FaZe SPAC Presentation Deck

TRANSACTION OVERVIEW(¹)

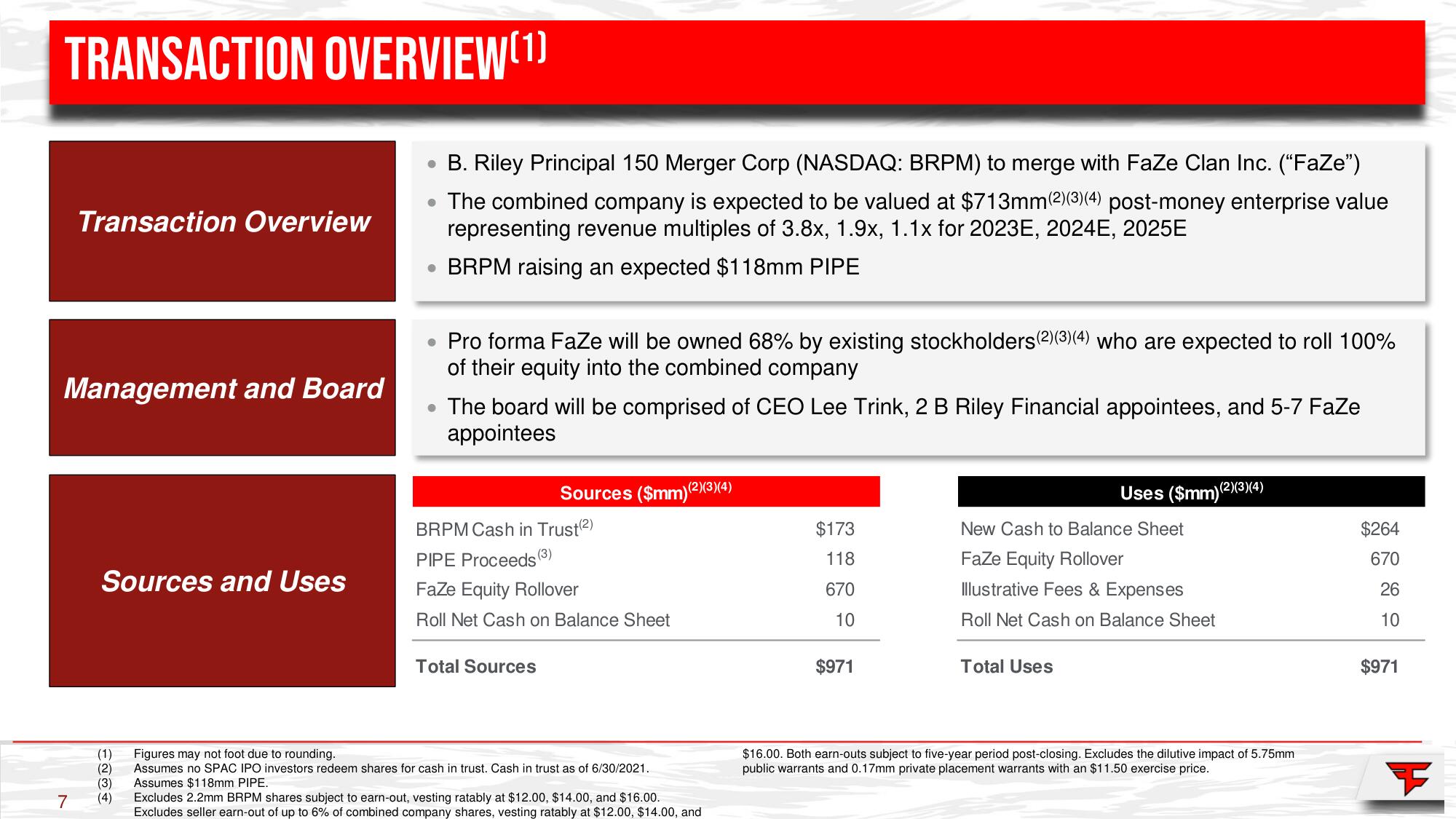

Transaction Overview

Management and Board

7

Sources and Uses

(1)

(3)

(4)

• B. Riley Principal 150 Merger Corp (NASDAQ: BRPM) to merge with FaZe Clan Inc. ("FaZe")

• The combined company is expected to be valued at $713mm (²)(3)(4) post-money enterprise value

representing revenue multiples of 3.8x, 1.9x, 1.1x for 2023E, 2024E, 2025E

• BRPM raising an expected $118mm PIPE

• Pro forma FaZe will be owned 68% by existing stockholders(2)(3)(4) who are expected to roll 100%

of their equity into the combined company

• The board will be comprised of CEO Lee Trink, 2 B Riley Financial appointees, and 5-7 FaZe

appointees

Sources ($mm) (²)

BRPM Cash in Trust(²)

PIPE Proceeds (3)

FaZe Equity Rollover

Roll Net Cash on Balance Sheet

Total Sources

(2)(3)(4)

Figures may not foot due to rounding.

Assumes no SPAC IPO investors redeem shares for cash in trust. Cash in trust as of 6/30/2021.

Assumes $118mm PIPE.

Excludes 2.2mm BRPM shares subject to earn-out, vesting ratably at $12.00, $14.00, and $16.00.

Excludes seller earn-out of up to 6% of combined company shares, vesting ratably at $12.00, $14.00, and

$173

118

670

10

$971

New Cash to Balance Sheet

FaZe Equity Rollover

Illustrative Fees & Expenses

Roll Net Cash on Balance Sheet

Total Uses

Uses ($mm) (2)

(2)(3)(4)

$16.00. Both earn-outs subject to five-year period post-closing. Excludes the dilutive impact of 5.75mm

public warrants and 0.17mm private placement warrants with an $11.50 exercise price.

$264

670

26

10

$971View entire presentation