jetBlue Mergers and Acquisitions Presentation Deck

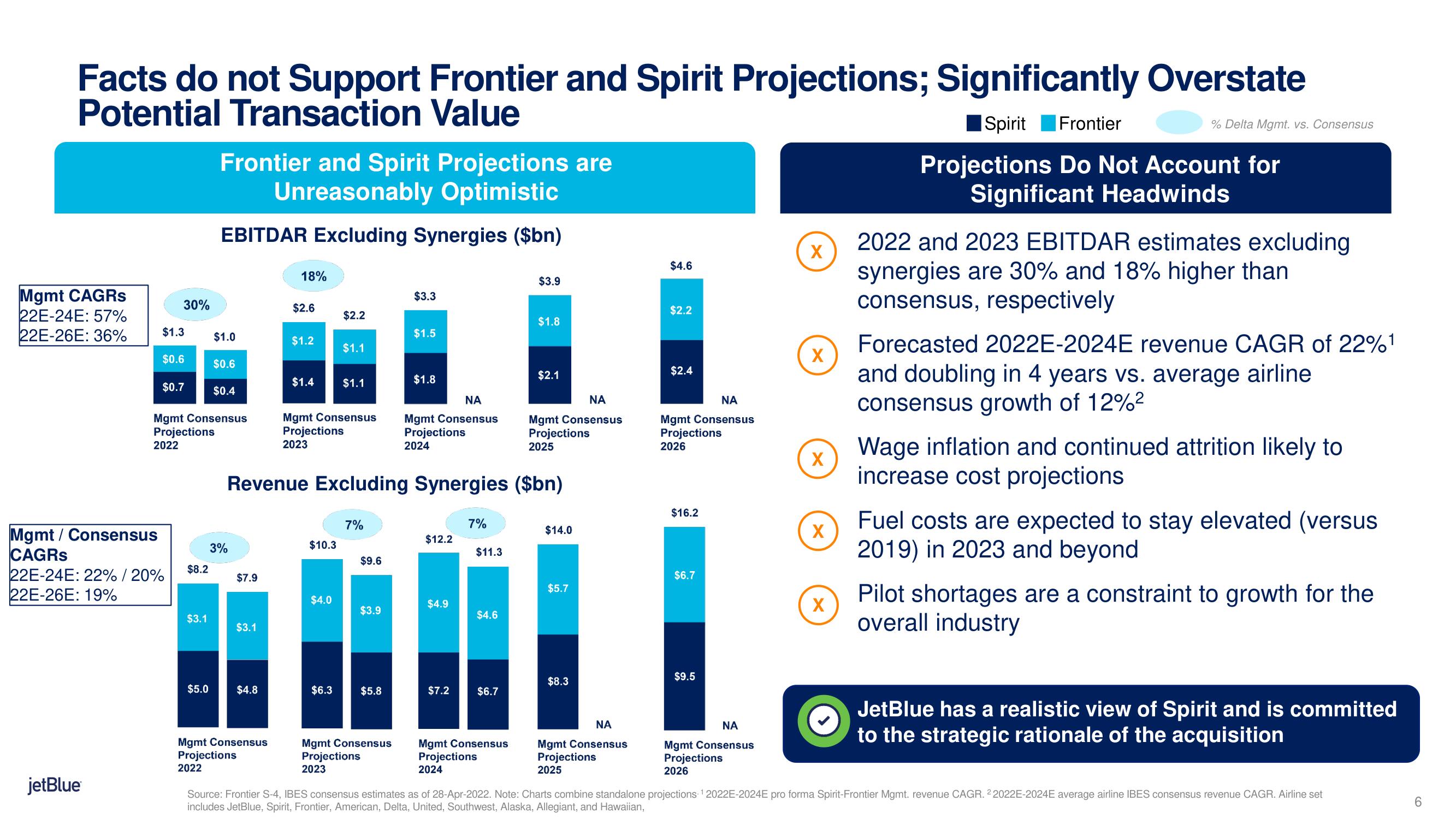

Facts do not Support Frontier and Spirit Projections; Significantly Overstate

Potential Transaction Value

Mgmt CAGRs

22E-24E: 57%

22E-26E: 36%

Mgmt / Consensus

CAGRS

jetBlue

30%

$1.3

$0.6

$0.7

22E-24E: 22% / 20%

22E-26E: 19%

Mgmt Consensus

Projections

2022

$8.2

$3.1

Frontier and Spirit Projections are

Unreasonably Optimistic

EBITDAR Excluding Synergies ($bn)

$5.0

$1.0

$0.6

$0.4

3%

$7.9

$3.1

$4.8

18%

Mgmt Consensus

Projections

2022

$2.6

$1.2

$1.4

$10.3

$2.2

Mgmt Consensus

Projections

2023

$4.0

$1.1

$6.3

$1.1

Revenue Excluding Synergies ($bn)

7%

$9.6

$3.9

$5.8

$3.3

Mgmt Consensus

Projections

2023

$1.5

$1.8

ΝΑ

Mgmt Consensus

Projections

2024

$12.2

$4.9

$7.2

7%

$11.3

$4.6

$6.7

$3.9

Mgmt Consensus

Projections

2024

$1.8

$2.1

ΝΑ

Mgmt Consensus

Projections

2025

$14.0

$5.7

$8.3

ΝΑ

Mgmt Consensus

Projections

2025

$4.6

$2.2

$2.4

ΝΑ

Mgmt Consensus

Projections

2026

$16.2

$6.7

$9.5

ΝΑ

Mgmt Consensus

Projections

2026

X

X

X

X

X

Spirit Frontier

Projections Do Not Account for

Significant Headwinds

% Delta Mgmt. vs. Consensus

2022 and 2023 EBITDAR estimates excluding

synergies are 30% and 18% higher than

consensus, respectively

Forecasted 2022E-2024E revenue CAGR of 22%¹

and doubling in 4 years vs. average airline

consensus growth of 12%²

Wage inflation and continued attrition likely to

increase cost projections

Fuel costs are expected to stay elevated (versus

2019) in 2023 and beyond

Pilot shortages are a constraint to growth for the

overall industry

JetBlue has a realistic view of Spirit and is committed

to the strategic rationale of the acquisition

Source: Frontier S-4, IBES consensus estimates as of 28-Apr-2022. Note: Charts combine standalone projections ¹2022E-2024E pro forma Spirit-Frontier Mgmt. revenue CAGR. 22022E-2024E average airline IBES consensus revenue CAGR. Airline set

includes JetBlue, Spirit, Frontier, American, Delta, United, Southwest, Alaska, Allegiant, and Hawaiian,

6View entire presentation