J.P.Morgan Investment Banking Pitch Book

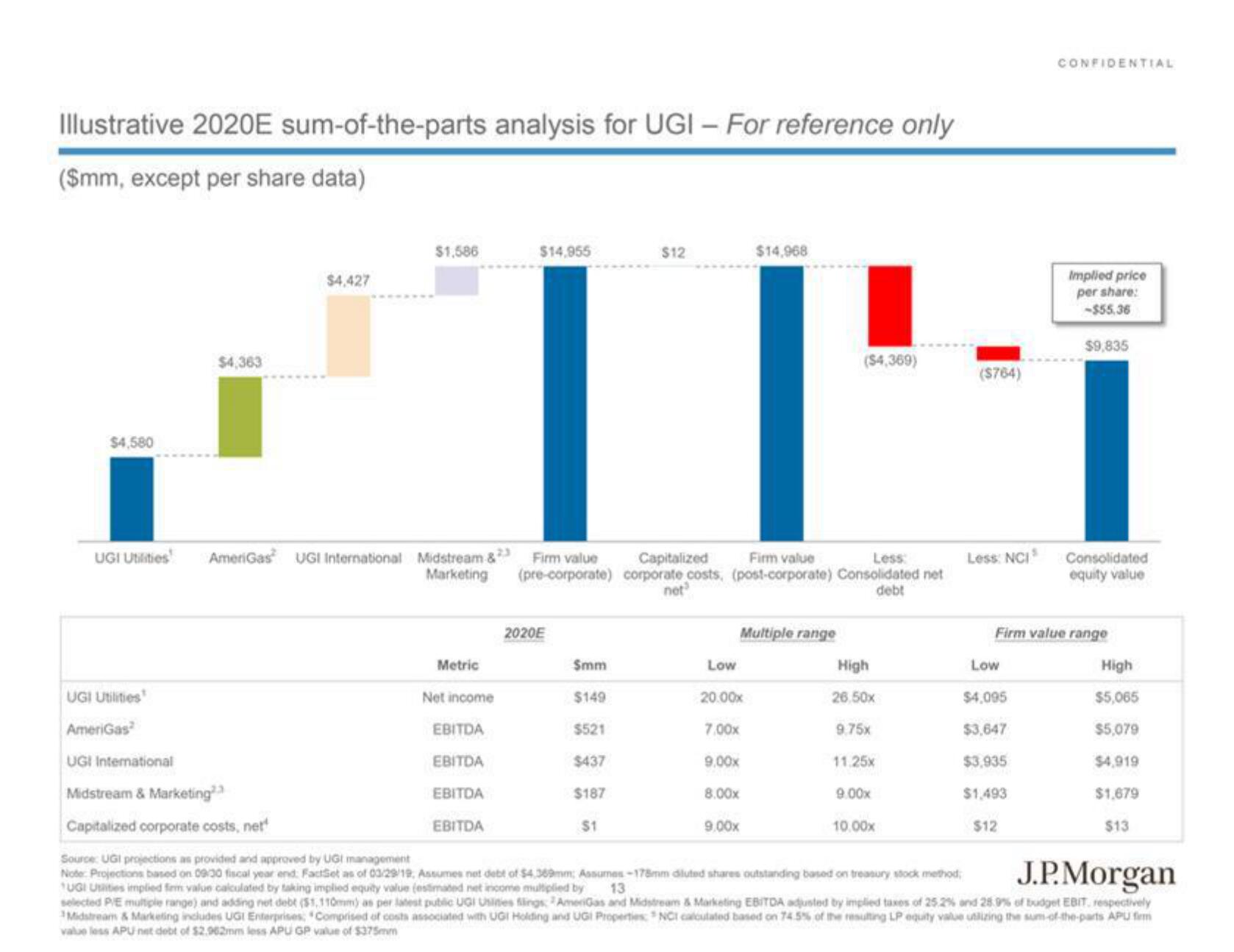

Illustrative 2020E sum-of-the-parts analysis for UGI - For reference only

($mm, except per share data)

$4,580

UGI Utilities

$4,363

$4,427

UGI Utilities

AmeriGas

UGI International

Midstream & Marketing.

Capitalized corporate costs, net

$1,586

AmeriGas UGI International Midstream & 23 Firm value

Metric

$14.955

Net income

EBITDA

EBITDA

EBITDA

EBITDA

Capitalized

Firm value

Less:

Marketing (pre-corporate) corporate costs, (post-corporate) Consolidated net

debt

net

2020E

$mm

$149

$12

$521

$437

$187

$1

Low

$14,968

Multiple range

20.00x

7.00x

9.00x

8.00x

9,00x

($4,369)

High

26,50x

9.75x

11.25x

9.00x

10.00x

($764)

Less: NCIS

Low

$4,095

$3,647

$3,935

CONFIDENTIAL

$1,493

$12

Implied price

per share:

-$55.36

$9,835

Firm value range

Consolidated

equity value

High

$5,065

$5,079

$4,919

$1,679

$13

J.P.Morgan

Source: UGI projections as provided and approved by UGI management

Note Projections based on 09/30 fiscal year end: FactSet as of 03/29/19, Assumes net debt of $4,369mm; Assumes-178mm diluted shares outstanding based on treasury stock method,

AUGI Utities implied firm value calculated by taking implied equity value (estimated net income multiplied by 13

selected P/E multiple range) and adding net debt ($1,110mm) as per latest public UGI Usities flings: AmeriGas and Midstream & Marketing EBITDA adjusted by implied taxes of 25.2% and 28.9% of budget EBIT, respectively

Midstream & Marketing includes UGI Enterprises: Comprised of costs associated with UGI Holding and UGI Properties: NCT calculated based on 74.5% of the resulting LP equity value utilizing the sum of-the-parts APU firm

value less APU net debt of $2.962mm less APU GP value of $375mmView entire presentation