BlackRock Results Presentation Deck

Operating Income

GAAP

Non-GAAP expense adjustments

As Adjusted

Nonoperating Income (Expense)

GAAP

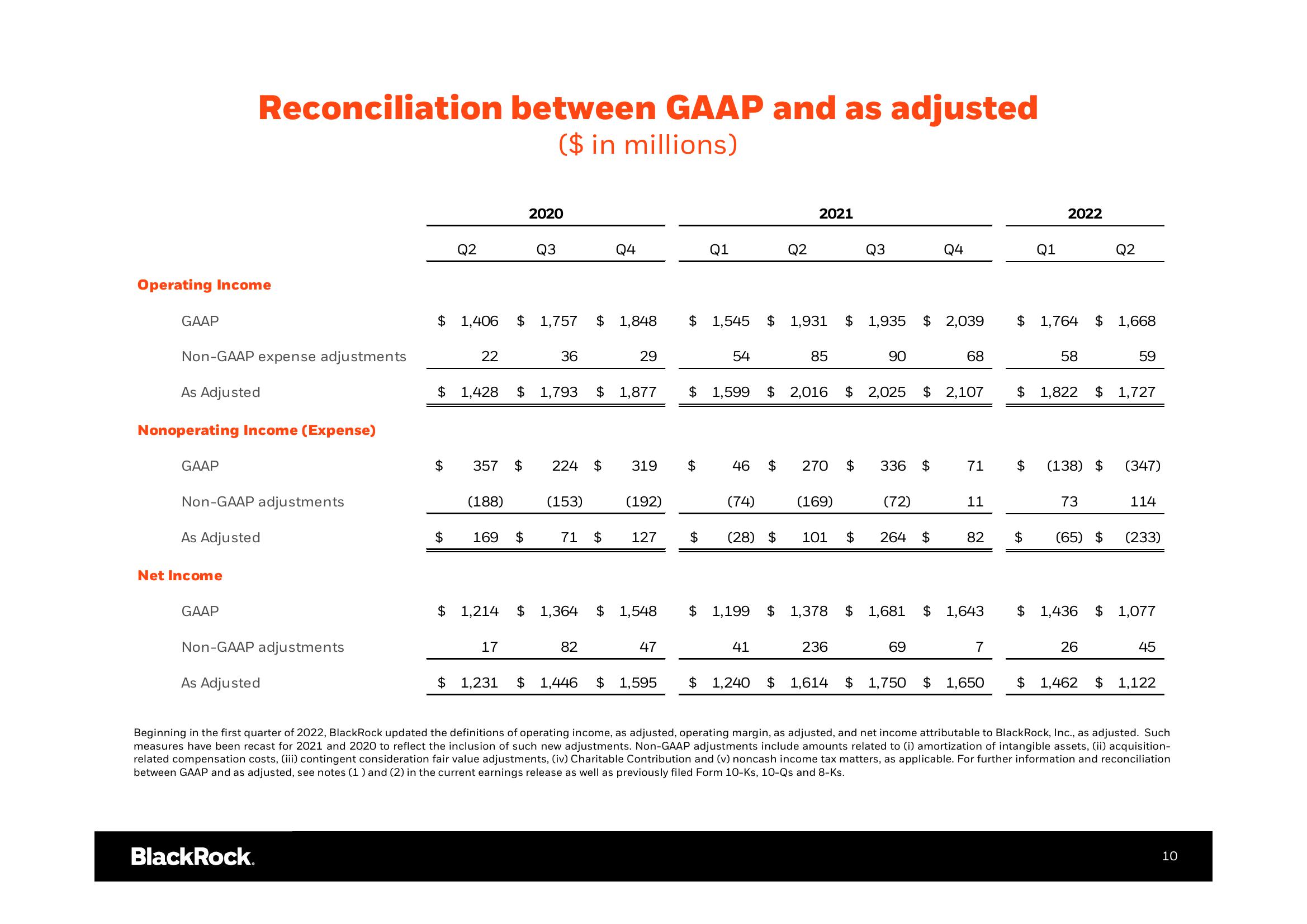

Reconciliation between GAAP and as adjusted

($ in millions)

Non-GAAP adjustments

As Adjusted

Net Income

GAAP

Non-GAAP adjustments

As Adjusted

BlackRock.

Q2

$

22

$ 1,406 $ 1,757 $ 1,848

357 $

(188)

$ 169

2020

$ 1,428 $ 1,793 $ 1,877

Q3

$

17

36

(153)

Q4

224 $ 319

71

29

$

82

(192)

$1,214 $ 1,364 $ 1,548

127

47

$ 1,231 $ 1,446 $ 1,595

Q1

$

$ 1,545 $ 1,931

$ 1,599

$

54

46

(74)

Q2

2021

(28) $

41

85

$ 270 $

(169)

$ 1,935

101 $

$ 1,199 $ 1,378 $

Q3

$ 2,016 $ 2,025 $ 2,107

236

90

336 $

(72)

$ 2,039

Q4

264 $

69

68

71

11

82

1,681 $ 1,643

7

$ 1,240 $ 1,614 $ 1,750 $ 1,650

$

Q1

$ 1,764

2022

$

58

73

Q2

$ 1,668

1,822 $ 1,727

$ (138) $ (347)

(65) $

59

26

114

(233)

$ 1,436 $ 1,077

45

$ 1,462 $ 1,122

Beginning in the first quarter of 2022, BlackRock updated the definitions of operating income, as adjusted, operating margin, as adjusted, and net income attributable to BlackRock, Inc., as adjusted. Such

measures have been recast for 2021 and 2020 to reflect the inclusion of such new adjustments. Non-GAAP adjustments include amounts related to (i) amortization of intangible assets, (ii) acquisition-

related compensation costs, (iii) contingent consideration fair value adjustments, (iv) Charitable Contribution and (v) noncash income tax matters, as applicable. For further information and reconciliation

between GAAP and as adjusted, see notes (1) and (2) in the current earnings release as well as previously filed Form 10-Ks, 10-Qs and 8-Ks.

10View entire presentation