Ford Investor Conference Presentation Deck

FORDREV

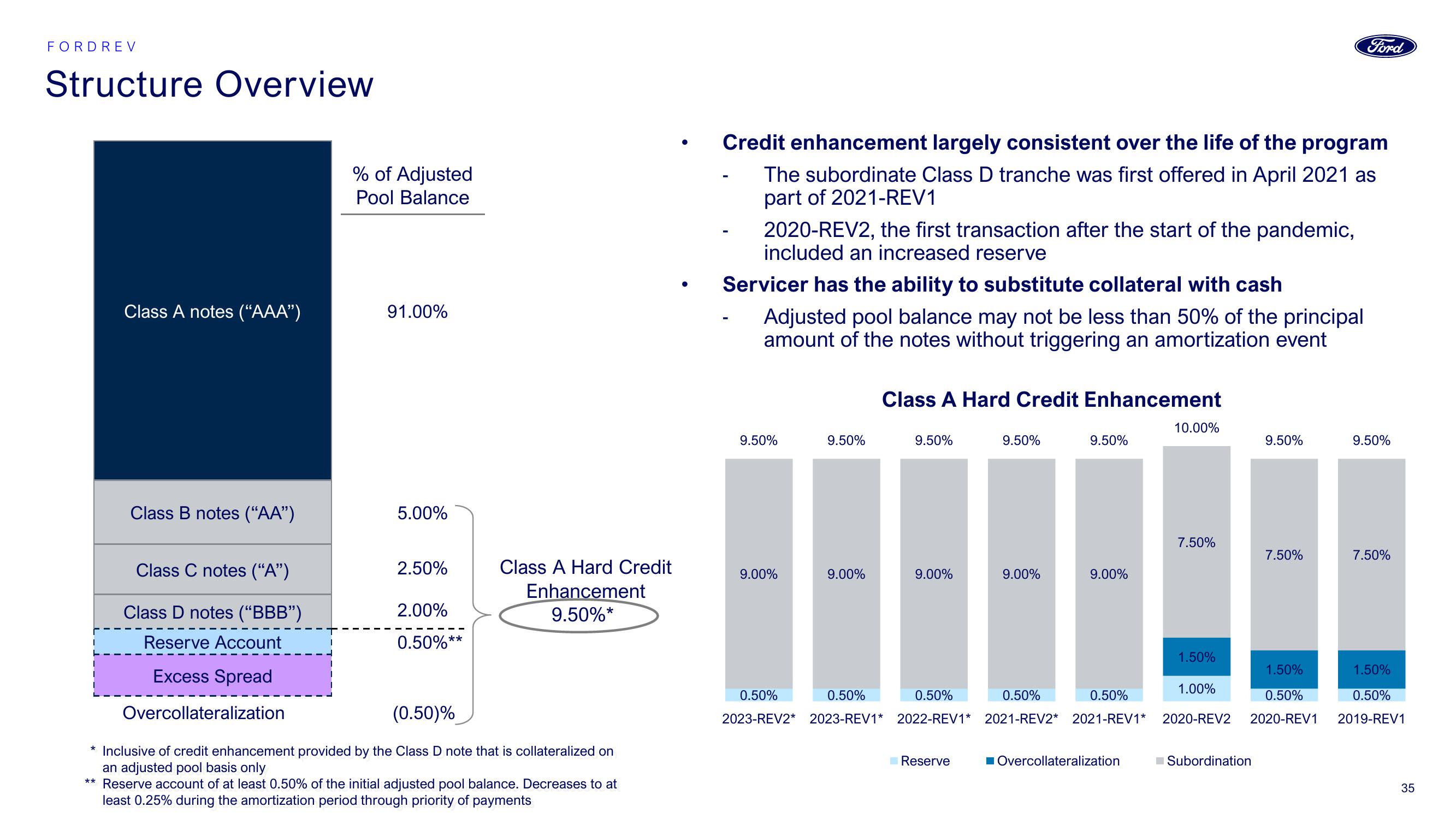

Structure Overview

I

Class A notes ("AAA")

Class B notes (“AA”)

Class C notes (“A”)

Class D notes ("BBB")

Reserve Account

Excess Spread

Overcollateralization

% of Adjusted

Pool Balance

91.00%

5.00%

2.50%

2.00%

0.50%**

Class A Hard Credit

Enhancement

9.50%*

(0.50)%

* Inclusive of credit enhancement provided by the Class D note that is collateralized on

an adjusted pool basis only

** Reserve account of at least 0.50% of the initial adjusted pool balance. Decreases to at

least 0.25% during the amortization period through priority of payments

Credit enhancement largely consistent over the life of the program

The subordinate Class D tranche was first offered in April 2021 as

part of 2021-REV1

2020-REV2, the first transaction after the start of the pandemic,

included an increased reserve

Servicer has the ability to substitute collateral with cash

Adjusted pool balance may not be less than 50% of the principal

amount of the notes without triggering an amortization event

9.50%

9.00%

9.50%

9.00%

Class A Hard Credit Enhancement

9.50%

9.00%

9.50%

Reserve

9.00%

9.50%

9.00%

10.00%

■Overcollateralization

7.50%

1.50%

9.50%

Subordination

Ford

7.50%

1.50%

1.50%

1.00%

0.50%

0.50%

0.50%

0.50%

0.50%

0.50%

0.50%

2023-REV2* 2023-REV1* 2022-REV1* 2021-REV2* 2021-REV1* 2020-REV2 2020-REV1 2019-REV1

9.50%

7.50%

35View entire presentation