Winc Investor Presentation Deck

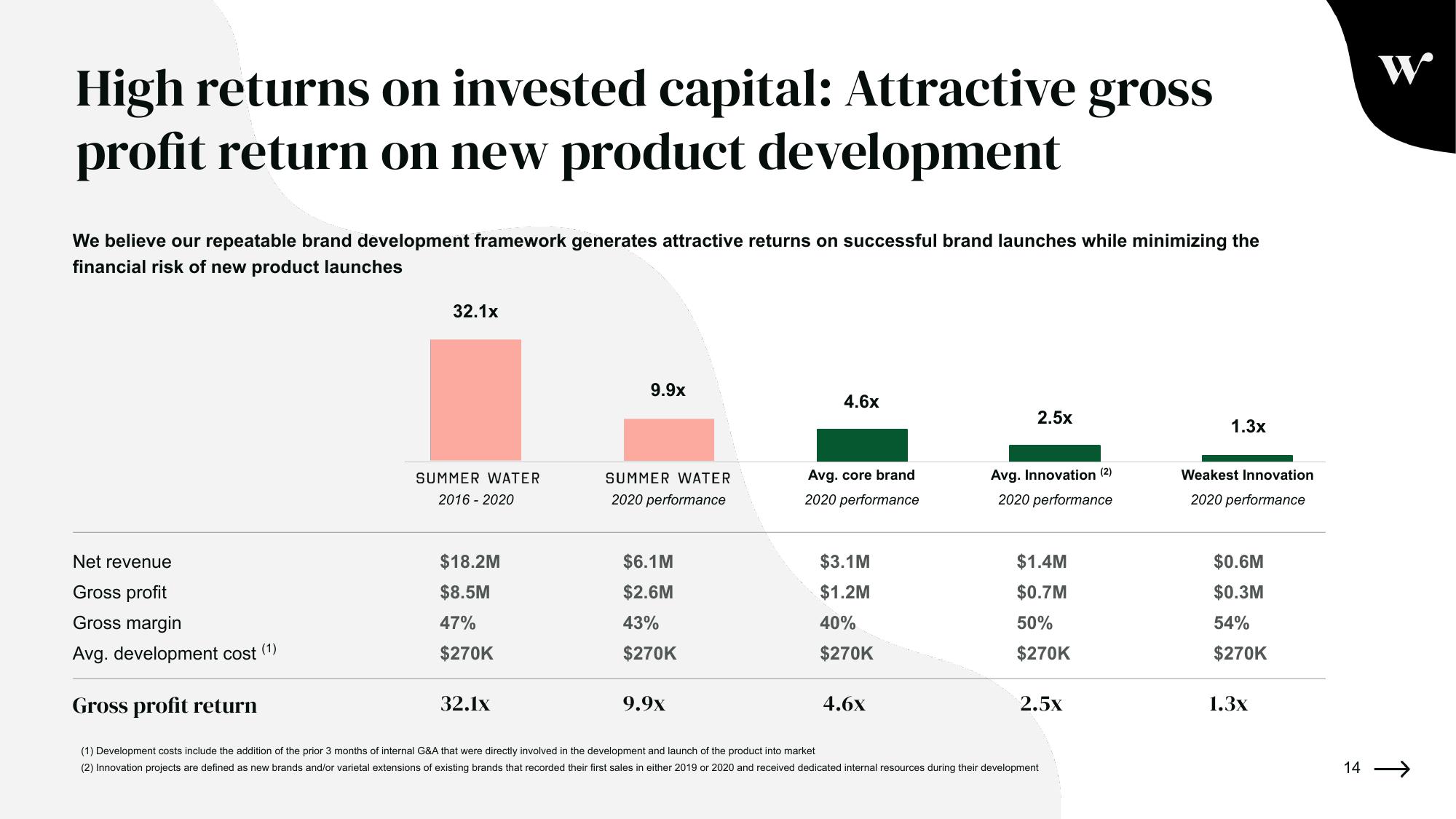

High returns on invested capital: Attractive gross

profit return on new product development

We believe our repeatable brand development framework generates attractive returns on successful brand launches while minimizing the

financial risk of new product launches

Net revenue

Gross profit

Gross margin

Avg. development cost (1)

32.1x

SUMMER WATER

2016-2020

$18.2M

$8.5M

47%

$270K

9.9x

32.1x

SUMMER WATER

2020 performance

$6.1M

$2.6M

43%

$270K

9.9x

4.6x

Avg. core brand

2020 performance

$3.1M

$1.2M

40%

$270K

4.6x

2.5x

Avg. Innovation (2)

2020 performance

Gross profit return

(1) Development costs include the addition of the prior 3 months of internal G&A that were directly involved in the development and launch of the product into market

(2) Innovation projects are defined as new brands and/or varietal extensions of existing brands that recorded their first sales in either 2019 or 2020 and received dedicated internal resources during their development

$1.4M

$0.7M

50%

$270K

2.5x

1.3x

Weakest Innovation

2020 performance

$0.6M

$0.3M

54%

$270K

1.3x

14

个View entire presentation