Polestar SPAC Presentation Deck

4

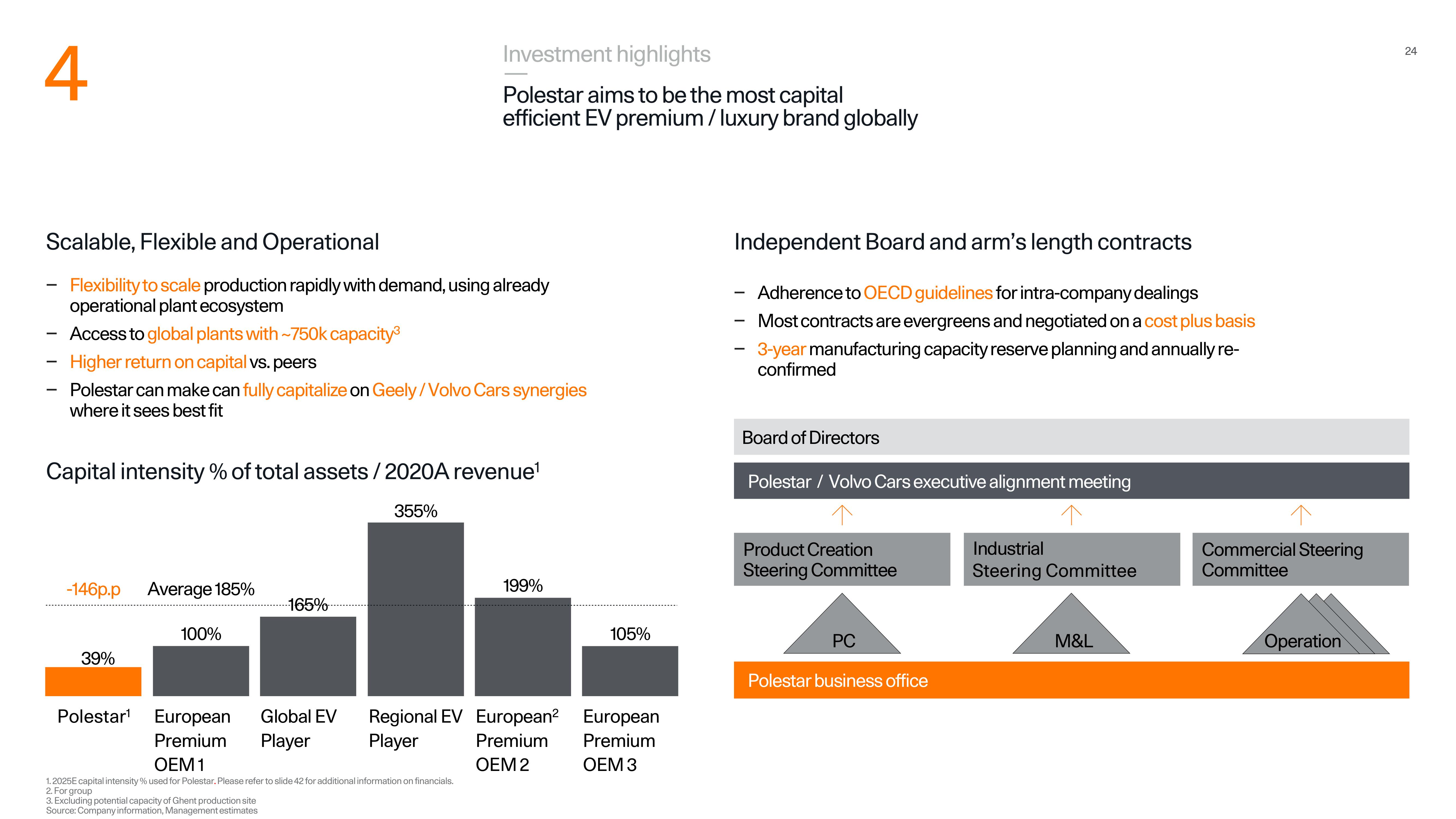

Scalable, Flexible and Operational

Flexibility to scale production rapidly with demand, using already

operational plant ecosystem

Access to global plants with ~750k capacity³

Higher return on capital vs. peers

Polestar can make can fully capitalize on Geely/Volvo Cars synergies

where it sees best fit

-

Capital intensity % of total assets/2020A revenue¹

-146p.p

39%

Polestar¹

Average 185%

100%

European

Premium

-165%

3. Excluding potential capacity of Ghent production site

Source: Company information, Management estimates

Global EV

Player

Investment highlights

Polestar aims to be the most capital

efficient EV premium / luxury brand globally

355%

OEM 1

1.2025E capital intensity % used for Polestar. Please refer to slide 42 for additional information on financials.

2. For group

199%

Regional EV European²

Player

Premium

OEM 2

105%

European

Premium

OEM 3

Independent Board and arm's length contracts

Adherence to OECD guidelines for intra-company dealings

Most contracts are evergreens and negotiated on a cost plus basis

3-year manufacturing capacity reserve planning and annually re-

confirmed

Board of Directors

Polestar / Volvo Cars executive alignment meeting

Product Creation

Steering Committee

PC

Polestar business office

Industrial

Steering Committee

M&L

Commercial Steering

Committee

Operation

24View entire presentation