Factset Investor Day Presentation Deck

FACTSET

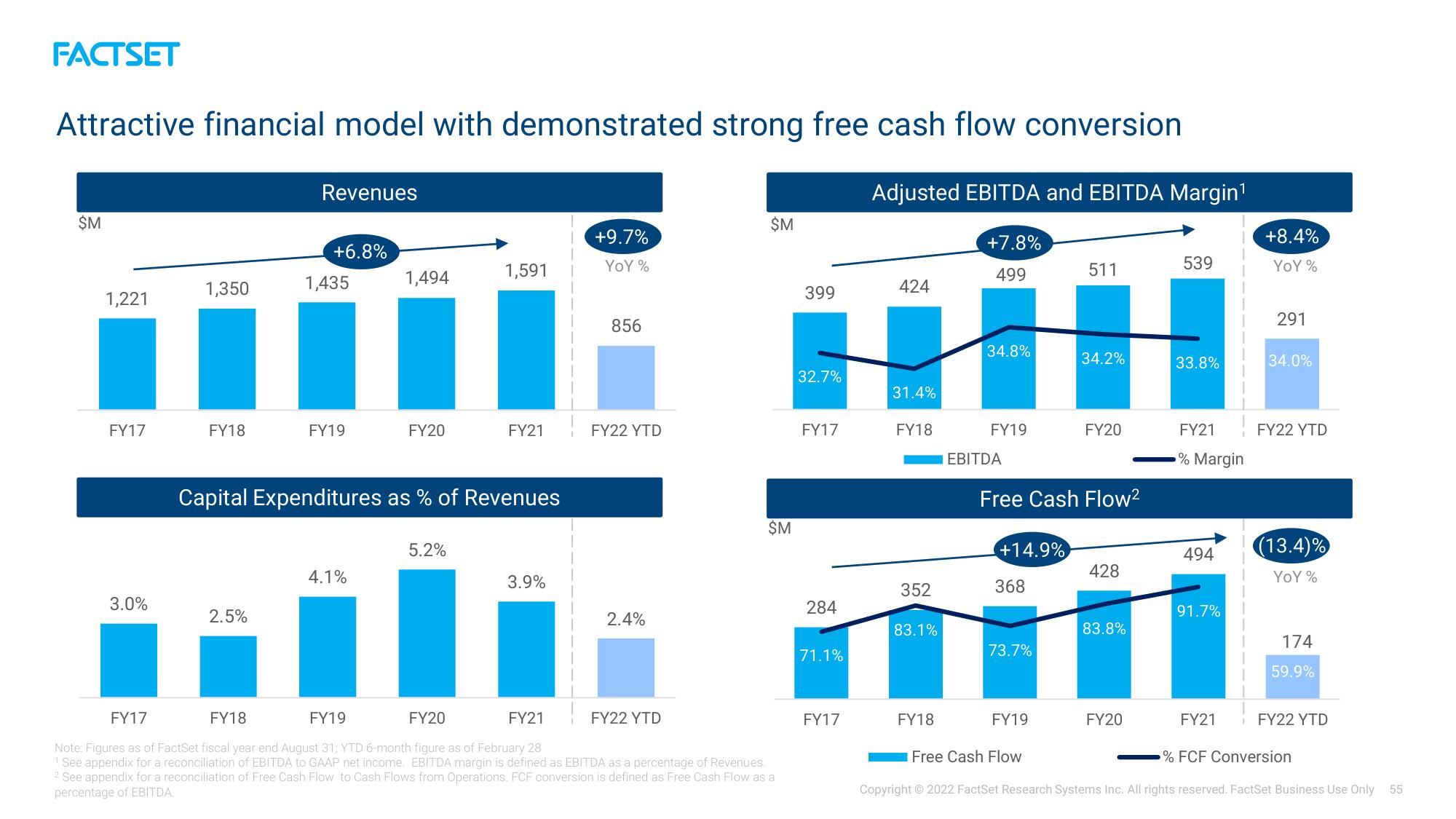

Attractive financial model with demonstrated strong free cash flow conversion

Adjusted EBITDA and EBITDA Margin¹

$M

1,221

FY17

3.0%

1,350

FY18

Revenues

2.5%

+6.8%

1,435

FY19

1,494

4.1%

FY20

Capital Expenditures as % of Revenues

1,591

5.2%

FY21

3.9%

+9.7%

YOY %

856

FY22 YTD

2.4%

$M

FY22 YTD

$M

FY17

FY18

FY19

FY20

FY21

Note: Figures as of FactSet fiscal year end August 31; YTD 6-month figure as of February 28

¹ See appendix for a reconciliation of EBITDA to GAAP net income. EBITDA margin is defined as EBITDA as a percentage of Revenues.

2 See appendix for a reconciliation of Free Cash Flow to Cash Flows from Operations. FCF conversion is defined as Free Cash Flow as a

percentage of EBITDA.

399

32.7%

FY17

284

71.1%

FY17

424

31.4%

FY18

352

83.1%

FY18

+7.8%

499

34.8%

FY19

EBITDA

+14.9%

368

Free Cash Flow²

73.7%

511

FY19

34.2%

FY20

428

83.8%

FY20

539

33.8%

FY21

% Margin

494

91.7%

FY21

+8.4%

YOY %

291

34.0%

FY22 YTD

(13.4)%

YOY%

174

59.9%

FY22 YTD

Free Cash Flow

% FCF Conversion

Copyright © 2022 FactSet Research Systems Inc. All rights reserved. FactSet Business Use Only 55View entire presentation