Evercore Investment Banking Pitch Book

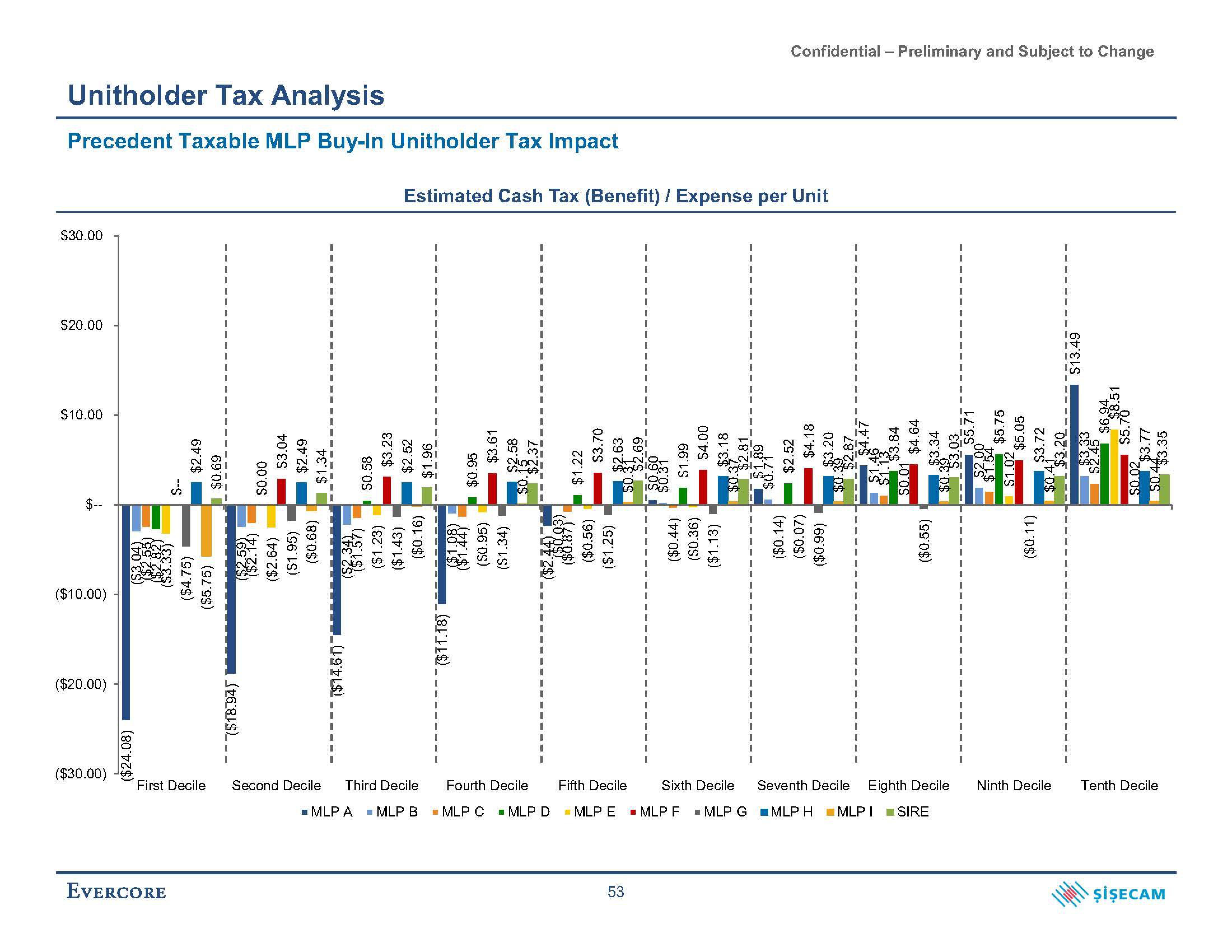

Unitholder Tax Analysis

Precedent Taxable MLP Buy-In Unitholder Tax Impact

$30.00

$20.00

$10.00

$--

($10.00)

($20.00)

($30.00)

(7255)

($3.04)

18282

($3.33)

($24.08)

--$

EVERCORE

$2.49

($4.75)

$0.69

($5.75)

$0.00

-($18.94)

$3.04

($2.5

($2.14)

($2.64)

$2.49

($1.95)

$1.34

($0.68)

$0.58

($14.61)

$3.23

Estimated Cash Tax (Benefit) / Expense per Unit

$2.52

($2.34))"

($1.23)

($1.43)

$1.96

($0.16)

$0.95

($11.18)

$3.61

$2.58

($1.98)

($0.95)

($1.34)

First Decile Second Decile Third Decile Fourth Decile

$1.22

($2.44)

$3.70

$2.63

($0.93)

($8.87))

($0.56)

($1.25)

Fifth Decile

▪ MLP A ■ MLP B ■ MLP C MLP D ▪ MLP E

53

69205

50.600

$1.99

$4.00

2$3.18

$2.81

($0.44)

($0.36)

($1.13)

$0.37

$1.89

Confidential - Preliminary and Subject to Change

$0.71

$2.52

$4.18

($0.14)

($0.07)

($0.99)

($0.55)

Sixth

Decile

Seventh Decile Eighth Decile

▪ MLP F ■ MLP G MLP HMLP I SIRE

$5.71

($0.11)

Ninth Decile

$13.49

$6.94

$5.788.51

Tenth Decile

ŞİŞECAMView entire presentation