CorpAcq SPAC Presentation Deck

7

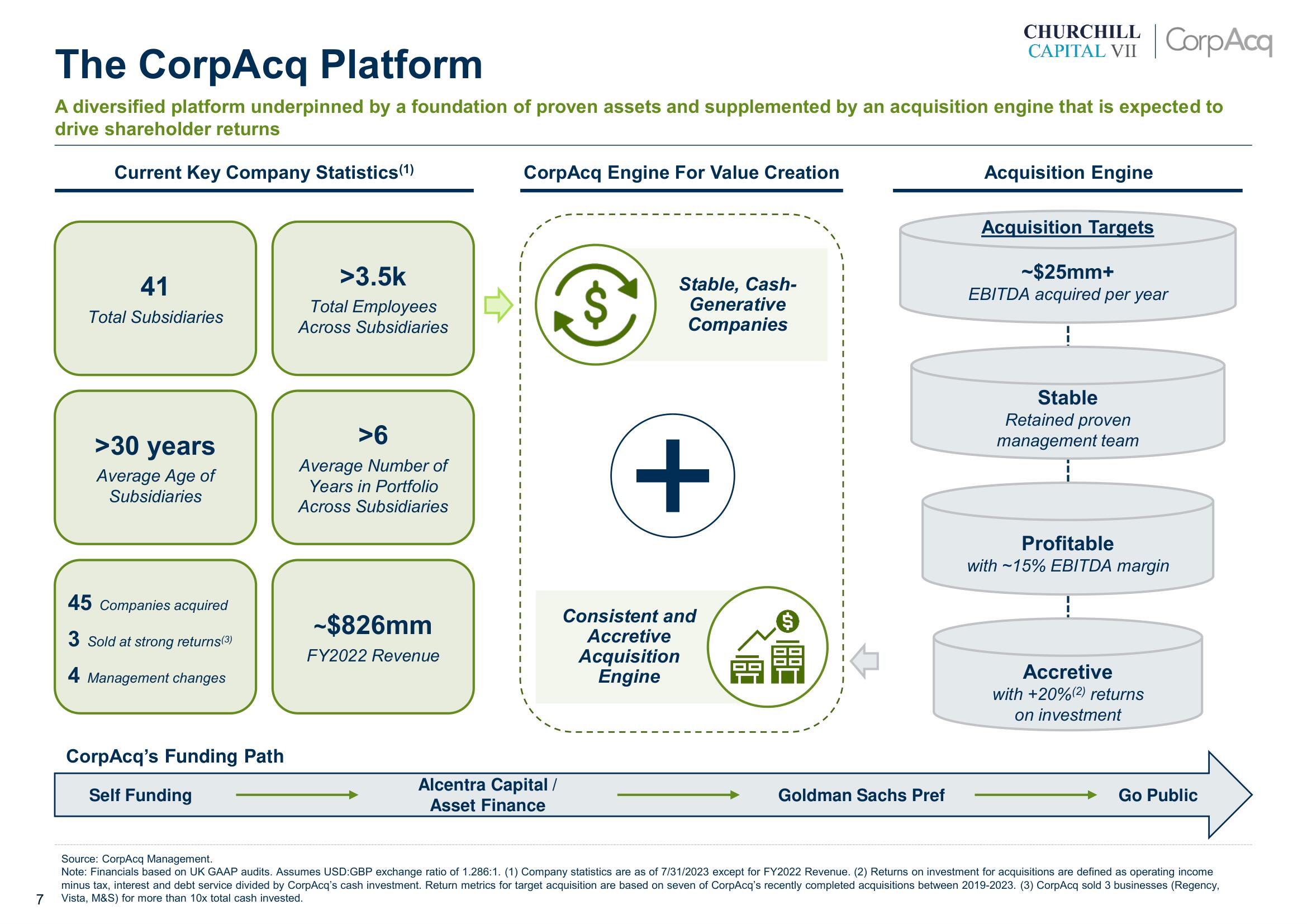

The CorpAcq Platform

A diversified platform underpinned by a foundation of proven assets and supplemented by an acquisition engine that is expected to

drive shareholder returns

Current key Company Statistics (1)

41

Total Subsidiaries

>30 years

Average Age of

Subsidiaries

45 Companies acquired

3 Sold at strong returns(3)

4 Management changes

CorpAcq's Funding Path

Self Funding

>3.5k

Total Employees

Across Subsidiaries

>6

Average Number of

Years in Portfolio

Across Subsidiaries

-$826mm

FY2022 Revenue

CorpAcq Engine For Value Creation

Alcentra Capital /

Asset Finance

$

Stable, Cash-

Generative

Companies

+

Consistent and

Accretive

Acquisition

Engine

CHURCHILL

CAPITAL VII CorpAcq

Goldman Sachs Pref

Acquisition Engine

Acquisition Targets

~$25mm+

EBITDA acquired per year

Stable

Retained proven

management team

Profitable

with ~15% EBITDA margin

Accretive

with +20%(2) returns

on investment

Go Public

Source: CorpAcq Management.

Note: Financials based on UK GAAP audits. Assumes USD:GBP exchange ratio of 1.286:1. (1) Company statistics are as of 7/31/2023 except for FY2022 Revenue. (2) Returns on investment for acquisitions are defined as operating income

minus tax, interest and debt service divided by CorpAcq's cash investment. Return metrics for target acquisition are based on seven of CorpAcq's recently completed acquisitions between 2019-2023. (3) CorpAcq sold 3 businesses (Regency,

Vista, M&S) for more than 10x total cash invested.View entire presentation