SmileDirectClub Investor Presentation Deck

Balance sheet highlights.

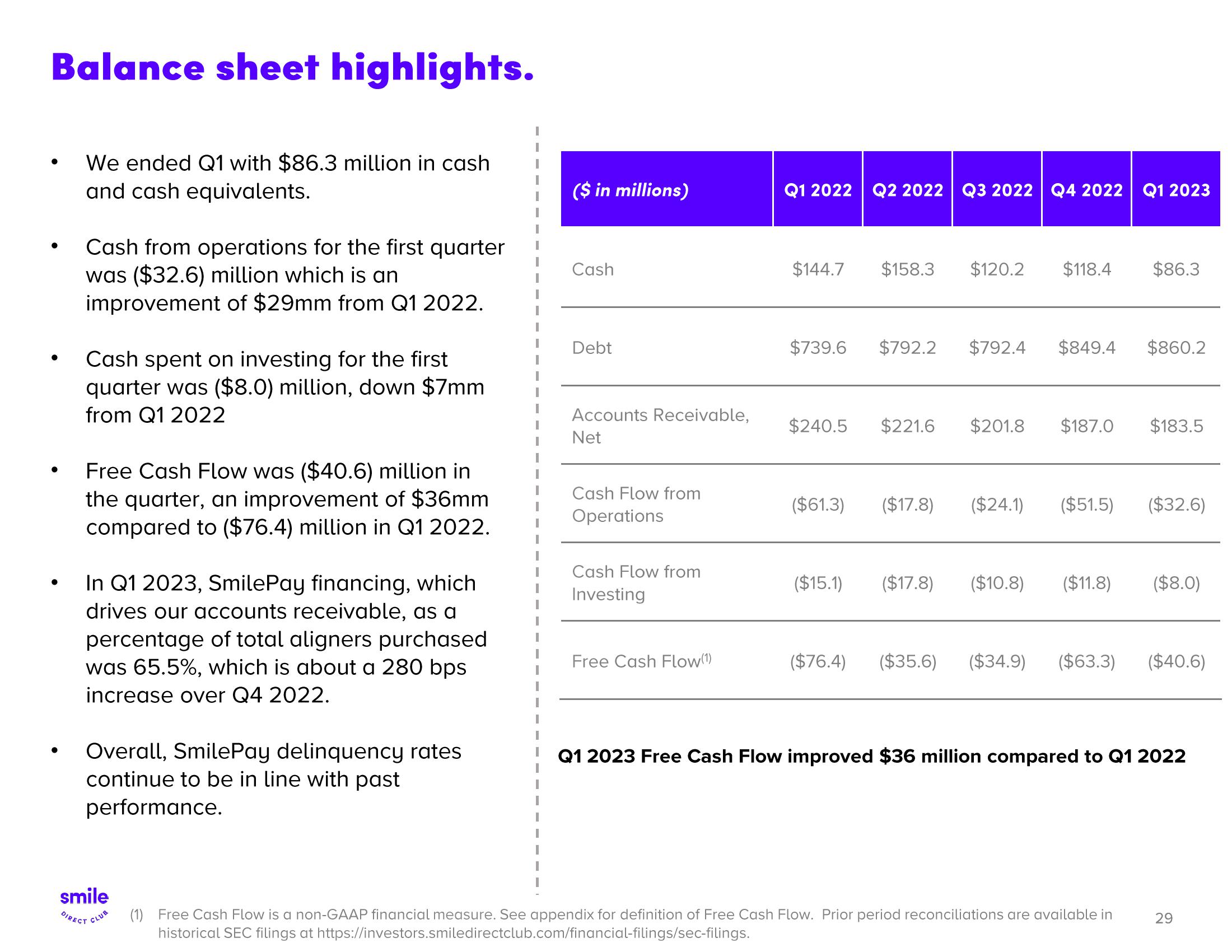

We ended Q1 with $86.3 million in cash

and cash equivalents.

Cash from operations for the first quarter

was ($32.6) million which is an

improvement of $29mm from Q1 2022.

Cash spent on investing for the first

quarter was ($8.0) million, down $7mm

from Q1 2022

Free Cash Flow was ($40.6) million in

the quarter, an improvement of $36mm

compared to ($76.4) million in Q1 2022.

In Q1 2023, SmilePay financing, which

drives our accounts receivable, as a

percentage of total aligners purchased

was 65.5%, which is about a 280 bps

increase over Q4 2022.

Overall, SmilePay delinquency rates

continue to be in line with past

performance.

smile

DIRECT CLUB

($ in millions)

Cash

Debt

Accounts Receivable,

Net

Cash Flow from

Operations

Cash Flow from

Investing

Free Cash Flow(¹)

Q1 2022 Q2 2022 | Q3 2022 | Q4 2022 Q1 2023

$144.7

$158.3 $120.2

$118.4

$739.6 $792.2 $792.4 $849.4 $860.2

($15.1)

$86.3

$240.5 $221.6 $201.8 $187.0 $183.5

($61.3) ($17.8) ($24.1) ($51.5) ($32.6)

($17.8) ($10.8) ($11.8) ($8.0)

($76.4) ($35.6) ($34.9) ($63.3) ($40.6)

Q1 2023 Free Cash Flow improved $36 million compared to Q1 2022

(1) Free Cash Flow is a non-GAAP financial measure. See appendix for definition of Free Cash Flow. Prior period reconciliations are available in

historical SEC filings at https://investors.smiledirectclub.com/financial-filings/sec-filings.

29View entire presentation