LSE Investor Presentation Deck

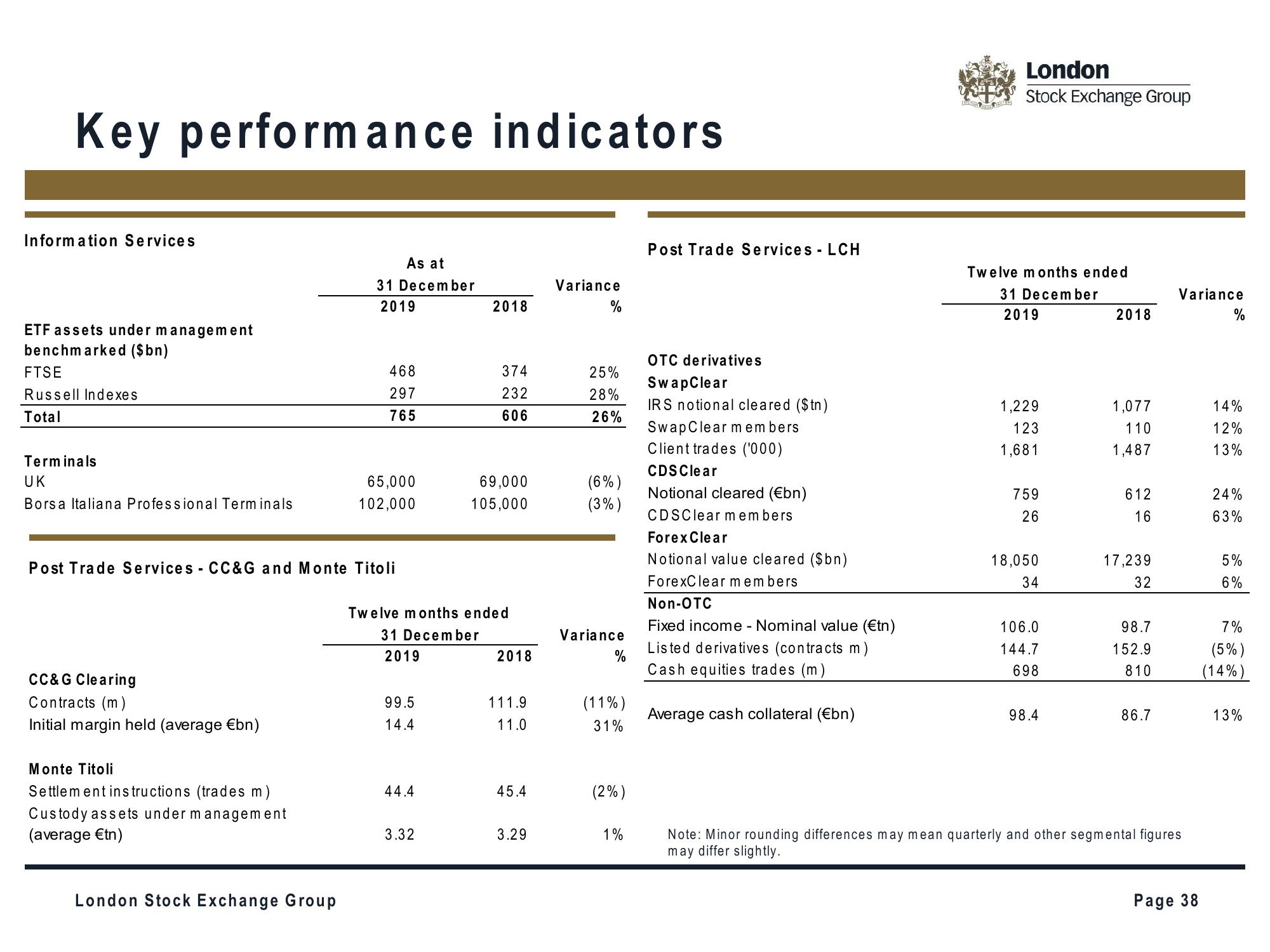

Key performance indicators

Information Services

ETF assets under management

benchmarked ($bn)

FTSE

Russell Indexes

Total

Terminals

UK

Borsa Italiana Professional Terminals

CC&G Clearing

Contracts (m)

Initial margin held (average €bn)

Monte Titoli

Settlement instructions (trades m)

Custody assets under management

(average €tn)

As at

31 December

2019

Post Trade Services - CC&G and Monte Titoli

London Stock Exchange Group

468

297

765

65,000

102,000

99.5

14.4

44.4

2018

Twelve months ended

31 December

2019

3.32

374

232

606

69,000

105,000

2018

111.9

11.0

45.4

3.29

Variance

%

25%

28%

26%

(6%)

(3%)

Variance

%

(11%)

31%

(2%)

1%

Post Trade Services LCH

OTC derivatives

SwapClear

IRS notional cleared ($tn)

SwapClear members

Client trades ('000)

CDS Clear

Notional cleared (€bn)

CDSClear members

Forex Clear

Notional value cleared ($bn)

ForexClear members

Non-OTC

Fixed income - Nominal value (€tn)

Listed derivatives (contracts m)

Cash equities trades (m)

Average cash collateral (€bn)

DHEIGHECHIE

London

Stock Exchange Group

Twelve months ended

31 December

2019

1,229

123

1,681

759

26

18,050

34

106.0

144.7

698

98.4

2018

1,077

110

1,487

612

16

17,239

32

98.7

152.9

810

86.7

Variance

Note: Minor rounding differences may mean quarterly and other segmental figures

may differ slightly.

Page 38

%

14%

12%

13%

24%

63%

5%

6%

7%

(5%)

(14%)

13%View entire presentation