Investor Presentation

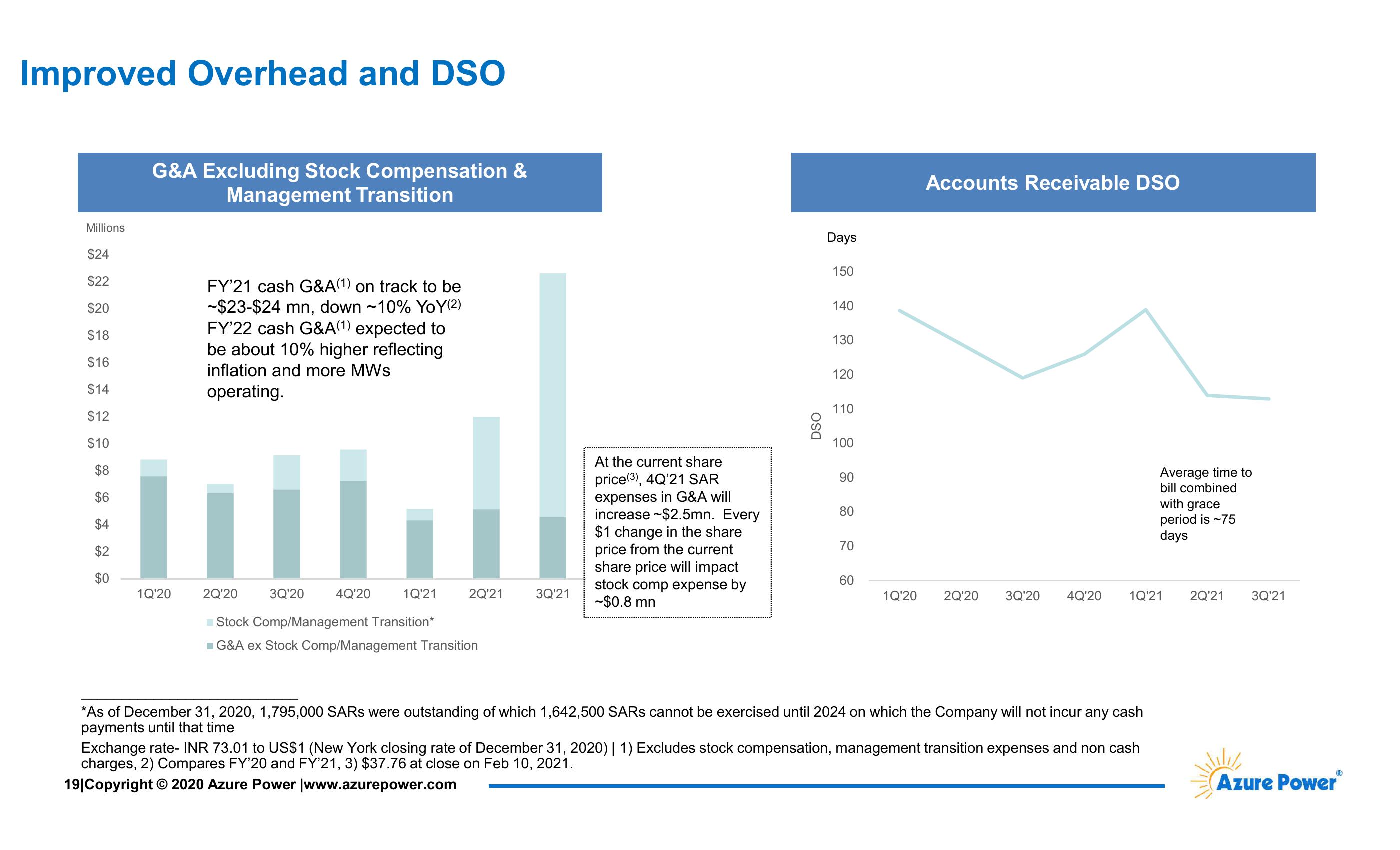

Improved Overhead and DSO

Millions

$24

G&A Excluding Stock Compensation &

Management Transition

$22

$20

$18

$16

$14

FY'21 cash G&A(1) on track to be

~$23-$24 mn, down ~10% YoY(2)

FY'22 cash G&A(1) expected to

be about 10% higher reflecting

inflation and more MWs

operating.

$12

$10

$8

$6

$4

$2

$0

1Q'20

2Q'20

3Q'20

DSO

Days

150

140

130

120

110

100

Accounts Receivable DSO

At the current share

price (3), 4Q'21 SAR

90

expenses in G&A will

increase $2.5mn. Every

80

$1 change in the share

Average time to

bill combined

with grace

period is ~75

days

price from the current

70

4Q'20

1Q'21

2Q'21

3Q'21

share price will impact

stock comp expense by

~$0.8 mn

60

1Q'20

2Q'20

3Q'20

4Q'20

1Q'21

2Q'21

3Q'21

Stock Comp/Management Transition*

■G&A ex Stock Comp/Management Transition

*As of December 31, 2020, 1,795,000 SARs were outstanding of which 1,642,500 SARS cannot be exercised until 2024 on which the Company will not incur any cash

payments until that time

Exchange rate- INR 73.01 to US$1 (New York closing rate of December 31, 2020) | 1) Excludes stock compensation, management transition expenses and non cash

charges, 2) Compares FY'20 and FY'21, 3) $37.76 at close on Feb 10, 2021.

19|Copyright © 2020 Azure Power |www.azurepower.com

®

Azure PowerⓇView entire presentation