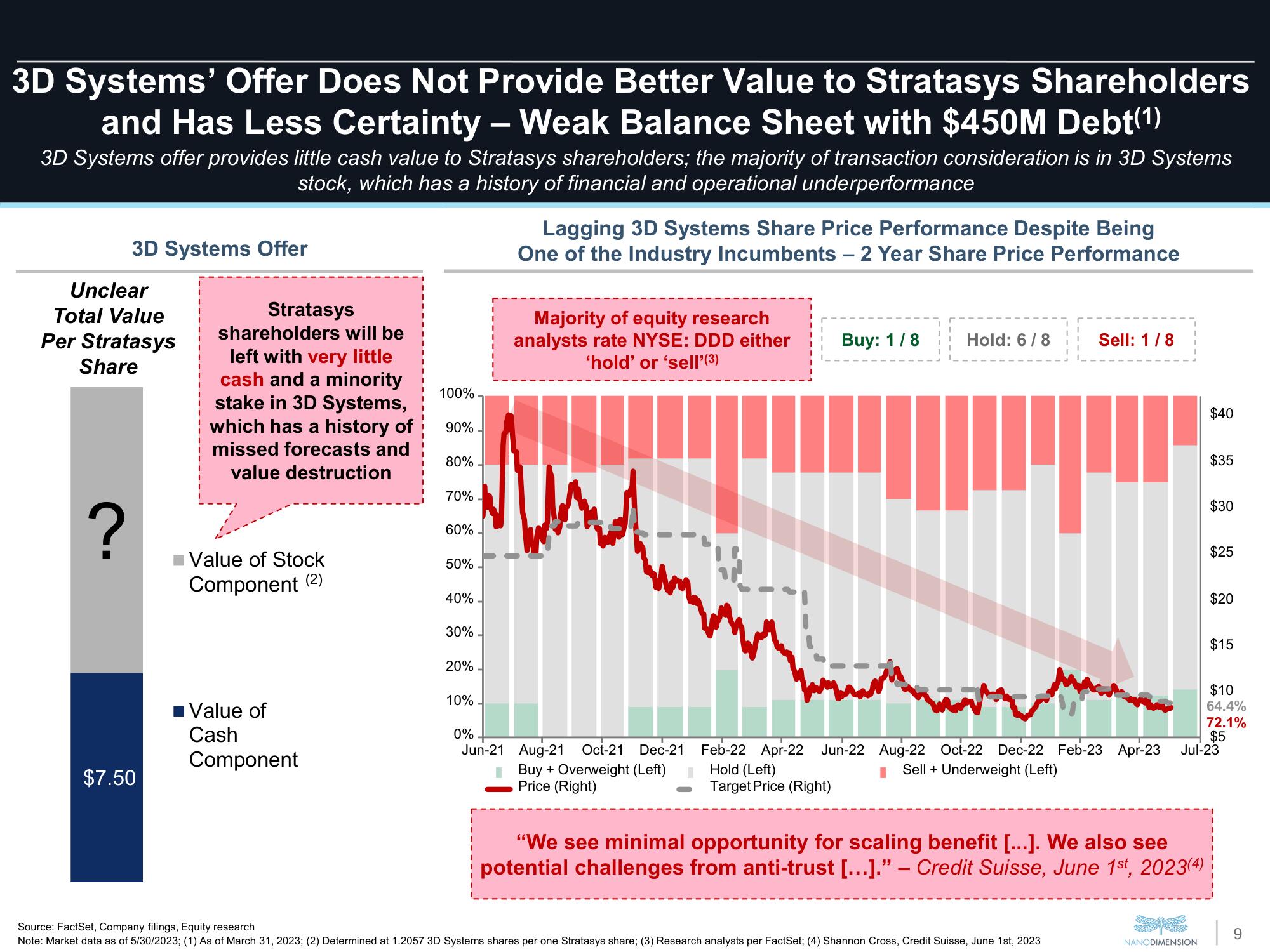

3D Systems' Offer Does Not Provide Better Value to Stratasys Shareholders

and Has Less Certainty - Weak Balance Sheet with $450M Debt(1)

3D Systems offer provides little cash value to Stratasys shareholders; the majority of transaction consideration is in 3D Systems

stock, which has a history of financial and operational underperformance

3D Systems Offer

Unclear

Total Value

Per Stratasys

Share

?

$7.50

Stratasys

shareholders will be

left with very little

cash and a minority

stake in 3D Systems,

which has a history of

missed forecasts and

value destruction

Value of Stock

Component (2)

Value of

Cash

Component

100%

90%

80%

70%

60%

50%

40%

30%

20%

10%

Lagging 3D Systems Share Price Performance Despite Being

One of the Industry Incumbents - 2 Year Share Price Performance

Majority of equity research

analysts rate NYSE: DDD either

'hold' or 'sell' (3)

II

0%

Jun-21 Aug-21 Oct-21 Dec-21

Buy + Overweight (Left)

Price (Right)

Buy: 1/8

Hold: 6/8

JU

Feb-22 Apr-22 Jun-22 Aug-22 Oct-22 Dec-22 Feb-23 Apr-23

Hold (Left)

Sell Underweight (Left)

Target Price (Right)

-

Sell: 1/8

"We see minimal opportunity for scaling benefit [...]. We also see

potential challenges from anti-trust [...]." Credit Suisse, June 1st, 2023(4)

Source: FactSet, Company filings, Equity research

Note: Market data as of 5/30/2023; (1) As of March 31, 2023; (2) Determined at 1.2057 3D Systems shares per one Stratasys share; (3) Research analysts per FactSet; (4) Shannon Cross, Credit Suisse, June 1st, 2023

$40

NANODIMENSION

$35

$30

$25

$20

$15

Jul-23

$10

64.4%

72.1%

$5

9View entire presentation