Kinnevik Results Presentation Deck

Intro

SEK m

GROUP FINANCIAL STATEMENTS

Change in fair value of financial assets

Dividends received

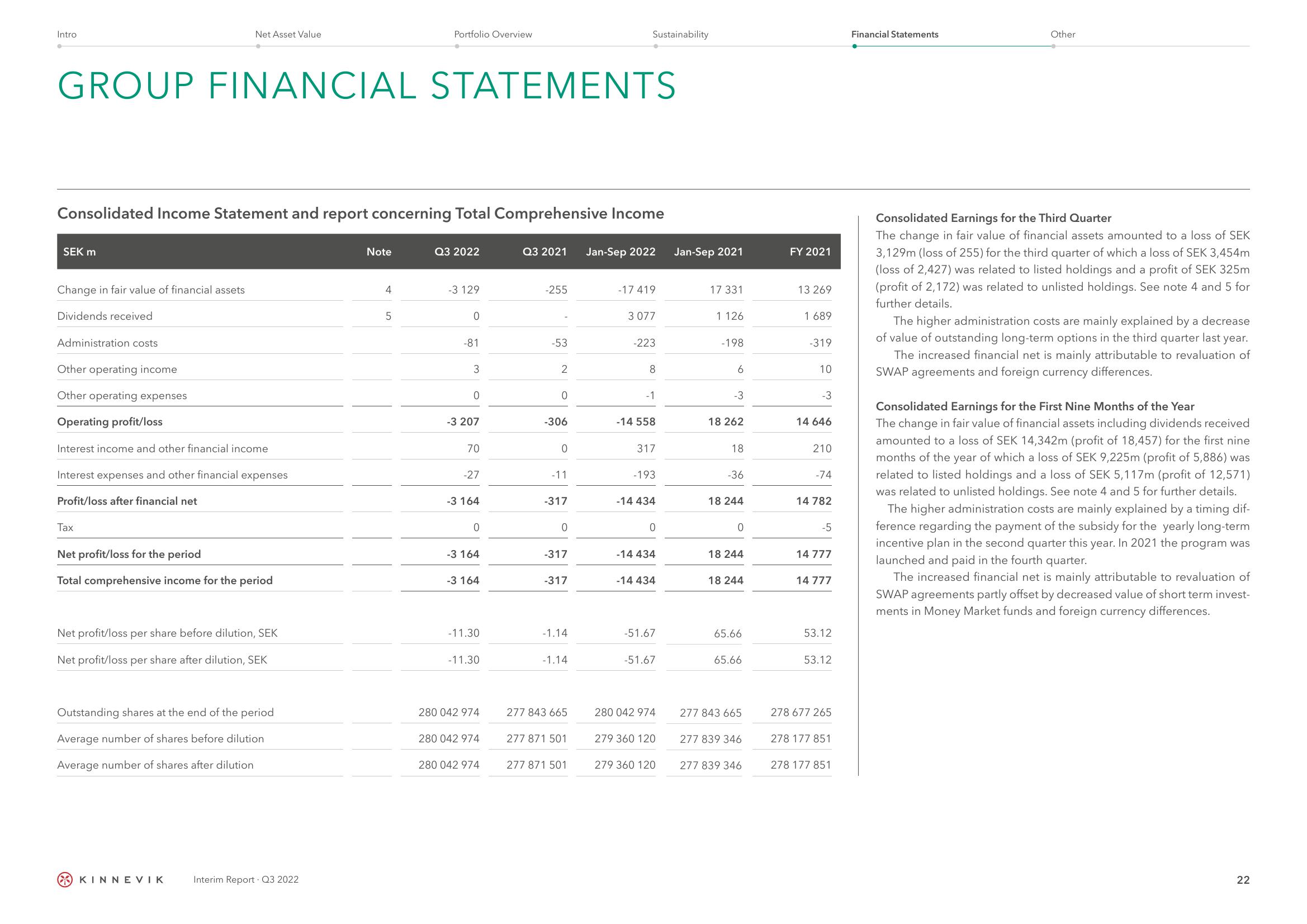

Consolidated Income Statement and report concerning Total Comprehensive Income

Administration costs

Other operating income

Other operating expenses

Operating profit/loss

Net Asset Value

Interest income and other financial income

Interest expenses and other financial expenses

Profit/loss after financial net

Tax

Net profit/loss for the period

Total comprehensive income for the period

Net profit/loss per share before dilution, SEK

Net profit/loss per share after dilution, SEK

Outstanding shares at the end of the period

Average number of shares before dilution

Average number of shares after dilution

KINNEVIK

Interim Report Q3 2022

Note

Portfolio Overview

4

5

Q3 2022

-3 129

0

-81

3

0

-3 207

70

-27

-3 164

0

-3 164

-3 164

-11.30

-11.30

280 042 974

280 042 974

280 042 974

Q3 2021

-255

-53

2

0

-306

0

-11

-317

0

-317

-317

-1.14

-1.14

277 843 665

Sustainability

277 871 501

277 871 501

Jan-Sep 2022

-17 419

3 077

-223

8

-1

-14 558

317

-193

-14 434

0

-14 434

-14 434

-51.67

-51.67

280 042 974

279 360 120

279 360 120

Jan-Sep 2021

17 331

1 126

-198

6

-3

18 262

18

-36

18 244

0

18 244

18 244

65.66

65.66

277 843 665

277 839 346

277 839 346

FY 2021

13 269

1 689

-319

10

-3

14 646

210

-74

14 782

-5

14 777

14 777

53.12

53.12

278 677 265

278 177 851

278 177 851

Financial Statements

Other

Consolidated Earnings for the Third Quarter

The change in fair value of financial assets amounted to a loss of SEK

3,129m (loss of 255) for the third quarter of which a loss of SEK 3,454m

(loss of 2,427) was related to listed holdings and a profit of SEK 325m

(profit of 2,172) was related to unlisted holdings. See note 4 and 5 for

further details.

The higher administration costs are mainly explained by a decrease

of value of outstanding long-term options in the third quarter last year.

The increased financial net is mainly attributable to revaluation of

SWAP agreements and foreign currency differences.

Consolidated Earnings for the First Nine Months of the Year

The change in fair value of financial assets including dividends received

amounted to a loss of SEK 14,342m (profit of 18,457) for the first nine

months of the year of which a loss of SEK 9,225m (profit of 5,886) was

related to listed holdings and a loss of SEK 5,117m (profit of 12,571)

was related to unlisted holdings. See note 4 and 5 for further details.

The higher administration costs are mainly explained by a timing dif-

ference regarding the payment of the subsidy for the yearly long-term

incentive plan in the second quarter this year. In 2021 the program was

launched and paid in the fourth quarter.

The increased financial net is mainly attributable to revaluation of

SWAP agreements partly offset by decreased value of short term invest-

ments in Money Market funds and foreign currency differences.

22View entire presentation