Proterra Investor Presentation Deck

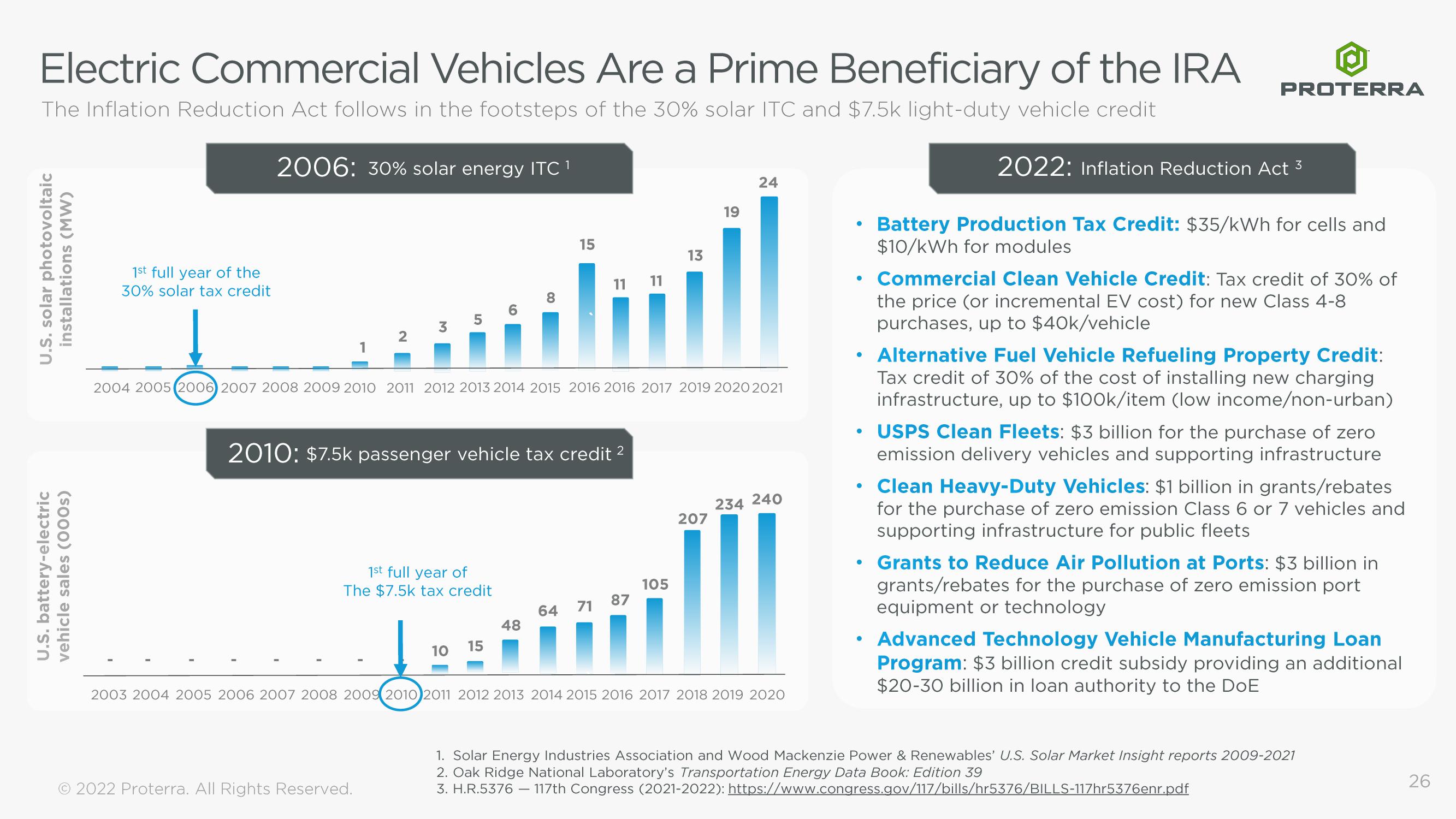

Electric Commercial Vehicles Are a Prime Beneficiary of the IRA

The Inflation Reduction Act follows in the footsteps of the 30% solar ITC and $7.5k light-duty vehicle credit

2006: 30% solar energy ITC ¹

U.S. solar photovoltaic

installations (MW)

U.S. battery-electric

vehicle sales (000s)

1st full year of the

30% solar tax credit

2

3

5

© 2022 Proterra. All Rights Reserved.

1st full year of

The $7.5k tax credit

6

2010: $7.5k passenger vehicle tax credit ²

10 15

8

15

2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2016 2017 2019 2020 2021

48

64 71

87

13

105

19

207

24

234 240

2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020

●

PROTERRA

●

2022: Inflation Reduction Act 3

Battery Production Tax Credit: $35/kWh for cells and

$10/kWh for modules

Commercial Clean Vehicle Credit: Tax credit of 30% of

the price (or incremental EV cost) for new Class 4-8

purchases, up to $40k/vehicle

Alternative Fuel Vehicle Refueling Property Credit:

Tax credit of 30% of the cost of installing new charging

infrastructure, up to $100k/item (low income/non-urban)

USPS Clean Fleets: $3 billion for the purchase of zero

emission delivery vehicles and supporting infrastructure

• Clean Heavy-Duty Vehicles: $1 billion in grants/rebates

for the purchase of zero emission Class 6 or 7 vehicles and

supporting infrastructure for public fleets

Grants to Reduce Air Pollution at Ports: $3 billion in

grants/rebates for the purchase of zero emission port

equipment or technology

Advanced Technology Vehicle Manufacturing Loan

Program: $3 billion credit subsidy providing an additional

$20-30 billion in loan authority to the DoE

1. Solar Energy Industries Association and Wood Mackenzie Power & Renewables' U.S. Solar Market Insight reports 2009-2021

2. Oak Ridge National Laboratory's Transportation Energy Data Book: Edition 39

3. H.R.5376 - 117th Congress (2021-2022): https://www.congress.gov/117/bills/hr5376/BILLS-117hr5376enr.pdf

26View entire presentation