Maersk Investor Presentation Deck

Ⓡ

●

Highlights Q4 2019

Logistics & Services

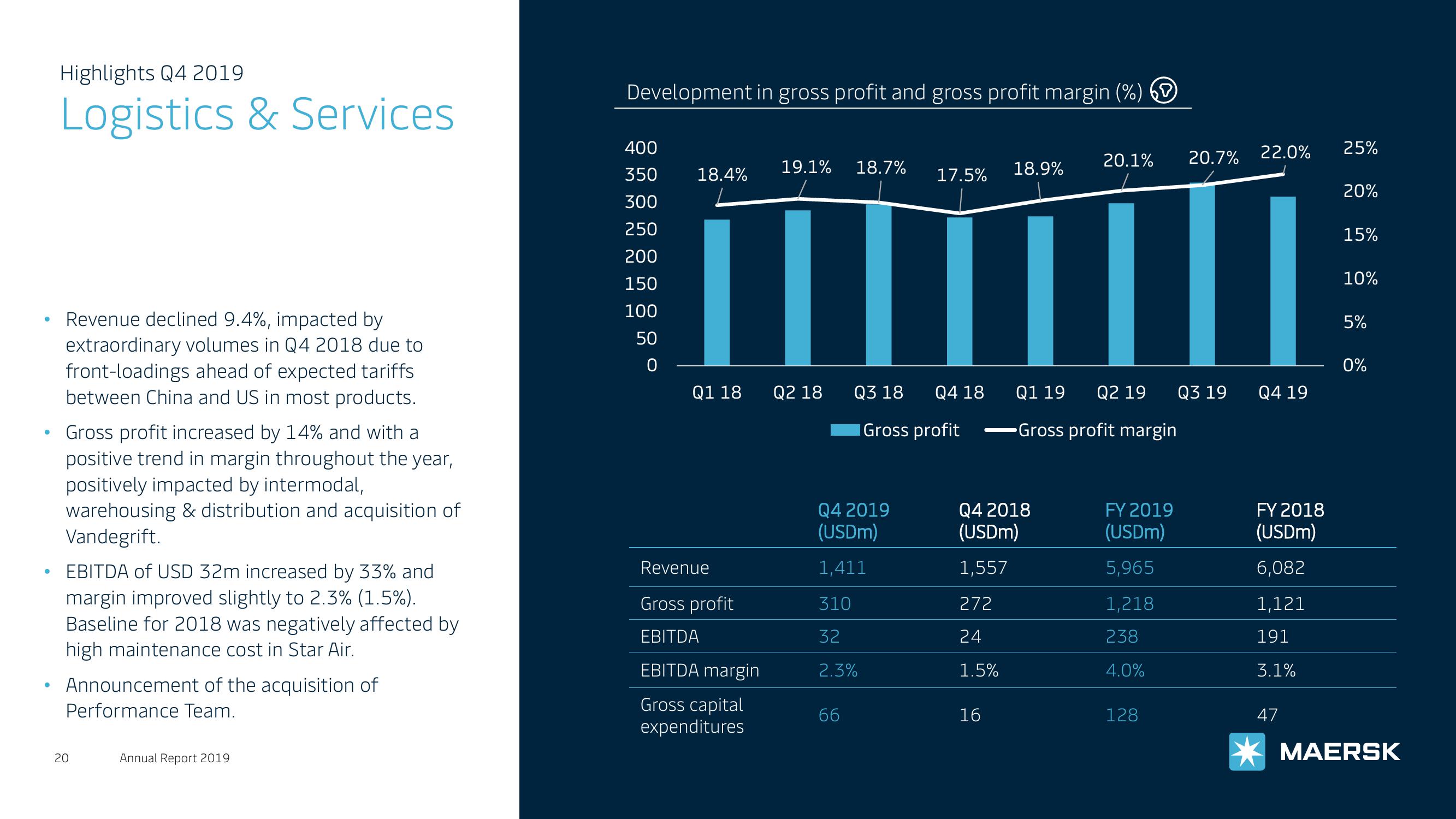

Revenue declined 9.4%, impacted by

extraordinary volumes in Q4 2018 due to

front-loadings ahead of expected tariffs

between China and US in most products.

Gross profit increased by 14% and with a

positive trend in margin throughout the year,

positively impacted by intermodal,

warehousing & distribution and acquisition of

Vandegrift.

EBITDA of USD 32m increased by 33% and

margin improved slightly to 2.3% (1.5%).

Baseline for 2018 was negatively affected by

high maintenance cost in Star Air.

Announcement of the acquisition of

Performance Team.

20

Annual Report 2019

Development in gross profit and gross profit margin (%) 6

400

350

300

250

200

150

100

50

0

18.4%

Q1 18

Revenue

Gross profit

EBITDA

EBITDA margin

Gross capital

expenditures

19.1% 18.7%

Q2 18

Q4 2019

(USDm)

1,411

310

32

2.3%

66

17.5%

Q3 18 Q4 18

Gross profit

18.9%

16

Q4 2018

(USDM)

1,557

272

24

1.5%

20.1%

Q1 19 Q2 19

Gross profit margin

FY 2019

(USDm)

5,965

1,218

238

4.0%

128

20.7%

TI

22.0% 25%

Q3 19

Q4 19

FY 2018

(USDM)

6,082

1,121

191

3.1%

47

20%

15%

10%

5%

0%

MAERSKView entire presentation