jetBlue Mergers and Acquisitions Presentation Deck

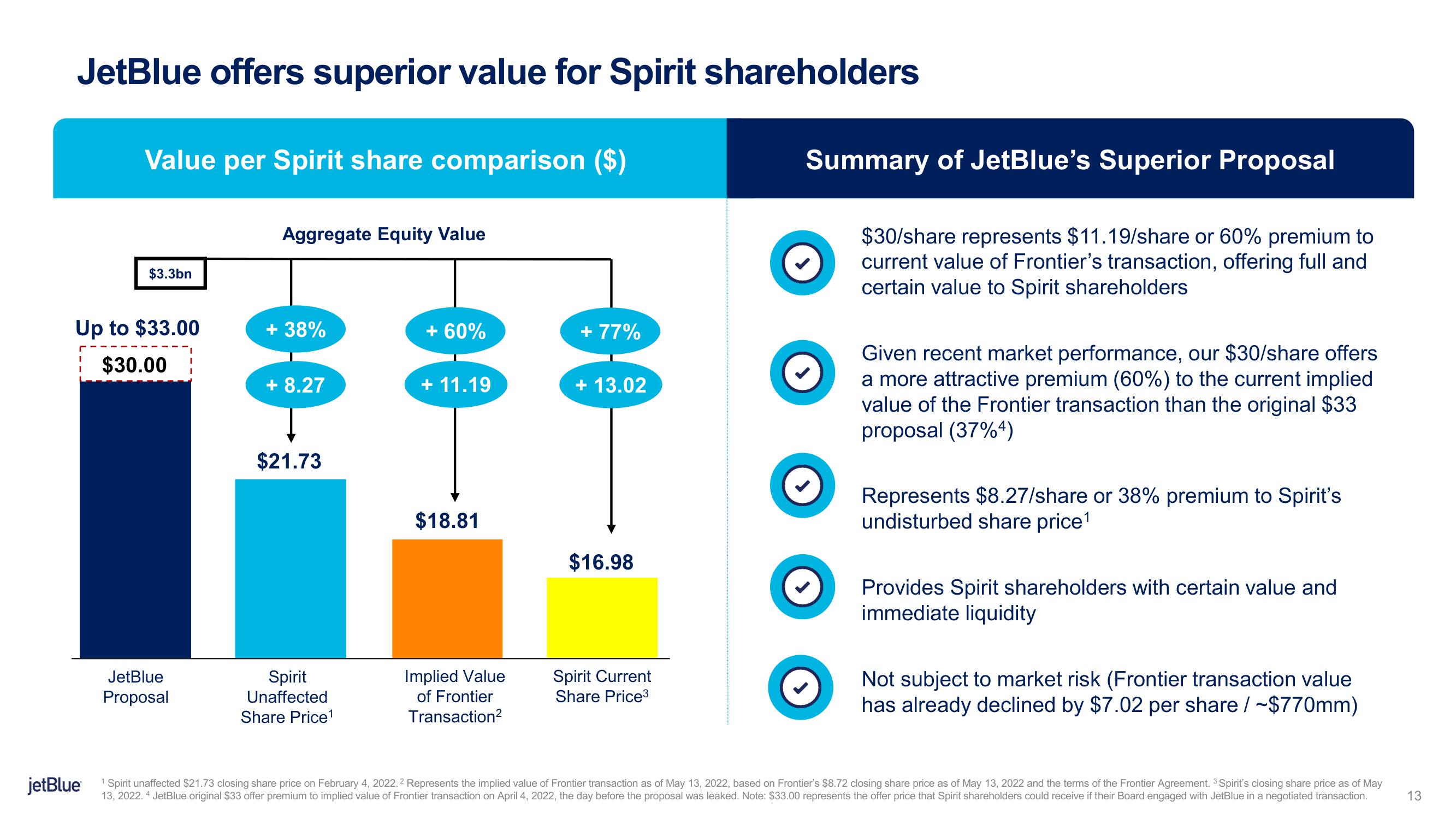

JetBlue offers superior value for Spirit shareholders

Value per Spirit share comparison ($)

jetBlue

$3.3bn

Up to $33.00

$30.00

JetBlue

Proposal

Aggregate Equity Value

+ 38%

+ 8.27

$21.73

Spirit

Unaffected

Share Price¹

+ 60%

+ 11.19

$18.81

Implied Value

of Frontier

Transaction²

+ 77%

+ 13.02

$16.98

Spirit Current

Share Price³

Summary of JetBlue's Superior Proposal

$30/share represents $11.19/share or 60% premium to

current value of Frontier's transaction, offering full and

certain value to Spirit shareholders

Given recent market performance, our $30/share offers

a more attractive premium (60%) to the current implied

value of the Frontier transaction than the original $33

proposal (37%4)

Represents $8.27/share or 38% premium to Spirit's

undisturbed share price¹

Provides Spirit shareholders with certain value and

immediate liquidity

Not subject to market risk (Frontier transaction value

has already declined by $7.02 per share/~$770mm)

1 Spirit unaffected $21.73 closing share price on February 4, 2022.² Represents the implied value of Frontier transaction as of May 13, 2022, based on Frontier's $8.72 closing share price as of May 13, 2022 and the terms of the Frontier Agreement. ³ Spirit's closing share price as of May

13, 2022.4 JetBlue original $33 offer premium to implied value of Frontier transaction on April 4, 2022, the day before the proposal was leaked. Note: $33.00 represents the offer price that Spirit shareholders could receive if their Board engaged with JetBlue in a negotiated transaction.

13View entire presentation