WeWork Investor Day Presentation Deck

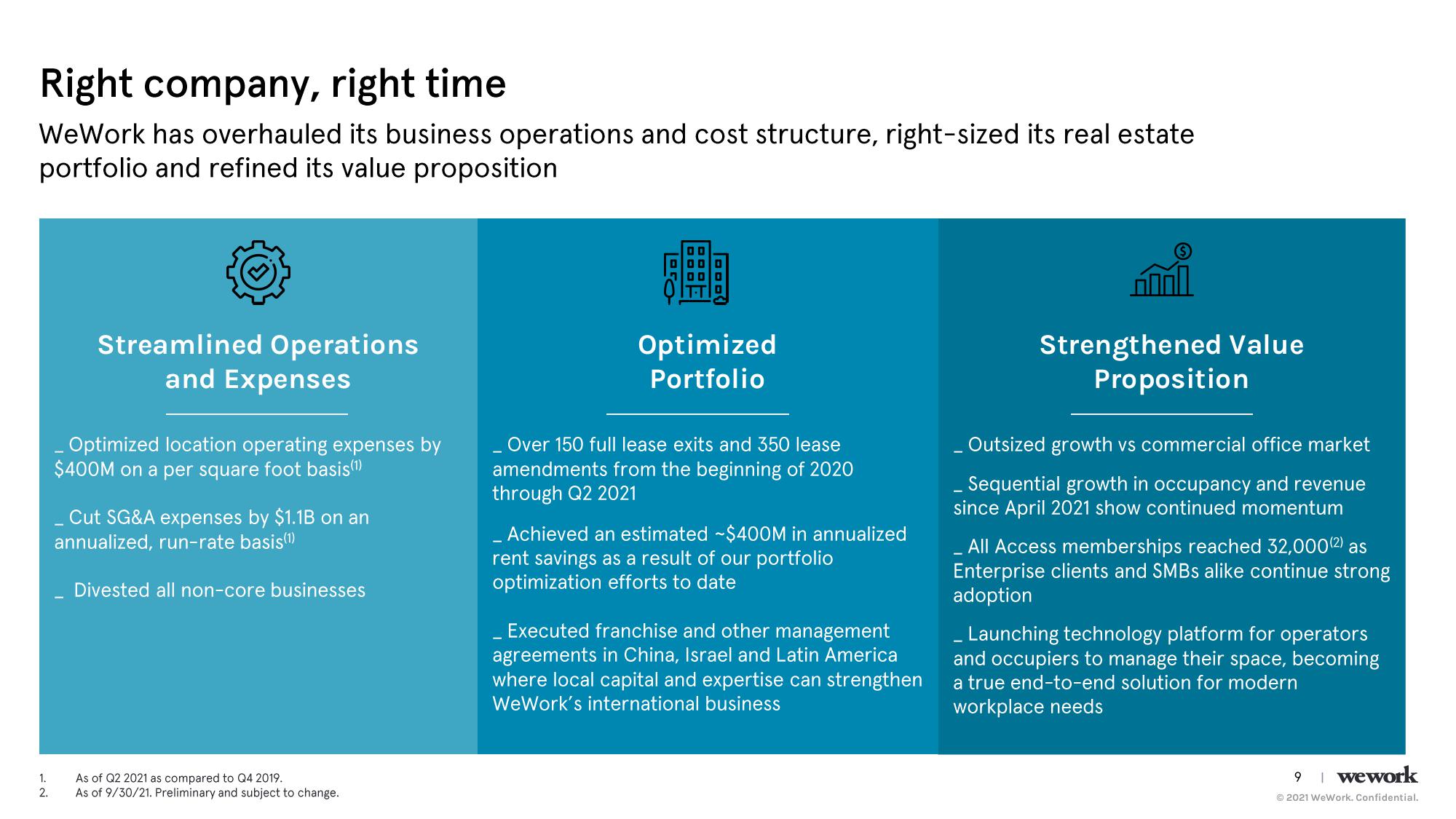

Right company, right time

WeWork has overhauled its business operations and cost structure, right-sized its real estate

portfolio and refined its value proposition

1.

2.

Streamlined Operations

and Expenses

Optimized location operating expenses by

$400M on a per square foot basis(1)

Cut SG&A expenses by $1.1B on an

annualized, run-rate basis(1)

Divested all non-core businesses

As of Q2 2021 as compared to Q4 2019.

As of 9/30/21. Preliminary and subject to change.

Optimized

Portfolio

_ Over 150 full lease exits and 350 lease

amendments from the beginning of 2020

through Q2 2021

_Achieved an estimated $400M in annualized

rent savings as a result of our portfolio

optimization efforts to date

_Executed franchise and other management

agreements in China, Israel and Latin America

where local capital and expertise can strengthen

WeWork's international business

Strengthened Value

Proposition

_ Outsized growth vs commercial office market

Sequential growth in occupancy and revenue

since April 2021 show continued momentum

All Access memberships reached 32,000 (2) as

Enterprise clients and SMBs alike continue strong

adoption

_ Launching technology platform for operators

and occupiers to manage their space, becoming

a true end-to-end solution for modern

workplace needs

9

wework

Ⓒ2021 WeWork. Confidential.View entire presentation