Silicon Valley Bank Results Presentation Deck

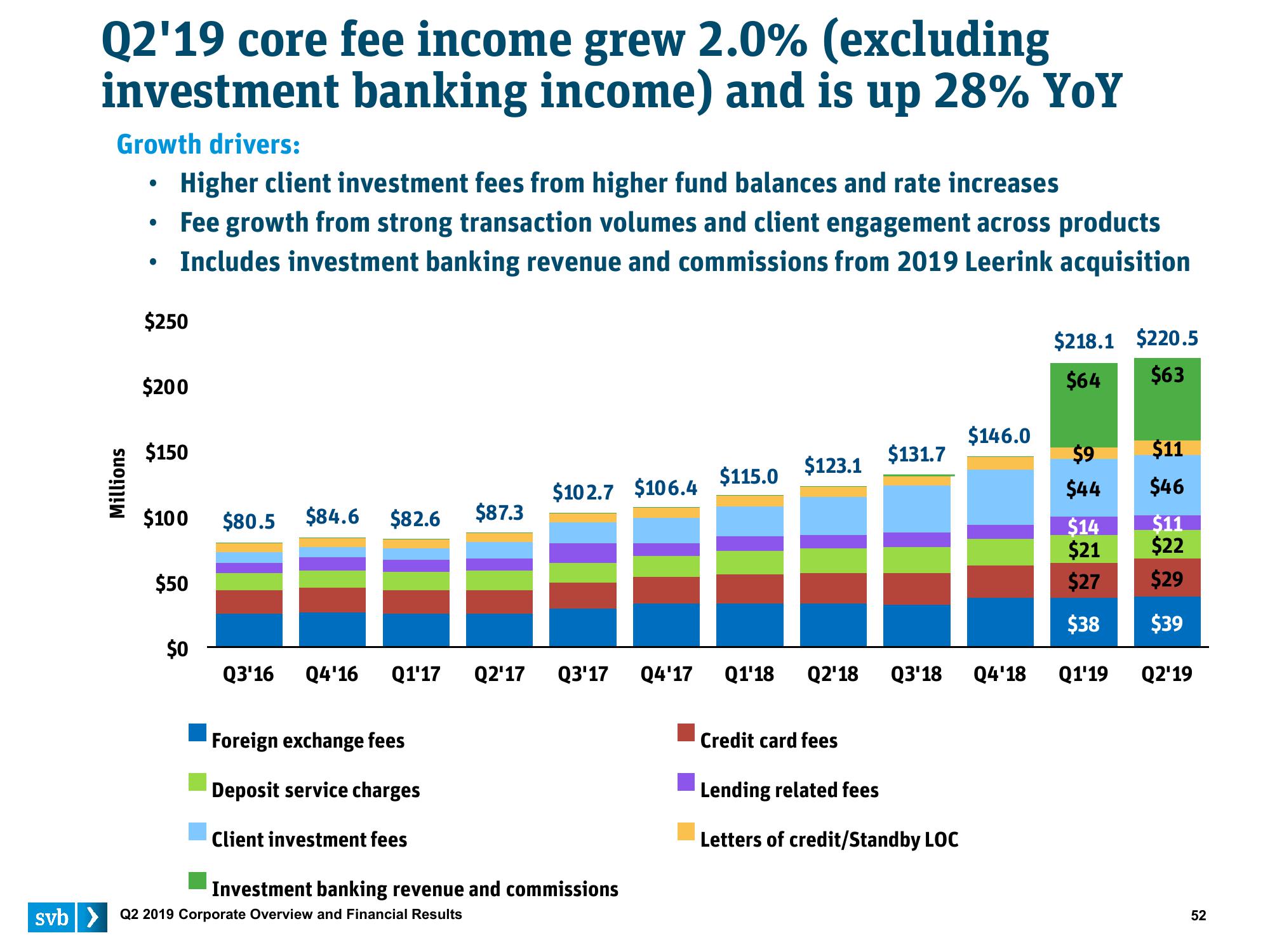

Q2'19 core fee income grew 2.0% (excluding

investment banking income) and is up 28% YoY

Growth drivers:

Millions

●

●

●

Higher client investment fees from higher fund balances and rate increases

Fee growth from strong transaction volumes and client engagement across products

Includes investment banking revenue and commissions from 2019 Leerink acquisition

$250

$200

$150

$100 $80.5 $84.6 $82.6 $87.3

$50

$0

$102.7 $106.4

Q3'16 Q4'16 Q1'17 Q2'17 Q3'17 Q4'17

Foreign exchange fees

Deposit service charges

Client investment fees

Investment banking revenue and commissions

svb> Q2 2019 Corporate Overview and Financial Results

$115.0

$123.1

Q1'18 Q2'18

Credit card fees

$131.7

$146.0

$9

$11

$44

$46

$14

$11

$21

$22

$27

$29

$38

$39

Q3'18 Q4'18 Q1'19 Q2'19

Lending related fees

Letters of credit/Standby LOC

$218.1 $220.5

$64

$63

52View entire presentation