Asos Results Presentation Deck

2023 asos

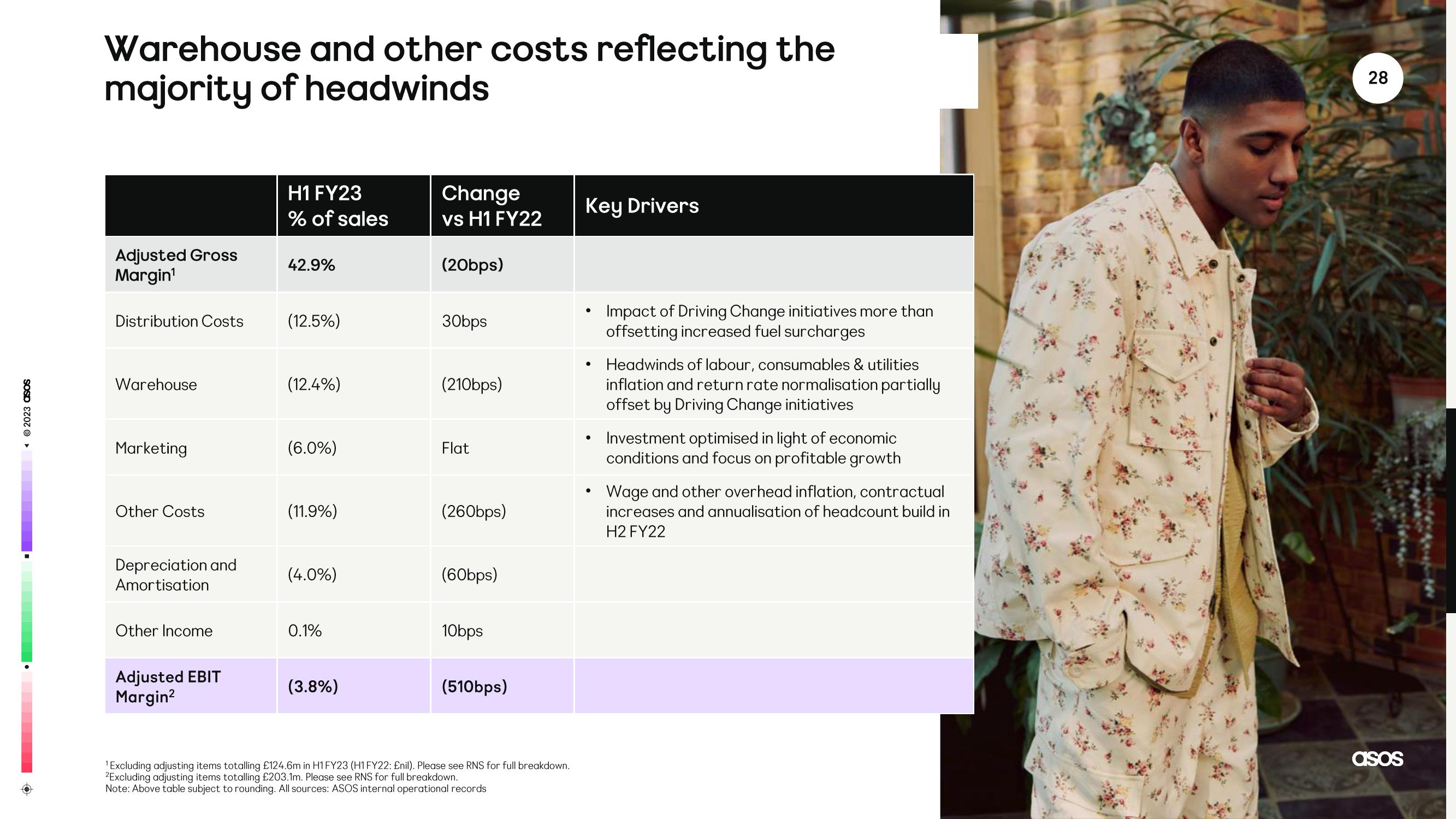

Warehouse and other costs reflecting the

majority of headwinds

Adjusted Gross

Margin¹

Distribution Costs

Warehouse

Marketing

Other Costs

Depreciation and

Amortisation

Other Income

Adjusted EBIT

Margin²

H1 FY23

% of sales

42.9%

(12.5%)

(12.4%)

(6.0%)

(11.9%)

(4.0%)

0.1%

(3.8%)

Change

vs H1 FY22

(20bps)

30bps

(210bps)

Flat

(260bps)

(60bps)

10bps

(510bps)

¹Excluding adjusting items totalling £124.6m in H1 FY23 (H1 FY22: £nil). Please see RNS for full breakdown.

2Excluding adjusting items totalling £203.1m. Please see RNS for full breakdown.

Note: Above table subject to rounding. All sources: ASOS internal operational records

Key Drivers

●

●

●

Impact of Driving Change initiatives more than

offsetting increased fuel surcharges

Headwinds of labour, consumables & utilities

inflation and return rate normalisation partially

offset by Driving Change initiatives

Investment optimised in light of economic

conditions and focus on profitable growth

Wage and other overhead inflation, contractual

increases and annualisation of headcount build in

H2 FY22

28

asosView entire presentation