Spotify Results Presentation Deck

Operating Expenses

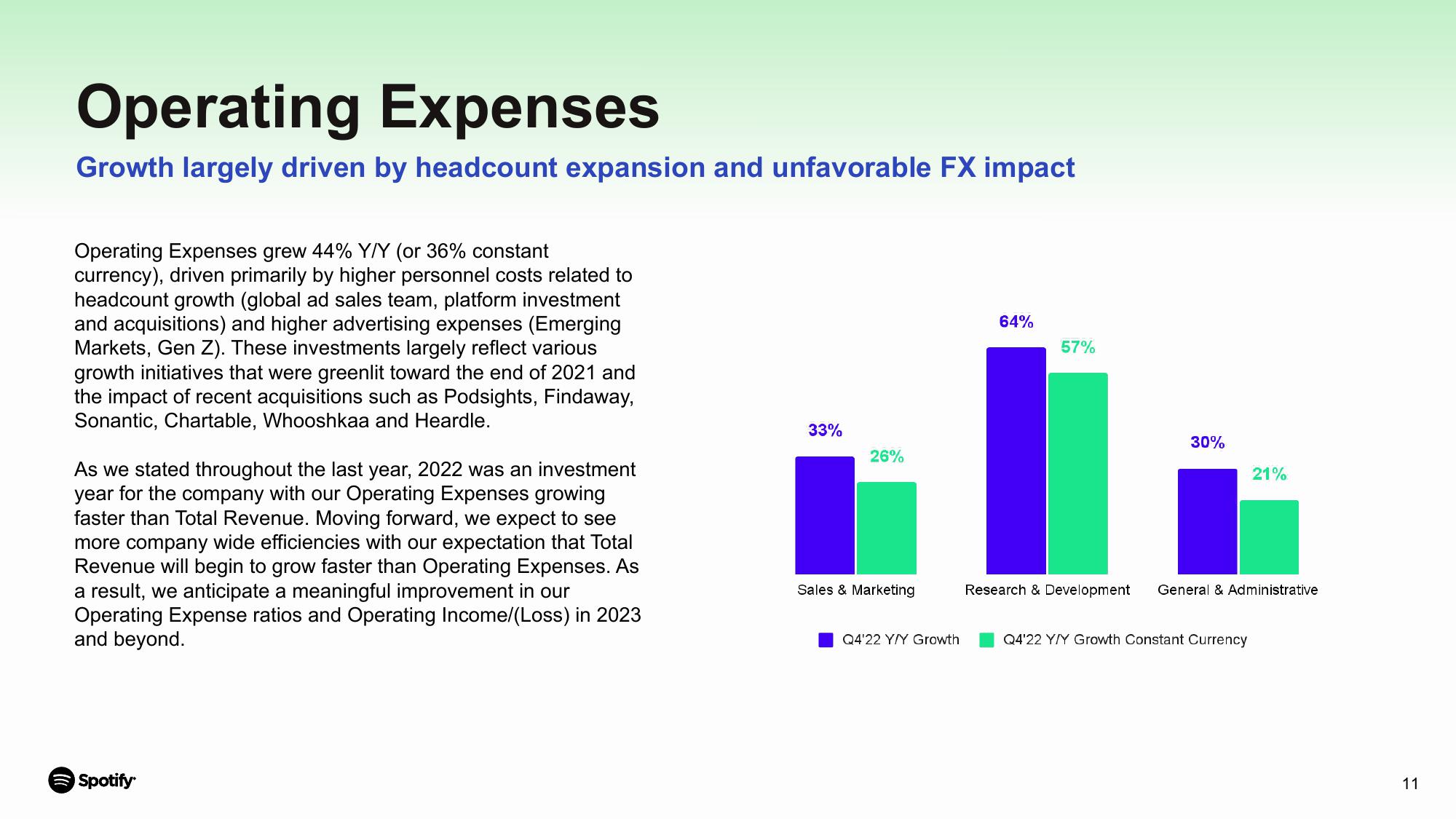

Growth largely driven by headcount expansion and unfavorable FX impact

Operating Expenses grew 44% Y/Y (or 36% constant

currency), driven primarily by higher personnel costs related to

headcount growth (global ad sales team, platform investment

and acquisitions) and higher advertising expenses (Emerging

Markets, Gen Z). These investments largely reflect various

growth initiatives that were greenlit toward the end of 2021 and

the impact of recent acquisitions such as Podsights, Findaway,

Sonantic, Chartable, Whooshkaa and Heardle.

As we stated throughout the last year, 2022 was an investment

year for the company with our Operating Expenses growing

faster than Total Revenue. Moving forward, we expect to see

more company wide efficiencies with our expectation that Total

Revenue will begin to grow faster than Operating Expenses. As

a result, we anticipate a meaningful improvement in our

Operating Expense ratios and Operating Income/(Loss) in 2023

and beyond.

Spotify

33%

26%

Sales & Marketing

Q4'22 Y/Y Growth

64%

57%

30%

21%

Research & Development General & Administrative

Q4'22 Y/Y Growth Constant Currency

11View entire presentation