J.P.Morgan Results Presentation Deck

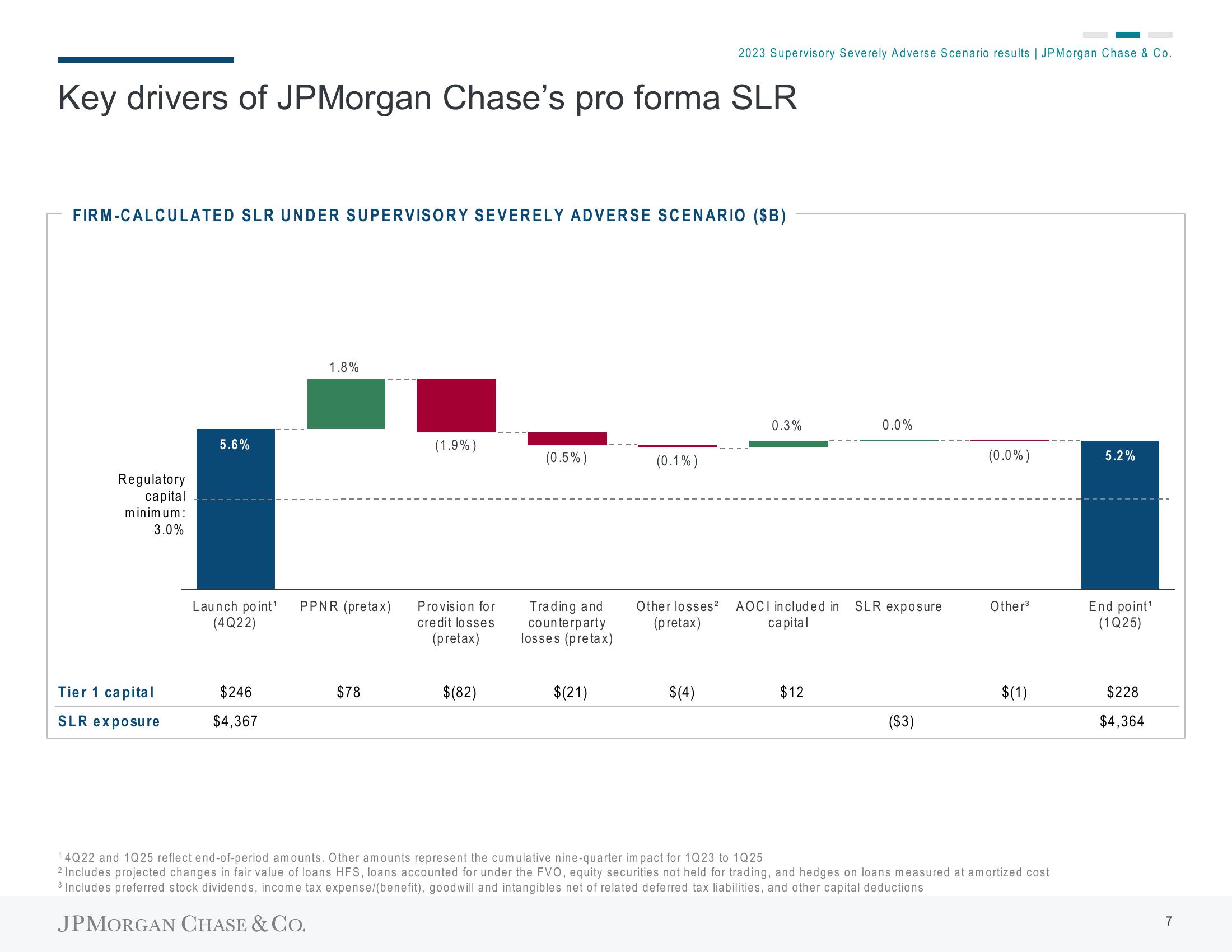

Key drivers of JPMorgan Chase's pro forma SLR

FIRM-CALCULATED SLR UNDER SUPERVISORY SEVERELY ADVERSE SCENARIO ($B)

Regulatory

capital

minimum:

3.0%

Tier 1 capital

SLR exposure

5.6%

Launch point¹

(4Q22)

$246

$4,367

1.8%

PPNR (pretax)

$78

(1.9%)

Provision for

credit losses

(pretax)

$(82)

(0.5%)

Trading and

counterparty

losses (pretax)

$(21)

2023 Supervisory Severely Adverse Scenario results | JPMorgan Chase & Co.

(0.1%)

$(4)

0.3%

Other losses² AOCI included in

(pretax)

capital

$12

0.0%

SLR exposure

($3)

(0.0%)

Other³

$(1)

14Q22 and 1Q25 reflect end-of-period amounts. Other amounts represent the cumulative nine-quarter impact for 1Q23 to 1Q25

2 Includes projected changes in fair value of loans HFS, loans accounted for under the FVO, equity securities not held for trading, and hedges on loans measured at amortized cost

3 Includes preferred stock dividends, income tax expense/(benefit), goodwill and intangibles net of related deferred tax liabilities, and other capital deductions

JPMORGAN CHASE & CO.

5.2%

End point¹

(1Q25)

$228

$4,364

7View entire presentation